A return to a normal rhythm of life (if only the triple crisis – geopolitical, energy and inflationary) can be considered “normal” – does not mean the return of consumers to the habits that they had before the pandemic.

An analysis of consumer shopping data in hypermarkets (over 2500 m2) and “neighborhood stores” is clear evidence that the changes that have taken place over the past three years in the organized food retail market have taken root.

And although the reason for “distancing” and the marking yellow stripes have disappeared from the “shopping in stores” rules, as they did during the quarantine, hypermarkets with a selling space of more than 2,500 square meters continue to rise even after the pandemic.

In 2022, large supermarkets recorded a turnover growth of 7.9% compared to 2021, according to the latest data from research firm IRI. Their share last year was 14.5%, almost at the level of 2021 (14.4%).

In fact, in January of this year, compared to the same month last year, they recorded the highest sales growth compared to other supermarkets at 11%, and their participation in turnover increased to 15.1%.

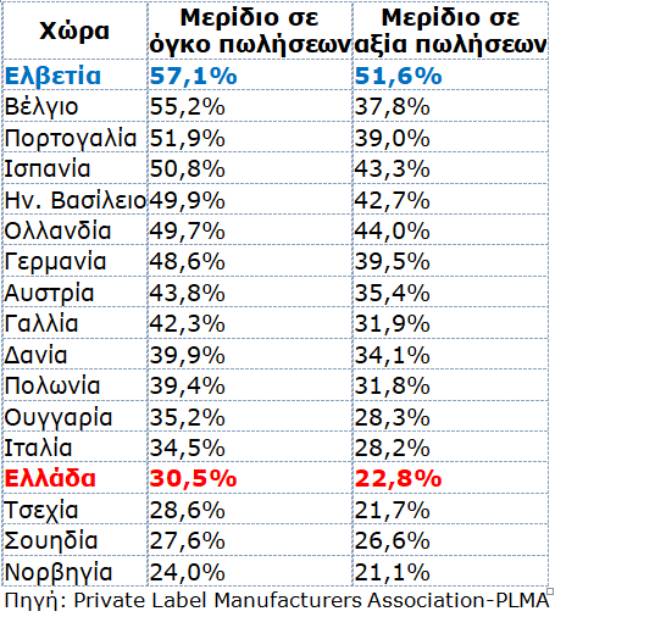

The Greek market for private label products (“from a small private producer”) ranks low compared to the rest of the European markets, both in terms of volume and value of sales, contrary to what one might expect.

According to the annual report of the Private Label Manufacturers Association among 17 countries in Europe, Greece is in 4th place from the bottom in terms of the share of private label products in sales volume, almost twice as compared to Switzerland (!), which ranks first. This is despite the significant recovery that has been and continues to be for private label products in Greece, in contrast to Switzerland, which was the only country to experience a decline in 2022.

In more detail, the share of private labels in our country increased to 30.5% in sales in 2022 from 29.4% in 2021, 30.1% in 2020 and 31.5% in 2019 ., and in value terms it was 22.8% from 21.4% in 2021, 22.2% in 2020 and 22.8% in 2019. It is noted that in 2011, the share of products in sales was only 23% according to the PLMA annual report for this year.

However, the very good performance of hypermarkets is added to the performance of 2021, when the turnover of this category of stores increased by 7.7%, as people preferred larger areas to avoid overcrowding. However, in terms of the percentage increase in trade in 2022, small supermarkets dominated, that is, up to 400 sq. m. In particular, small supermarkets and convenience stores recorded an increase in turnover by 11.6%, and their share was 13.6%. They demonstrated a steady growth in January of this year (the increase in turnover amounted to 10.5%). In contrast to hypermarkets, the growth of small stores in 2021 was almost zero (+0.2%).

As for the other categories of supermarkets, which also account for the lion’s share, since they together account for 72% of the chain’s turnover, the growth they showed was much lower. In 2022, medium-sized supermarkets, from 400 to 1000 m2, showed a turnover growth of 5.3%, while medium and large ones, from 1000 to 2500 m2, showed a turnover growth of 3.6%.

What are the reasons? In an inflationary environment where households are saving even on basic necessities, large stores favor offers and promotions, a commercial practice that is more pronounced in this category of stores. Great variety in the codebook also plays an important role, as fewer visits and larger baskets meet the needs of the month.

More Stories

EU employment record: Greece "stuck" in a low position

“Bonus” of 300 euros for the long-term unemployed

Turkish tourists choose Samos for their holidays