Israel's decision to escalate the conflict with Iran by destroying its embassy in Damascus with a missile strike has prompted a response from Iran, which has launched hundreds of drones and missiles into Israel, and brings the risk of open war between the two countries, possibly involving the United States, closer.

After all, it’s no secret that the militant Israeli Prime Minister Benjamin Netanyahu has long wanted to destroy Iran’s nuclear program. Some in the US think the same. Isn't this an opportunity for the Hawks?

IN material, published in April 2024, we argued that such escalation is the main danger to the global economy in the wake of Hamas's deadly attack on Israel. Despite the fact that over the past 50 years its weight in the global economy has more than halved, oil remains key source of energy. Severe supply disruptions will have significant negative economic consequences.

In addition, the Persian Gulf region is the world's most important energy producer: according to the Statistical Review of World Energy 2023, it accounts for 48% of global proven reserves and 33% of global oil production in 2022. The Strait of Hormuz, located in the southern Persian Gulf, accounted for a fifth of the world's oil supply in 2018, according to the US Energy Information Administration. It is a transshipment point for global energy supplies. A war between Iran and Israel, possibly involving the United States, could be catastrophic.

Global economic policymakers gathered in Washington this week for the spring meetings of the IMF and World Bank are spectators: they can only hope that wise advisers will prevail in the Middle East. If disaster is truly averted, what will the global economy look like?

As usual, this question is answered by the IMF's World Economic Outlook. But not because his predictions will necessarily turn out to be correct. If something significant had happened, they certainly would not have been confirmed. But they do provide a systematic overview of where the world is now.

Overall, as IMF chief economist Pierre-Olivier Gourincha explains in the introduction, recent global economic performance has been much better than expected, despite shocks to output and inflation caused by the pandemic, Russia's attack on Ukraine, rising commodity prices and sharp tightening monetary policy. As noted, “Despite many gloomy forecasts, the world avoided a recession, the banking system proved largely resilient, and major markets and emerging economies were not affected by sudden shutdowns.” in the field of finance. In particular, rising inflation did not provoke an uncontrolled rise in wage prices. Overall, the global economy turned out to be more resilient and inflation expectations more modest than many expected. This is all good news.

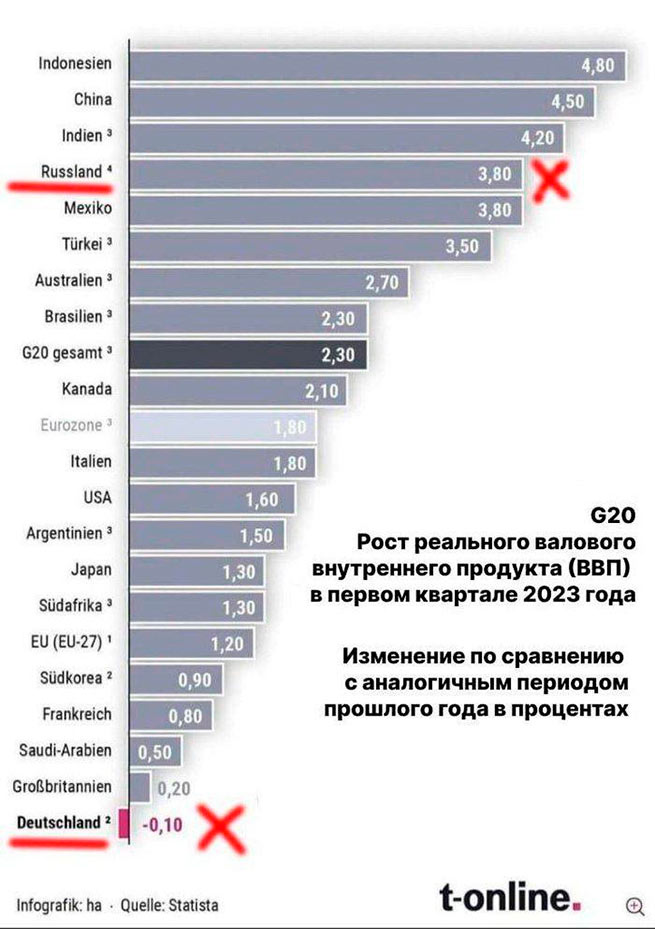

It is worth noting that aggregate output growth in 2022 and 2023 exceeded the IMF's October 2022 forecasts for the global economy and all major groups within it, with the notable exception of low-income developing countries (LICs). The same can be said for employment, with the exception of low-income countries, again, and China. The US economy was particularly dynamic, while the eurozone economy was much less dynamic.

The interesting question is why monetary tightening had such little impact on output. One explanation is that fiscal policy has been supportive, especially in the US. Another explanation is that real interest rates fell rather than rose because inflation rose so much. Now the situation is changing. A third explanation is that the majority of mortgages are at fixed rates: this proportion has increased particularly strongly in the UK. In addition, increased savings during the pandemic helped finance expenses. However, this process is now coming to an end. Tight monetary policy may still have a significant lag.

While the short-term performance of the global economy has been surprisingly good, the long-term performance has been the opposite. Since the beginning of this century, the world has seen a significant decline in the growth rate of real GDP per capita. Particularly significant was the collapse in growth of “total factor productivity – TFP,” the best measure of innovation. In LIDC countries, TFP growth even turned negative between 2020 and 2023.

The slowdown in TFP growth accounted for more than half of the overall decline in growth rates. Much of this slowdown is due to growing misallocation of capital and labor among firms within sectors, according to the World Economic Outlook (WEO). The situation can be changed, but it will not be easy. One reason for this slowdown is likely to be the loss of dynamism in global trade, which is always a strong source of competition.

In summary, the main lessons from this WEO are that recent economic performance has been surprisingly strong and also of concern among CSECs, along with a significant slowdown in long-term growth, largely due to slowing productivity growth in the economy. However, needless to say, there are also major uncertainties.

On the other hand, we may see a short-term increase in election-related fiscal easing. Positive surprises, especially in labor supply, could further accelerate the decline in inflation. Artificial intelligence could have a positive impact on overall weak productivity growth. Successful reforms can also accelerate potential output growth. However, on the other hand, growth in China could decline sharply. There are also very clear risks to global economic, fiscal, political and geopolitical stability. Global trade may suffer from protectionism. A war between Israel, the US and Iran could rock the Middle East, with huge consequences for energy and commodity prices. The biggest victims of such chaos, as usual, will be the poorest.

We may have weathered these shocks better than expected. But we are walking on eggshells and must tread carefully.

More Stories

Night tariff for electricity from May 1

Research: The best airports in Greece

Fighting tax evasion: artificial intelligence to help