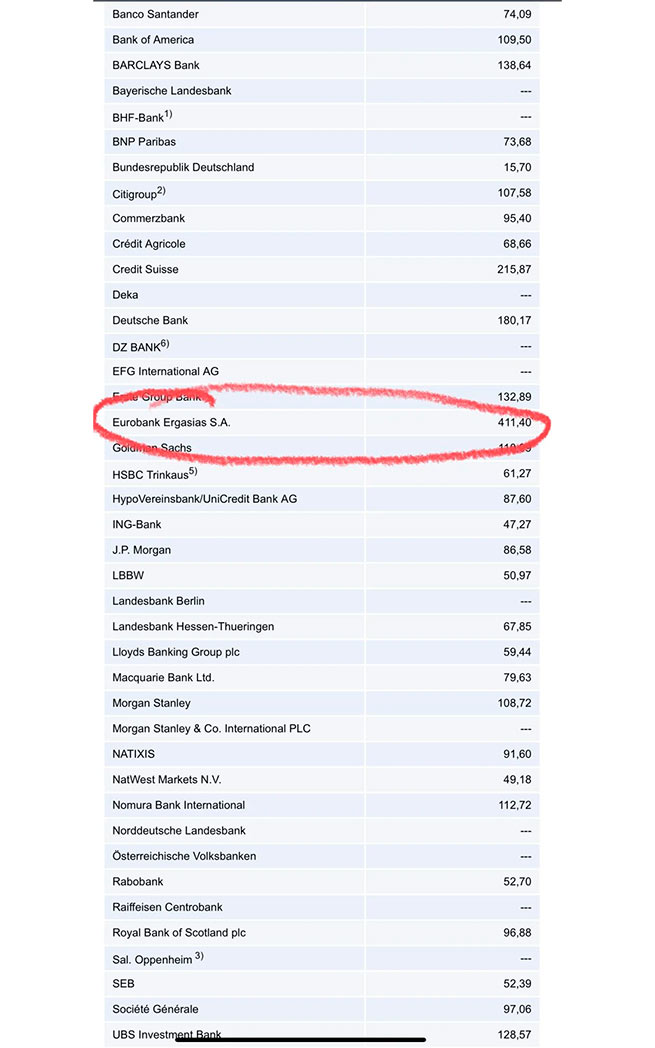

The Eurobank is at the top of the “black list” CDS, which raises serious concerns for the Greek banking system in a very difficult time. Credit default swaps (CDS) are directly related to a bank’s creditworthiness, which is the main criterion for its rating.

When credit default swaps (CDS) are very high, this means that the bank may be on the verge of collapse, as happened in the case of Credit Suisse. The prices below are for CDS with a five-year maturity and corporate bonds of banks as benchmarks. The base units indicated represent the premium that the policyholder must pay to protect against default on the respective bank’s bonds.

These premiums can provide information about a bank’s creditworthiness, always in conjunction with ratings from recognized agencies. A low CDS, i.e. a low risk premium, indicates a high creditworthiness of the bank, and vice versa. In the case of Eurobank, the risk premium is very high…

More Stories

EU employment record: Greece "stuck" in a low position

“Bonus” of 300 euros for the long-term unemployed

Turkish tourists choose Samos for their holidays