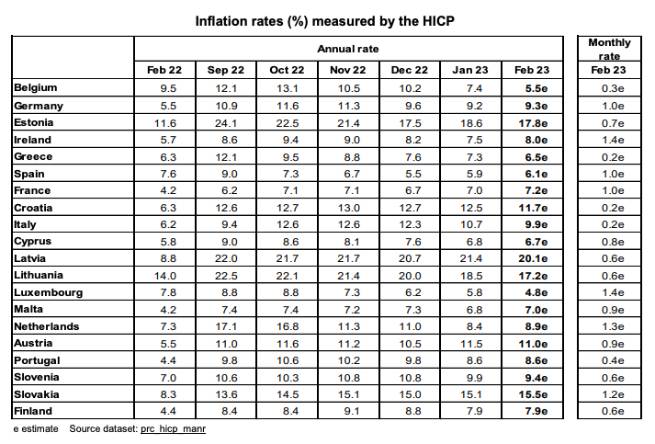

Inflation in Greece dropped markedly last month. The harmonized inflation rate in February, compared to the corresponding month of 2022, was 6.5%, as evidenced by preliminary data published today by the official statistical service of the European Union.

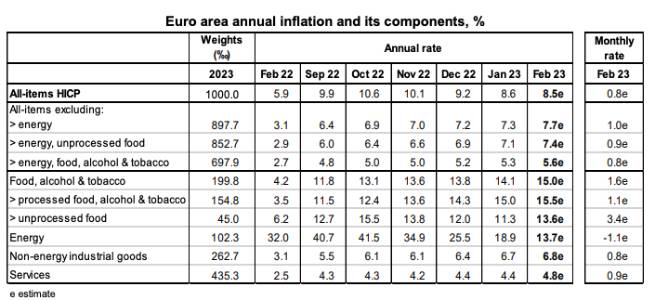

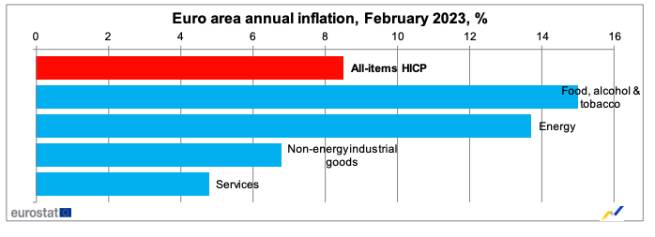

At the same time, consumer prices in the euro area fell slightly to 8.5% from 8.6%, which is higher than the forecast of 8.2%. February brings two optimistic and one pessimistic message. After many months, registered rising energy prices is not the largest among groups of goods and services, but, on the other hand, the group with the largest price increase falls on food. Among the four major groups, only energy prices slowed in February. ot.gr. On a monthly basis and compared to January, inflation in Greece increased by 0.2%, and in the euro area by 0.8%.

Recall that in January, the consumer price index reduced to European data in Greece slowed to 7.3% on an annualized basis from 7.6% in the last month of last year. At the eurozone level, inflation also slowed down from 9.2% in December 2022 to 8.6%. It should be noted that the traditionally harmonized Eurostat inflation indicator is somewhat higher than the one presented ΕΛΣΤΑΤ (in January, the announced figure was 7.2%).

On the other hand, structural inflation, which excludes fluctuations in the prices of energy, food and beverages, is estimated to have accelerated in the euro area, reaching 5.6% in February, compared with 5.3% in January and 5% projected.

Food prices continued their rise in February: they are expected to rise by 15% after they strengthened to a position of 14.1% a month earlier. Inflation rates are the highest for many months among the main groups of goods, as energy prices rose by 13.7% last month from 18.9% in January. Prices for non-energy (industrial) goods rose by 6.8% from 6.7% in January, while prices in the services sector rose by 4.8% from 4.4%.

A slight slowdown in inflation and its persistence at a high level will undoubtedly be the topic of debate among European Central Bank policymakers at the next meeting, scheduled for March 16. The money market forced the ECB to raise interest rates by 50 basis points, setting the key deposit rate at 3% (from 2.50% currently). However, at this level of inflation, it is doubtful that any ideas about slowing down the interest rate increase will be discussed.

More Stories

Greece: growth in deposits from households and businesses in March 2024

How much will it cost a Greek family to celebrate Easter?

EU employment record: Greece "stuck" in a low position