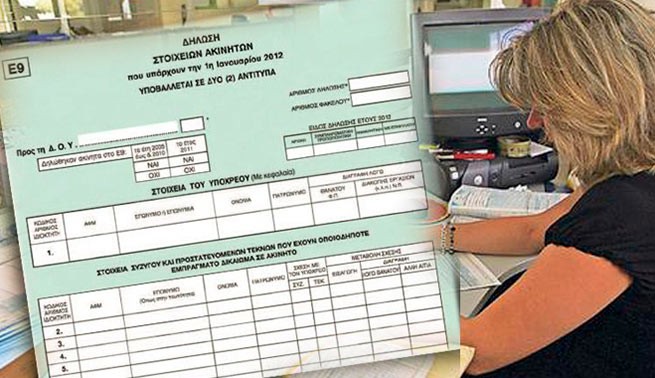

Property owners (in case of changes) must submit declaration forms E9 until Friday 8 March.

Owners of real estate in Greece, residents or non-residents, are required to submit a declaration of real estate data (E9):

- for any acquisition or other change in his/her real estate located in Greece

- for each acquisition or other change of real estate located in Greece, until March 31 of the year following the date of acquisition or change.

An exception is the case of acquiring real estate by inheritance, for which the E9 declaration is submitted before the last working day of the month following the end of the period for refusal of inheritance. Applications are submitted through the online platform aade.gr

1. Using the online service, legal entities can submit:

- Declaration of real estate data (E9)

- Original and amended E9 returns for 2011 and subsequent years.

In addition, you can submit the following declarations:

- Print the Administrative/Adjustment Tax Determination Statement for 2014 and subsequent years, if one was issued.

- Certificate issuance ΕΝ.Φ.Ι.Α. (Article 54A of Law 4987/2022) in the current year.

2. Using the online service, individuals can submit:

- Declaration of real estate data (E9)

- Original and amended E9 returns for 2010 and subsequent years.

In addition, on the platform you can:

- Print the individual tax report for 2010-2013 and the Administrative/Corrective Tax Report for 2014 and subsequent years, if issued.

- Receive the ΕΝ.Φ.Ι.Α certificate. (Article 54A of Law 4987/2022) in the current year.

3. Automatic creation and submission of digital declaration of real estate data (E9) via the myPROPERTY application

- Starting from 07/07/2023, in cases where the real estate transfer tax declaration is submitted digitally through the “myPROPERTY” application in accordance with paragraph a, paragraph. 1 A of the AADE Director’s Resolution of A. 1110/2022, in the integrated information system (Ο.Π.Σ.) “Real Estate Cadastre”, a declaration of real estate data (E9) of counterparties is automatically generated indicating changes in their real estate.

- From 01/31/2024, in cases where parental gift and donation tax returns are filed digitally through the “myPROPERTY” application and relate to agreements in which 100% full ownership passes from the donor/parent to the donor/spouse, according to with A.1015/2024 decision of the Director of AADE, the declaration of real estate data (E9) of the contracting parties with changes in their real estate is automatically generated in the integrated information system (Ο.Π.Σ.) Real estate cadastre.

More Stories

They don't want to transport electric cars on ferries. Authorities' reaction

Real estate: investment interest in private islands in Greece

Eurostat: what goods and services do Greeks purchase online?