Created by AI

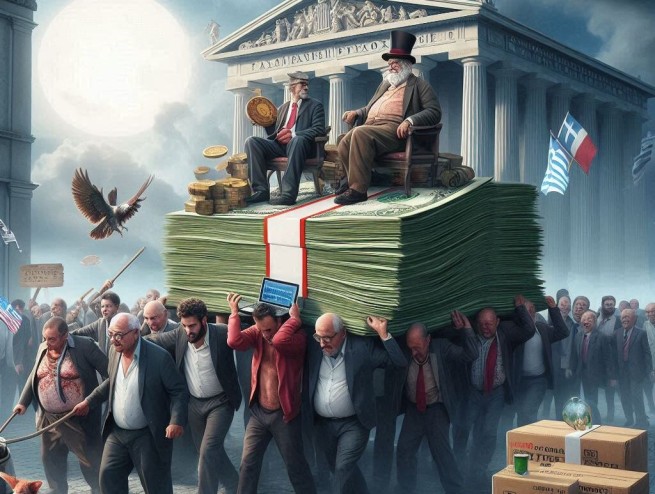

Of great concern in the context of progressive inflation are the figures of the Foundation for Economic and Industrial Research (IOBE) regarding poverty, which is observed in Greece.

Tellingly, a special analysis entitled “Progressiveness of taxation of declared income in Greece, 2012-2021” included in the report on the Greek economy shows that class inequality has increased. But not only that. Another important fact is that in the economic pie, which has shrunk, The poorest people earn even less than the richest, whose income has increased.

As noted, in the 2012-2021 decade, a significant part of the population was below the poverty line, which is reflected in citizens’ tax contributions. According to the corresponding analysis, 40% of the population paid 1.63% of the total taxes (having incomes of up to 6098 euros). It is worth noting that the poverty threshold, according to the classification ELSTAT for 2021 was €5,712 per year for a one-person household and €11,995 per year for households with two adults and two dependent children under 14 years of age.

There are increased levels of income inequality compared to 2012, as the bottom 20% received just 0.2% of total income (down from 1.4% in 2012), while the rich 20% received 58.7% of total income (down from 52.6 % in 2012). In fact, the richest part of the population increases their income in the midst of a crisis, unlike the poorest.

ELSTAT: 2,658,400 citizens faced poverty in Greece.

IOBE (Ίδρυμα Οικονομικών και Βιομηχανικών Ερευνών) uses publicly available data from the Independent Directorate of State Revenue (AADE) on personal taxation. The most available data (2021) is compared with the earliest (2012). Reported revenues (actual revenues from all sources) in 2021 were reported to be 7.2% lower than in 2012.

Also in 2021, 20% of taxpayers fell into the lowest income category (up to €1,016). And another 20% are those whose income is 19,312 euros and above.

In addition, using the Eurostat price index to compare incomes of different years with each other (price levels in 2021 were slightly lower than in 2012), the study notes that the impact of the financial crisis on citizens' incomes was quite significant.

“We also note that, based on the income data declared to the tax authorities, a large percentage of the population is below the poverty line, which, according to the ELSTAT classification for 2021, was 5,712 euros per year for a single-person household and 11,995 euros for families with two adults and two dependent children under 14 years of age.”

The World Bank's Gini inequality index ranks Greece 57th in the world in 2021, according to IOBE. Gini coefficient – a statistical indicator of the degree of stratification of society in a given country or region according to any studied characteristic. Used to measure economic inequality. The Gini coefficient can vary between 0 and 1. The more its value deviates from zero and approaches one, the more income is concentrated in the hands of certain groups of the population. Gini index — percentage representation of this coefficient.

As you know, the tax system in Greece is progressive (i.e. tax rates increase as income increases). In this regard, according to IOBE, 40% of the population paid 1.63% of total taxes, and 20% paid 76.84% of total taxes.

In addition, according to data reported to the tax authorities, income inequality, which is obtained by comparing the distribution of shares of total income, has worsened despite the current progressive tax system, says the IOBE study. In fact, despite a slight decline in the progressivity of overall income taxes over the past decade, the report notes, there has been a systematic increase in the level of progressivity, with citizens with the highest reported incomes bearing a disproportionate share of overall taxes.

In conclusion, IOBE estimates that the economic crisis experienced by Greece has had an impact negative and significant impact on

incomes of citizens, and the effect has not yet been overcome. Moreover, despite the current progressive tax system, based on income declared to the tax authorities, inequality, which is obtained by comparing the distribution of shares in total income, has worsened.

More Stories

Robot Sophia commented on her fall from the steps in Thessaloniki

Impressive "missile war" in Vrontado on Chios

Public transport traffic in Athens on Easter weekend