Market shares of the largest electricity and gas producers in EU have been falling in most countries since 2013, when Eurostat started collecting these data.

The specific market share indicator shows how much energy is supplied to the market by the largest grid company. A large share indicates a monopoly or oligopolistic (with strong non-price competition) market.

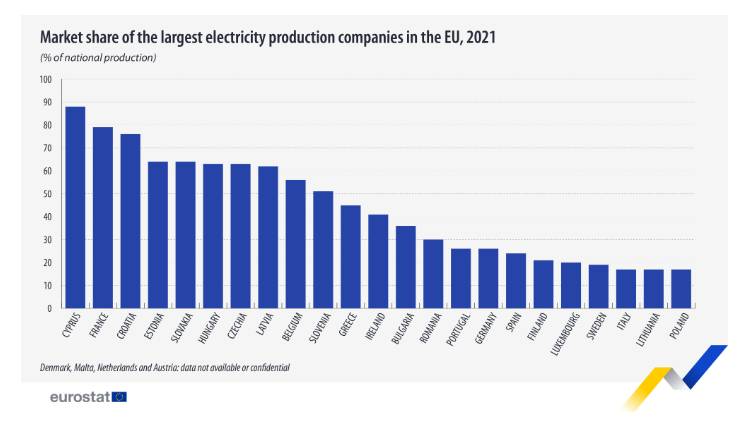

In 2021, the market share of the largest electricity producer in the market differed between EU countries, with the highest recorded in Cyprus (88%), followed by France (79%), Croatia (76%) and Estonia (64%). At the other end of the scale, the market share of the largest producer in the electricity market was less than 20% in four EU members: Poland, Lithuania and Italy (17%), Sweden (19%). In Greece it was just over 44%.

On an annualized basis, from 2020 to 2021, the largest increase in market share was registered in Ireland (32%), while the largest decrease occurred in Portugal (32%). An increase in inventories indicates an increase in market concentration, for example, after a merger of large market participants. Conversely, a decrease in inventories indicates a decrease in market concentration. Of the other EU countries, 15 reported a change of less than 10% from 2020 to 2021.

Compared to 2013, the market share of the largest producer in the electricity market in 2021 was lower in most EU countries. The decline in market share ranged from -39 percentage points (p.p.) in Luxembourg (after electricity market liberalization), to -20 p.p. in Slovakia, to -1 p.p. in Bulgaria and -4 p.p. in Finland. On the contrary, the share remained stable in Sweden (19%) and Poland (17%). And in Hungary (+10%), Romania (+3%) and Spain (+14:00) it increased.

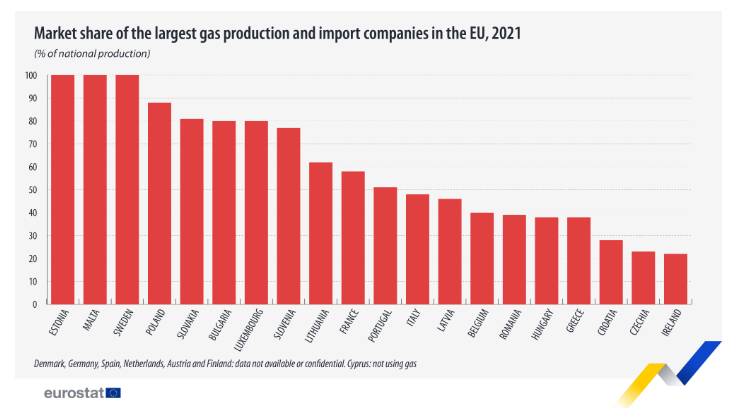

Import and production of natural gas: the market share of the largest company fell in 14 EU countries. The largest market share was 100% in Estonia, Malta and Sweden, where only one legal entity dominated national production and imports. In 2021, gross available energy from natural gas was only 2.3% of the total in Sweden.

Malta is a small market, so one organization is expected to be able to meet the needs of the market. On the contrary, at largest importer and producer of natural gas had the lowest market penetration in Ireland (22%) and the Czech Republic (23%).

On an annualized basis, from 2020 to 2021, the largest decline in market share was registered in Croatia (-45%) and the Czech Republic (-38%). The number of major companies importing or producing natural gas for the local market increased from 5 to 6 in the Czech Republic and from 3 to 5 in Croatia.

Compared to 2013, the market share of the largest importer and producer of natural gas has decreased in 14 EU countries in 2021 data. The largest decline was recorded in Greece (-61 p.p.), Latvia (-54 p.p.) and the Czech Republic (-46 p.p.). At the same time, in Sweden the share remained the same (100%), while in four EU members it increased: in Lithuania (+22 p.p.), Estonia (+16 p.p.), Slovakia (+13 p.p.) and Belgium (+7 percentage points).

More Stories

Greece: growth in deposits from households and businesses in March 2024

How much will it cost a Greek family to celebrate Easter?

EU employment record: Greece "stuck" in a low position