Additional contributions paid by insured persons, regardless of whether they are members of the same fund, have parallel insurance or belong to a special scheme for difficult and hazardous occupations, give a pension of up to 754 euros.

All insured persons, regardless of whether they started insurance before or after 1993, are recipients of additional contributions, according to a publication in the publication Eleftheros Tipos. As long as they pay additional contributions to their funds, for every 1% of additional contributions they receive a replacement rate increase of 0.075% each year.

The pension supplement through increased contributions applies to those who retired on or after 13/5/2016, and in particular to four categories of insured persons:

- Persons insured by communal banking funds who pay pension contributions in excess of the 20% pension contribution rate applicable to employees for almost their entire working life. For this category of insured persons, the pension is calculated taking into account employee and employer contributions of up to 35% instead of the 20% applied to all others. This category also has higher supplementary insurance contributions (eg 12% instead of 6%), resulting in a corresponding increase in supplementary pension.

- Insurance in two parallel funds until 2016 and a single contribution to ΕΦΚΑ from 1/1/2027 onwards. With parallel insurance, the time spent in the two funds before 2016 is calculated either as an additional pension (which benefits most people) or as a second funded pension. The additional pension contribution for parallel insurance is 20%.

- Insured with deductions for difficult and harmful working conditions in the private sector (IKA), with an additional pension contribution of 3.6% (total 23.6%).

- Insured with contributions for hard and hazardous work in municipalities with an additional pension contribution of 4.5% (total 24.5%).

Additional contributions are paid by both old insured people before 1992 and new insured people after 1/1/1993. In the funds of state-owned enterprises and banks, additional pension contributions reached (National Bank Fund) 37.5% and began to gradually decline after 2012 to reach 20% from 2020.

With parallel insurance in two funds, the insured persons paid separate contributions until 2016, and the insurance period until 2016 is calculated separately in each fund. With parallel insurance until 2016, it is in the interests of the insured person to receive a funded pension from the fund with the longest insurance period and an increase of 0.075% for the years of insurance in the second fund.

Since 2017, after the integration of the old funds into the ΕΦΚΑ, the insurance period has become single, and additional contributions paid by the insured person to the two funds (for example, TSAY and the state) increase the size of the funded pension. For example, an insured person who has parallel insurance in the public sector and ΤΣΑΥ until 2016 and in ΕΦΚΑ (with double contributions) from 2017, becomes entitled to a pension in 2024, when the service is 40 years old and turns 62 years old. Out of 40 years, he worked for 32 years in two foundations until 2016, and the remaining 8 years in EFKA from 2017 to 2024. He will receive a funded pension, which will be calculated for 40 years of insurance in the most paid fund (for example, state) and an additional payment for insurance in the second fund (for example, ΤΣΑΥ) for 32 years of contributions until 2016. Assuming that as an insured person in ΤΣΑΥ his contribution-based pension earnings are 1000 euros, the increase in pension he will receive will be 480 euros.

Increases in pensions for workers with difficult and (or) hazardous working conditions, but… at 67 years old. For insured persons participating in pension programs for workers with difficult and/or hazardous working conditions, the increase caused by additional contributions goes directly into the replacement rate. For example, for a person insured in a pension system for 35 years and paying 3.6% of insurance premiums, the normal replacement rate is 37.31%. However, due to pensions for workers with difficult and (or) harmful working conditions, the final coefficient will increase by 9.45% and amount to 46.76%.

If his pensionable earnings are €1,800, the pension he will receive (contributory plus national) will be €1,267.85. Without large contributions, the pension would be 1097.95 euros. In this example, the benefit from additional contributions for heavy workers is 170 euros.

ATTENTION: A legal provision adopted in 2018 significantly changed the situation for those insured with IKA under the heavy plan, since it was stipulated that if they use the heavy provisions to retire 5 years earlier, i.e. at 62 years old instead of 67, they will not receive an increase, whereas if they retire at 67, they will receive a heavy increase and the pension will be higher. This change only applies to severe IKA, not to severe OTA or heavy for certain occupations of workers in DEKOs (PPC, OTE etc.).

What can they claim? Why were older workers excluded from promotions? The 0.075% increase in pension due to additional contributions applies only to those who retire from May 2016, and not to old pensioners who receive a recalculated pension. This provision is provided by Law 4387/2016 (Katrougalos Law) and Law 4670/2020 (Vroutsis Law), which also improved pensions from 30 years of insurance coverage and above.

Despite the fact that former DEKO pensioners went to court demanding that their pensions be increased through additional contributions, no decision has yet been made that would be in their favor. The injustice concerns older pensioners who were insured in two parallel funds but did not reach 16 years of parallel insurance, which would entitle them to a second pension at age 67. These pensioners today can still demand an increase in their pension, taking into account double contributions, or a refund of their contributions if their claims are not overdue.

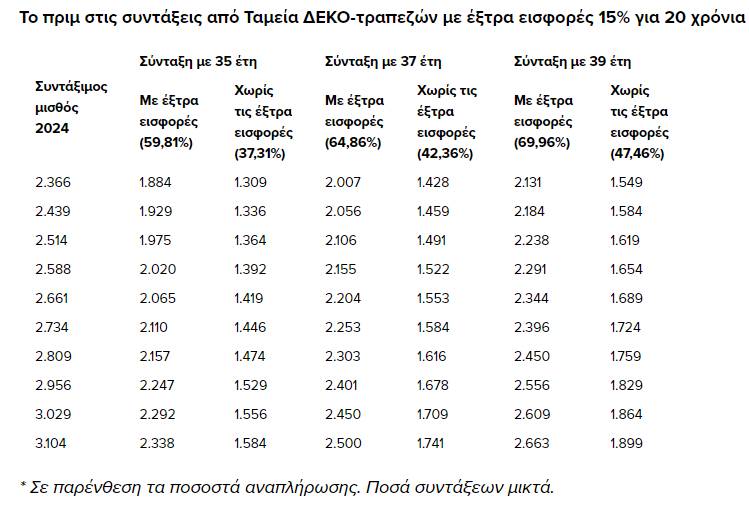

Increase in pension by up to 754 euros due to additional contributions to PPO and banks – example. An insured person with 35 years of service in the ΔΕΚΟ or banking fund, of which he has made additional contributions of 15% for 20 years, will receive a pension with a replacement rate of 59.81% due to the premium from additional contributions. With a pensionable salary of €2,661, the pension in 2024 will be €2,065 gross, while the regular pension (without additional contributions) will be €1,419. The benefit of additional contributions is an increase in pension by 646 euros per month.

An insured person with 39 years of service, of which 20 years is 15% of additional pension contributions, will receive a pension with a replacement rate of 69.96%, taking into account the premium due to additional contributions. With a pensionable salary of 3,104 euros, the pension in 2024 will be 2,663 euros gross, and without additional contributions – 1,899 euros. The profit from additional contributions is 754 euros per month.

More Stories

Conditions for early and full retirement

Zakynthos: the famous “Shipwreck” beach is closed again this year

Riots in Athens, police used tear gas and batons (video)