The Greek real estate market is turning into a two-speed market, with foreign capital inflows remaining strong and fueling the upward trend in prices.

According to the interim report Bank of Greece (BoG) on monetary policy, expectations for the coming period remain cautiously positive, influenced by international events and the environment of high inflation, rising interest rates and uncertainty, which directly affect Europe and the global economy as a whole. At the same time, the shift in demand patterns that began after the pandemic period continues to this day, with certain property categories and locations attracting disproportionately high investment interest, reinforcing the image of a mixed-speed market.

To the extent that overseas demand remains strong and the supply of quality properties remains limited, prices are expected to continue their upward trend at the high end of the market, dragging down secondary market prices. However, the rate of price growth is expected to become more moderate as the current situation does not allow investors to become complacent about the medium-term evolution of market conditions.

Houses and apartments

More specifically, according to Bank of Greece, the Greek real estate market has attracted significant investor interest, despite negative developments in the international environment and the uncertainty that has arisen over the past two years due to increased geopolitical instability. Property prices continued their upward trend as increased demand from abroad and domestically for quality properties is not covered by the current limited supply and maintains a high growth rate, albeit softer compared to previous quarters.

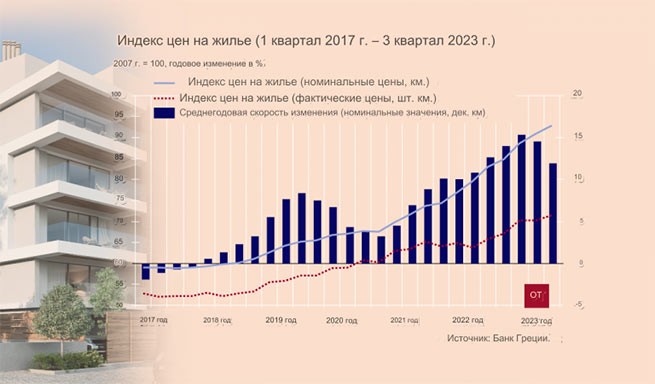

However, leading indicators related to the domestic market, as well as price developments at European and international level, potentially indicate an approaching period of price correction, especially in relation to the purpose, characteristics and location of properties in lower demand. In the residential real estate market, high rates of growth in apartment prices continued until the 3rd quarter of 2023, despite the fact that the last two quarters saw a slowdown in individual price indices. Based on estimates collected Bank of Greecefor nfirst nine months of 2023 apartment prices (in nominal terms) grew by 13.9% year on year compared with an increase of 11.2% in the corresponding period of 2022.

At the local level, house prices show heterogeneity in their changes, with large increases observed mainly in areas of high investment interest, and in other areas changes are less significant. The increase in apartment prices nationwide in the first nine months of 2023 was largely driven by high rates of price growth in most urban areas of the country.

More specifically, the highest growth rates were recorded in Thessaloniki (16.5%), Athens (14.5%) and other major cities (14.1%), while in other regions of the country growth was more soft (11.1%). Over the same period, prices for older apartments (over 5 years old) grew by an average of 14.4% per year, compared to 13.1% for prices of new apartments.

The housing market, despite the current uncertainty, maintains its dynamics and is characterized by high, mainly investment, demand and low supply. Positive developments in tourism and short-term rentals, subsidized housing programs for youth and increased investment interest from abroad in purchasing real estate, including the Golden Visa program, continue to strengthen market dynamics, as reflected in other relevant indicators.

More specifically, for the eight months of 2023, activity in the housing construction sector (data ELSTAT) recorded positive annual rates of change in both the number and value of new residential building permits at the country level (22.5% and 14.5% respectively), up significantly from the slight decline in the corresponding period last year (- 1.3% and -4.1%). Residential property investment (seasonally adjusted ELSTAT data, at constant prices) nationwide strengthens significantly year-on-year at 40.2% in the first nine months of 2023 (compared to 12.1% in the corresponding period of 2022), although are still at a very low level as a percentage of GDP (2.0%). At the same time, positive business expectations for residential construction (IOBE data) are further strengthened in the first nine months of 2023, up 13.3% year on year.

Despite increased interest in residential real estate, bank financing is low, with total new mortgage loans recording a 4.9% year-on-year decline in the ten months of 2023. Finally, in the first nine months of 2023, year-on-year total new home construction values (ELSTAT data) continued to rise by 6.7%, partly helping to strengthen home prices.

Offices and shops

In the commercial real estate sector, based on data collected Bank of Greece, in the first half of 2023, office prices rose 6.6% year-on-year, and retail space prices increased 6.9%. In Athens, the corresponding rate of increase in office prices was higher (7.2%), while the rest of Greece also saw a significant increase (7.3%), after a long period of relative price stagnation. In Thessaloniki, after two consecutive six-month periods of high growth, prices recorded a slight correction compared to the previous year (-0.5%).

Regarding luxury retail premises, in the first half of 2023 significant positive annual rates were recorded in the price indices of Athens (8.4%) and Thessaloniki (9.8%), while the corresponding figure for the rest of Greece amounted to 3.7%. Finally, across the country as a whole, both office leasing and store leasing recorded annual growth of 5.6% over the same period.

In the eight months of 2023, commercial real estate construction activity (ELSTAT data) recorded a positive rate of change overall, while individual categories showed a mixed picture. More specifically, the number of new office building permits increased (75.2%), while the corresponding total volume (in cubic meters) decreased by 15.9% compared to the corresponding eight months of 2022.

New hotel building permits fell 15.6% and volume decreased 8.0%. Finally, retail construction activity was particularly strong in volume (226.9%) but moderately positive in new permits (7.8%). The mixed picture of construction activity is likely due to conditions of excess demand in an economic environment that is not particularly conducive to the launch of new projects. It is also due to the small number of new building permits by category in absolute terms, resulting in large percentage fluctuations when in reality the fluctuations are small.

ΑΕΕΑΠ

Based on data collected by the Bank of Greece and the results of a study of the commercial real estate market, in the first half of 2023 most of the funds real estate investment companies (ΑΕΕΑΠ) and other investment portfolios, as well as real estate development companies, was aimed at the purchase and/or development of high-quality office premises, predominantly with modern bioclimatic characteristics.

Hotels, commercial warehouses and special purpose investment housing have also attracted significant capital. The minimum yield for high-end offices in the most commercial areas of the capital city center varied between 5.5 and 6.6%, roughly in line with the previous six months, while the minimum yield for high-end stores in the most commercial areas of central Athens varied between 5.3 and 6.0 %.

More Stories

They don't want to transport electric cars on ferries. Authorities' reaction

Real estate: investment interest in private islands in Greece

Eurostat: what goods and services do Greeks purchase online?