“Ensims” in Greece are understood as National Insurance stamps, which are determined according to the number of working days.

These stamps (12-15 years ago these were real stamps) represent documentary evidence of social security contributions paid by both the employer and the employee. These contributions are calculated on the basis of the employee's gross salary, which cannot be less than the minimum.

When working legally in Greece, it is mandatory to be insured by the competent social insurance fund (ΕΦΚΑ). “ΕΦΚΑ” is the National Social Security Organization of Greece, which offers various services, from medical treatment to pensions. Payment of contributions to the social insurance fund is mandatory, gives access to free medical care and a pension, upon reaching the minimum retirement age and the minimum required amount of “ensim”.

Please note the following:

If you work full time in Greece, you earn 25 ensim/marks per month.

To gain access to health care (insurance option), you must pay insurance premiums corresponding to at least 50 days of work (ensima) during the previous calendar year or during the last twelve months preceding the illness.

If you don't pay National Insurance contributions, you are not entitled to free healthcare and a state pension.

If the employer does not pay the insurance premiums, the insured person must file a complaint with e-EFKA. A fine is imposed on the employer and appropriate insurance premiums are assessed.

Insurance premiums for private sector workers

For private sector workers insured by the National Social Security Organization of Greece (e-EFKA), 20% of the primary pension contributions are required. This contribution is distributed between the insured person (6.67%) and the employer (13.33%).

Insurance premiums are calculated on the basis of all types of employee remuneration, with the exception of social benefits associated with marriage, birth of a child, death and severe disability. Contributions are calculated on earnings not exceeding EUR 7,126.94 per month (maximum insured earnings). Bonuses such as Christmas and Easter bonuses and holiday pay are also subject to these premiums, with the maximum insurable salary being applied separately.

Insurance premiums for agricultural workers

Agricultural workers insured by e-EFKA and receiving a labor pension contribute 10% of their salary as insurance contributions to all insurance sectors, including the primary pension, health care and the Rural Housing Fund. At the end of each year, premiums are reconciled to determine the coverage period. Contributions for the entire year must cover the required contributions to the previously named “OGA” for the insurance months resulting from the reconciliation. The difference is paid by the insured person. The employer deducts the insured person's contribution from his salary and transfers it along with the employer's contribution to e-EFKA within the specified time frame. Please note again that failure to pay your National Insurance contributions will result in your ineligibility for free healthcare and the State Pension.

7 steps to check your enshima online

You can follow these steps to check how much ensim you have collected on the platform e-EFKA (in Greek).

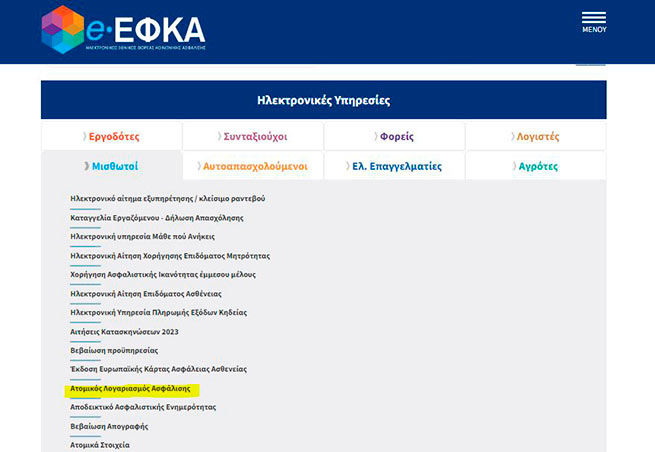

- Login to the e-EFKA platform

- Select “Ατομικός λογαριασμός ασφάλισης” (individual insurance account).

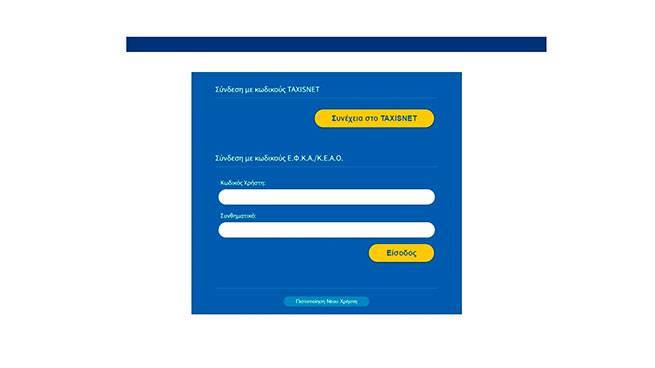

- Click on “Συνέχεια στο TAXISNET” and enter your TaxisNET credentials.

- Enter your AFM (ΑΦΜ) And AMKAand press “Είσοδος”.

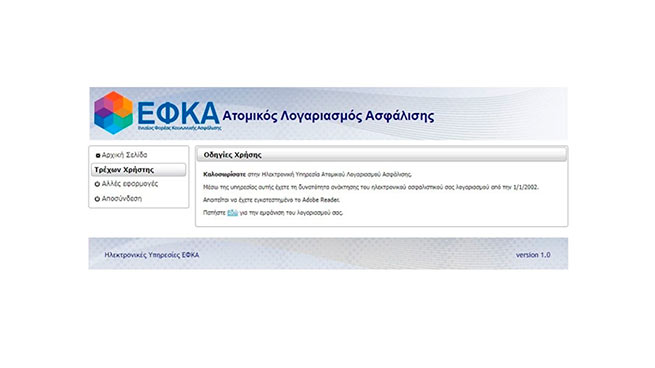

- Click on “εδώ” – “Οδηγίες Χρήσης – Πατήστε εδώ για την εμφάνιση του λογαριασμού σα ς” (Instructions for use – Click here to view your account).

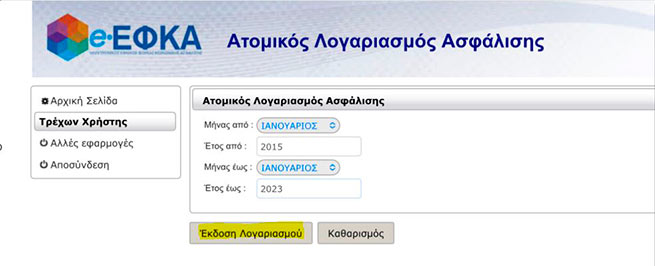

- Select the dates of the period for which you want to view your “enshima” and click “Έκδοση Λογαριασμού”.

- A document with a detailed record of your “ensim” will appear on the screen. The quantity will be indicated under the line “ΗΜΕΡ. ΑΠΑΣΧ.”.

More Stories

AMKA: new rules for issuing and deactivating social security numbers

Bill on mini-insurance of citizens: main provisions

Pensions: who will receive 50 euros and who will receive 100 euros for each month of waiting for an additional pension