“The Biden administration cannot mindlessly build up debt,” House Speaker Kevin McCarthy said after meeting with the US president.

Events in the US are developing rapidly: shortly after a meeting at the White House with President Joe Biden, Kevin McCarthy told reporters that “nothing has changed” and the country is still moving towards its first bankruptcy!

Just finished meeting at the White House. My position is clear and reasonable—House Republicans have done their job to avoid a default and responsibly raise the debt limit. Democrats must now do the same. https://t.co/AkR3DoagD9

— Kevin McCarthy (@SpeakerMcCarthy) May 9, 2023

The speaker of the House of Representatives said that in order to raise the debt limit, a deal must be struck to tame it, as it threatens all American households: “We have high inflation and four of our largest banks have failed. Nothing has changed since then. The only thing that has changed is that the House of Representatives has been raising the debt ceiling so far. That’s why we had a meeting today.”

“At this meeting, all participants repeated their positions. But I did not see any new movement. The president said that we should meet again, although I was very clear with the president,” McCarthy continued. “We only have two weeks left.”

US debt problems baffle many people not only in the US, but around the world, because until recently everyone was used to Americans raising their debt ceiling by simply printing a few more trillion dollars.

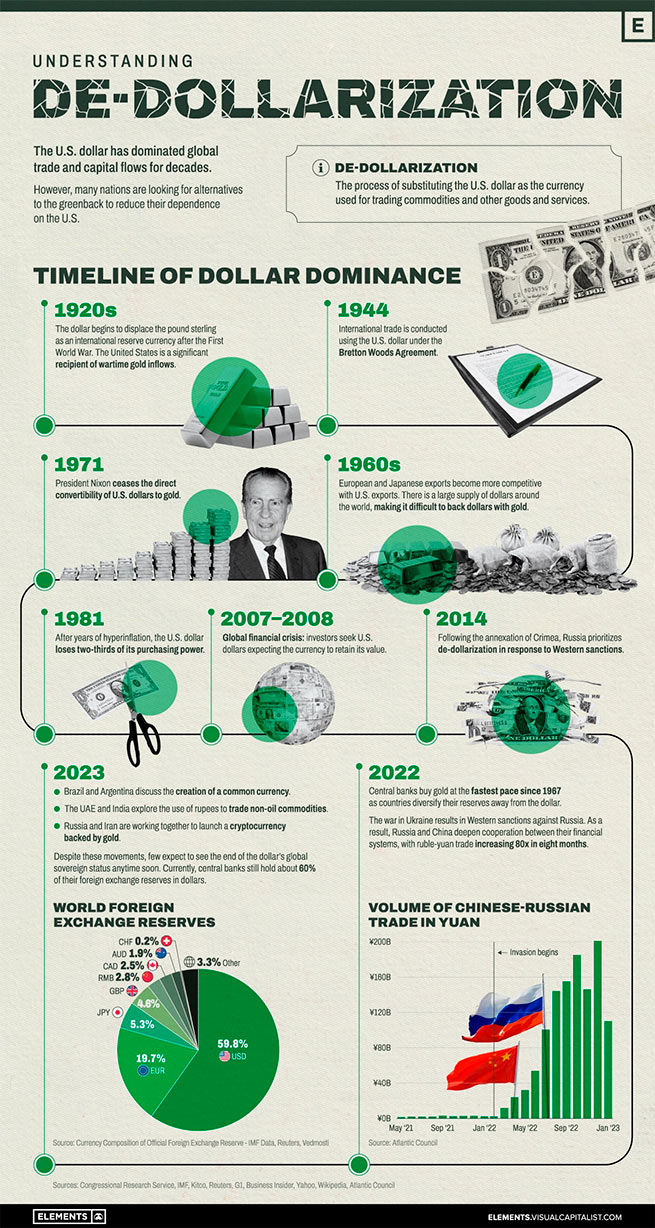

Theoretically, as unfair as it was, it could be done because the dollar was the dominant world reserve currency, and so there was a demand for dollars from other countries. But ever since Russia and China made the decision to eliminate the dollar from all their operations and methodically persuaded other major economies to do so, demand for dollars has rapidly declined. This means that printed dollars now remain in the US. And this means that now they are inflationary and create all the problems that historically were created by inflationary money.

To understand the difference with the past, note that in 2001 the US dollar accounted for 71% of all world currencies. Now it is only 47%, and its share in the world market continues to decline.

Republicans, realizing what is happening, are trying to save the dollar and the American economy, wanting to introduce austerity and limit spending. Democrats do not want this simply because all the policies they have pursued so far that have proved disastrous for Americans and the world are based on their constant funding, such as the Ukraine conflict.

Bruno Venditti of Visual Capitalist recently did an extensive analysis of which countries are currently destroying their economies, or are on the way to doing so, as they want to break their dependence on the US so that Americans cannot impose sanctions whenever a policy is put in place that they do not like, that is, contrary to American interests.

It should be noted here that the impetus for accelerating the process of de-dollarization in many large economies was the sanctions imposed against Russia in connection with the intervention in Ukraine. All over the world began to understand that if their country does not like the United States, it is quite simple – you just have to be disagreeing with the policies of the White Househow right there you are you can lose your money. Naturally, the flight from the dollar began.

As the United States and other Western countries imposed economic sanctions on Russia in response to its meddling in Ukraine, Moscow and the Chinese government have worked together to reduce reliance on the dollar and improve cooperation between their financial systems. Since the intervention in 2022, the trade in the ruble and yuan has increased eighty times!

According to the Russian news agency Vedomosti, Russia and Iran are also working together to launch a gold-backed cryptocurrency. In addition, central banks (especially Russian and Chinese) have been buying gold at the fastest pace since 1967 as countries seek to diversify their reserves away from the dollar.

De-dollarization is a problem in other parts of the world as well. In recent months, Brazil and Argentina have been trying to move forward with a common currency that would essentially unite South America’s two largest economies. At a conference in Singapore in January, several former Southeast Asian officials spoke of ongoing de-dollarization efforts.

According to Reuters, the United Arab Emirates and India are in talks to use the rupee for non-oil trading in an attempt to move away from the dollar. For the first time in 48 years, Saudi Arabia has said the oil-rich country is open to trading in currencies other than the US dollar. Despite these moves, few expect to see an end to the dollar’s global dominance any time soon. Currently, central banks still hold about 60% of their foreign exchange reserves in dollars.

But a few decades ago, this reserve was about 80%, and the pace of de-dollarization is growing. In addition, the US has an additional problem because they used to be able to print as many dollars as they wanted because they exported them all over the world. So they had no problems with inflation.

More Stories

Paris: wild clashes between police and "black" block

Modern Germans are far from the most hardworking in Europe

Georgia: Opposition leaders were brutally beaten by security forces (video)