About restoration 10 critical moments and the main problems of the Greek economy are described by Reuters in an extensive article.

“The economic recovery is strong, at least on paper”, notes the international agency, emphasizing that the country is now facing new problems. It's surprising that the comments Reuters were ignored by government propaganda, which probably only read the first part of the publication.

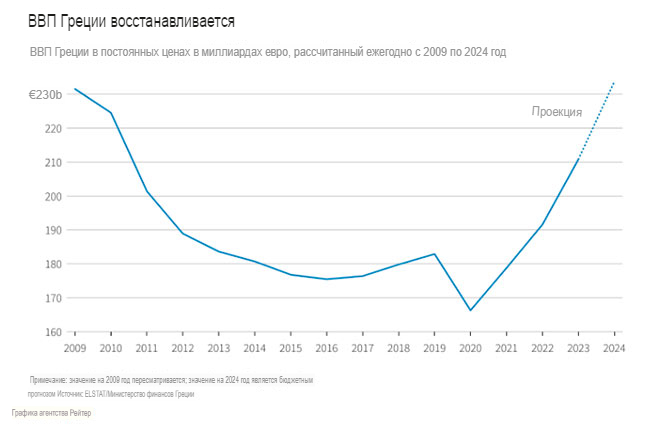

“After a devastating debt crisis, years of austerity, hardship and turmoil, officials and investors now argue that 2024 could be the year the Greek economy finally completes its recovery,” – says the foreword to Reuters.

Citing estimates from relevant institutions, the agency claims that the Greek economy will grow by around 3% this year. If this estimate is confirmed, it will be close to the pre-crisis level of 2009 and well above the eurozone average, whose growth is estimated at 0.8%.

On a positive note, Reuters noted that borrowing costs have fallen below those in Italy and that banks bailed out during the crisis will be fully back in private hands for the first time in decades. In retrospect, it reminds us that by 2015 Greece had signed three “rescue programs” with the eurozone and the International Monetary Fund worth 280 billion euros.

“In return, it agreed to austerity measures that cut public sector wages and pensions and sparked years of violent protests. After exiting the bailout program in 2018, Greece rebuilt its banking system and began to rely solely on debt markets for its banking needs.” borrowings, it repaid its debt to the IMF two years ahead of schedule in 2022.” – it said, including a table showing the reduction in debt as a percentage of GDP, which nevertheless remains the highest in Europe and one of the highest in the world.

10 critical moments

Moving on to the challenges currently facing the Greek economy, a Reuters report states that the first “new problem” is that it recovery is held back by stagnation “the same eurozone giants who once imposed tough economic reforms.”

More than half of foreign direct investment in Greece, which amounted to about 7.5 billion euros ($7.98 billion) in 2022, comes from countries of Northern and Central Europe such as France and Germany, which themselves are experiencing weak growth or are even in recession.

Greek exports, two thirds of which go to EUfell nearly 9% last year, and economic growth slowed to 2% in 2023. “Lowering growth expectations in Europe are affecting Greece in two main ways: through pressure on exports and through the higher cost of money,” – said Nikos Vettas, head of IOBE.

Reuters continues to report on other “critical moments”

“Low birth rate And labor shortage threaten long-term prospects, and spread of climate-related disasterssuch as fires and floods, puts pressure on government finances. Many Greeks hit by the crisis say they see little change in their daily lives, and economists stress it will take time for the broader benefits of the economic recovery to reap more benefits.. For the majority of citizens, the newspaper notes, economic recovery has not led to an increase in living standards.

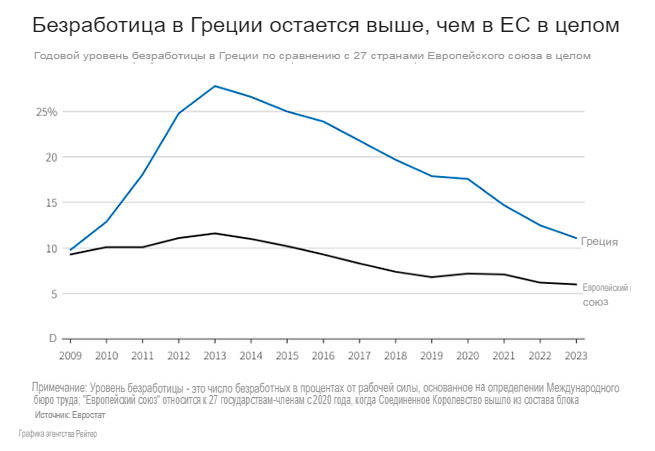

The unemployment rate remains above 10%, the second highest in the EU after Spain, and GDP per capita by purchasing power is the second lowest in the bloc, only higher than Bulgaria, according to Eurostat. In addition, according to official data from the Ministry of Labor, the average monthly salary of 1,175 euros is 20% lower than 15 years ago (and in real purchasing power equivalent, 100% lower).

Regarding the wave of insensitivity sweeping the Greek market, Reuters reports a major 24-hour general strike on Wednesday demanding higher wages and measures to combat inflation and obscenity.

The publication also notes that to ensure long-term growth, the country needs to go beyond traditional economic sectors, namely tourism, real estate and services. Greece needs to develop sectors where investments will be longer-term, such as infrastructure and manufacturing, emphasized Nikos Vettas.

More Stories

Digital Currencies: Global Control or New Opportunities? What's Behind the Introduction of Digital Money

BRICS + ACEAN: A New Era of World Currencies

How much does a square meter of housing cost in the Cyclades