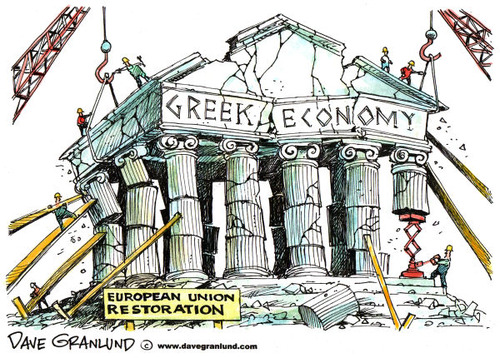

Greece is returning to fiscal deficit and debt rules just as US banks start to collapse…

A recent European Commission directive that ended support measures for member states is expected to be ratified by eurozone finance ministers at today’s Eurogroup meeting in Brussels, boding bad news for the Greek economy. Because fiscal rules on deficit and debt will return in 2024. This means that the “management” of the economy by the Mitsotakis government and especially its real results will be impossible to hide.

Until now, there was a clause about “indulgences” given due to the coronovirus, and then the energy crisis. Apparently, Brussels decided that either the crises are over, or, most likely, no more money to take.

Combined with a crisis that, according to the tradition of the last 100 years, comes from the USA, where already two banks (SVB and Signature Bank) have collapsed, and three more are on the brink (Silvergate Capital, First Republic Bank and Wells Fargo Bank), for Europe and, in particular, Greece, which is facing a serious debt problem and the collapse of the primary economy, very bad things are coming.

The paradox is that although EU and the US has imposed an unprecedented number of sanctions against Russia, but it is the US banks that are failing…

It is worth recalling that when Lehman Brothers collapsed in 2008, Greece ended up signing three consecutive memoranda since 2010 and undertaking three recapitalizations of Greek banks (which have not yet recovered). And, for the avoidance of doubt, suffice it to say that the Greek economy is in fact in virtual normality with foreign debts twice the country’s GDP.

That is, it would seem that the country solved its problems, but in fact it simply put them aside, because with the coming to power of the government of Mitsotakis, Greece, as a true ally of the United States, simply ceased to be reminded of them.

Unfortunately, when a global crisis begins, creditors first of all remember the debtors. And given the possibility of the defeat of the “New Democracy”, Greece will definitely hint about it. Greek public debt at the level 400.275 billion Euro in relation to GDP, which is about 220 billion euros at the end of 2022 – 181.82%.

The public debt of Greece consists of the following debt obligations:

- 96 billion government bonds;

- 11.8 billion euros in Greek government bills;

- 303.5 billion euros in debt, of which 235 billion euros are loans from support mechanisms;

- €49 billion is intra-government lending.

Some argue that in a few years of good growth and due to inflation, the debt-to-GDP ratio will decline. But recent history has proven that the real potential for GDP growth in Greece is no more than 2% per year. “Pleased” only inflation in the euro area, which tends to 10% per year.

As for the banks, with 1,600,000 Greek citizens and 85 billion in red loans, it cannot be said that they are in a good position. Side effects of this problem also affect banks:

- Because out of 750,000 companies, only 40,000 are eligible for loans and only under certain conditions.

- Banks issued senior bonds for the securitization of NPEs – senior bond – and received state guarantees for 18 billion. However, these bonds already show losses of 4-5 billion euros.

If banks sell 50% of their senior bonds – as required by SSM – they will register losses. In addition, due to state guarantees, Greek banks cannot distribute dividends or buy back their own shares.

More Stories

EU employment record: Greece "stuck" in a low position

“Bonus” of 300 euros for the long-term unemployed

Turkish tourists choose Samos for their holidays