A year after Russia invaded Ukraine, despite “hellish sanctions”, Russian fossil fuels continue to flow to all countries of the world.

The Center for Energy and Clean Air Research (CREA) estimates that since the invasion began about a year ago, Russia has earned more than $315 billion from fossil fuel exports around the world, of which nearly half ($149 billion) has come from EU countries.

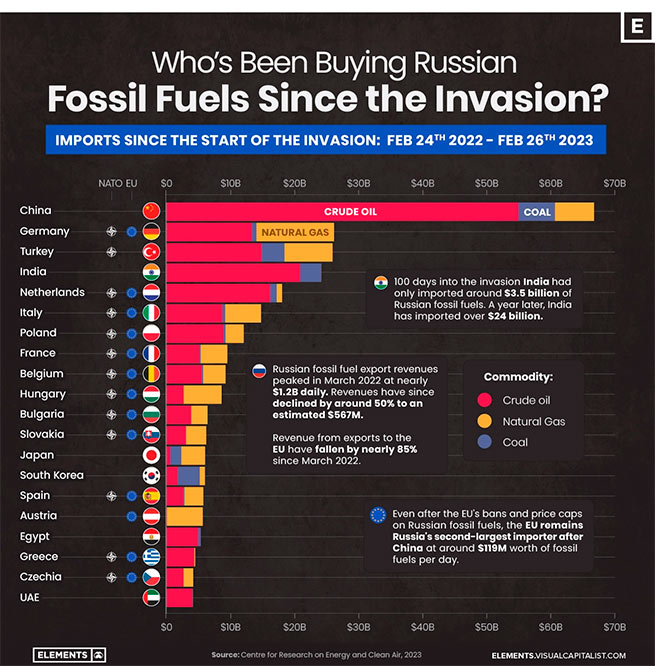

Leading Importers of Russian Fossil Fuels

As you might expect, since the beginning of the invasion, China has been the biggest buyer. Neighbor and informal ally Russia mainly imports crude oil, which makes up more than 80% of its imports, totaling more than $55 billion since the invasion began.

largest economy EU Germany is the second largest importer of Russian fossil fuels, mainly through gas imports worth more than $12 billion.

Turkey, a member of NATO but not the EU, follows Germany as the third largest importer of Russian fossil fuels after the invasion. The country is likely to overtake Germany soon as, as a non-EU member, it is not subject to the bloc’s import bans from Russia that took effect last year.

Import to Greece

Since the start of the war, Greece has imported $4.5 billion worth of fossil fuels from Russia, of which $4.3 billion was crude oil and $0.2 billion natural gas, according to CREA.

Falling fossil fuel revenues in Russia

EU bans and price caps have caused Russia’s daily fossil fuel income to fall by almost 85%, from a peak of $774 million in March 2022 to $119 million on February 22, 2023.

And although India increased its imports from $3 million on the day of the invasion to $81 million on the day of February 22 this year, this increase does not cover the hole of $655 million due to lower imports from EU countries.

Similarly, despite the fact that African countries have doubled their imports of Russian fuel since December last year, Russian marine exports of petroleum products are still down 21% overall since January, according to S&P Global.

Other factors affecting RF income

Overall, since its peak of $1.17 billion on March 24, Russia’s fossil fuel revenues have fallen by more than 50% to just $560 million a day (which, however, is significantly higher than the same period in previous years). ).

Along with lower EU purchases, a key factor was the nearly 50% drop in the price of Russian crude oil after the invasion, from $99/bbl to $50/bbl today (as other oil prices have fallen).

Sanctions

International sanctions imposed on Russia in response to the war in Ukraine, including a $60 per barrel ceiling on crude oil prices imposed by the G7, have resulted in Russian Urals oil being sold at a marked discount from Brent oil.

Since December, 27 EU countries have also banned the export of Russian oil by sea and imposed sanctions on the export to Russia of technologies necessary for oil refining. The US and UK have also imposed sanctions on Russian oil exports. However, this did not help much, Russia found many ways to circumvent these sanctions.

Moscow has used oil and gas revenues — about 11.6 trillion rubles ($154.68 billion) last year — to cover its budget spending and has been forced to start selling off its international foreign exchange reserves to cover the deficit created by its invasion of Ukraine. .

Europe’s Green Dream.

February 5, 2023 marked a new era for the global oil market, redrawing the trade map and highlighting new players: on the first Sunday of this month, the EU embargo on petroleum products came into force, two months after the embargo on Russian oil, marking the full independence of the EU from Russian oil . Or, at least, as its original purpose was declared.

Europe appears to be adjusting to a new reality, and in fact there are quite a few who claim it is getting closer to its green aspirations…

This change is, of course, a far cry from the “green transition” that Europe envisioned for its long-term future, where governments pay whatever they need to keep LNG safe. And it has been painful, as electricity costs hit a symbolic $1 trillion last year.

However, even the most optimistic analyzes of the bloc’s own experts and leaders at the start of the war failed to predict how fast Europe could move forward. A year ago, Europe was spending about $1 billion a day paying for gas, oil and coal imported from Russia. Today, the EU countries pay Russia only a small part of this amount. However, this does not mean that Europe has reduced the consumption of oil and gas, just now a much larger amount goes to suppliers from the United States, and the price of hydrocarbons from across the ocean is noticeably more expensive than from Russia…

“Russia has been blackmailing us by threatening to cut energy supplies,” European Commission President Ursula von der Leyen said earlier this month, noting that Europe has completely shed its dependence on Russia. At the same time, they forgot to mention the price that the European economy and population paid for this independence.

The situation of 2022 reminded the author of a story that took place in 1904, when due to the actions of terrorists from among the Socialist Revolutionaries, paid for by Standard Oil, oil production facilities in Baku were practically destroyed, which allowed the American company to oust Russia from the European market oil, where before that it occupied more than 70%, thus reducing its share to less than 30%.

More Stories

Greece: growth in deposits from households and businesses in March 2024

How much will it cost a Greek family to celebrate Easter?

EU employment record: Greece "stuck" in a low position