How basic needs and the state of household income changed within the economic framework shaped by rising inflation, and the consequences this had on the daily lives of citizens, experts said.

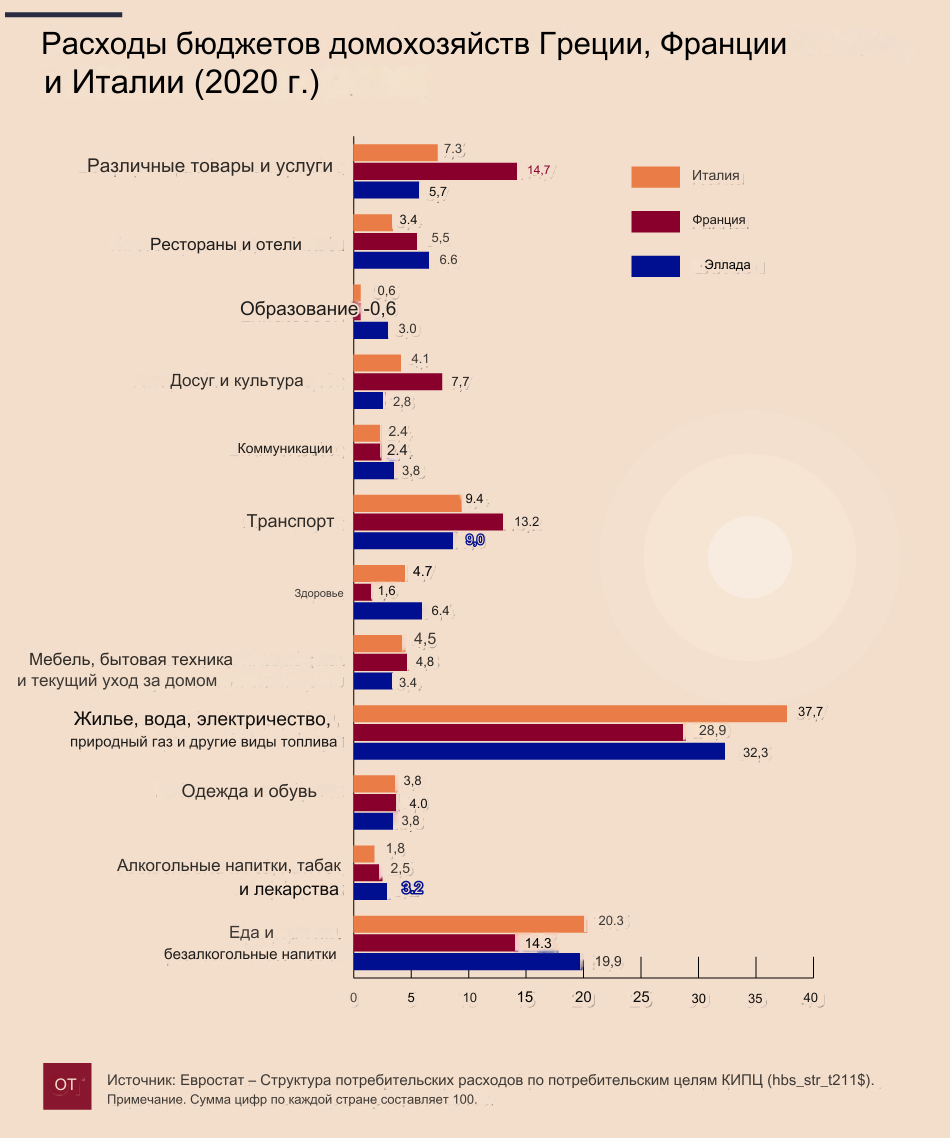

The sharp rise in prices for basic goods and services plunged households into a new reality, forcing them to adjust their spending priorities. Below are shown the expenditures of family budgets on certain groups of goods and services in Greece, France and Italy in 2020. It is clear that a large percentage of Greek and Italian household income is spent on food and energy.

Chart 2 shows the price level for January 2024 for various categories of goods and services for the three economies.

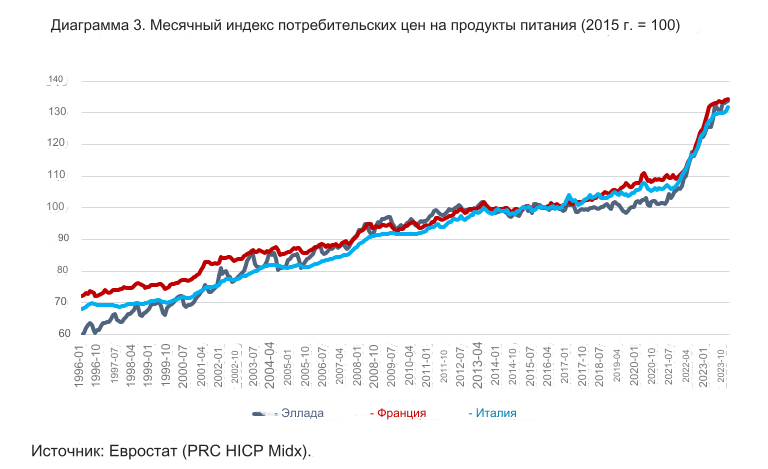

With the exception of falling energy prices in Greece and Italy, all other categories continue to see significant price increases. Chart 3 shows the dynamics of the monthly consumer price index for food products.

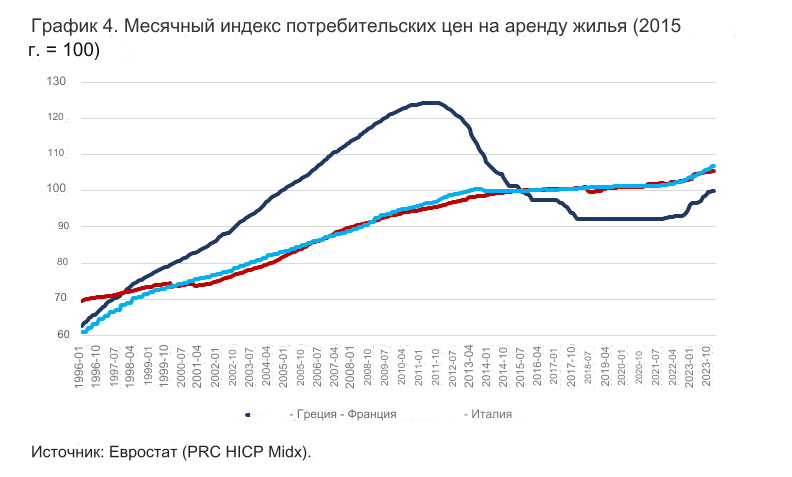

The continued rise in prices for food and non-alcoholic drinks is evident, as is the general trend for durable goods, household goods and services, as well as for hotels, cafes and restaurants. Of course, after 2022, growth will be especially sharp for the economies of the three countries. Chart 4 shows the dynamics of the monthly consumer price index for rental housing.

The graph shows a significant increase in home prices in 2022, with this trend leveling off somewhat in 2023 (although prices remain significantly high). There are two areas of concern at this stage: the first is related to rising prices and disposable income, and the second is the impact of rising prices on consumer confidence.

In the first topic, the observation is as follows: “When 32.3% percent of the family budget is spent on housing, water, electricity, natural gas, etc., while the average nominal annual wage income is 13,730 euros, this means that 4,434 euros per year is spent on these needs, and another 9,296 euros remain for other expenses, of which 1,849 euros are for food, leaving 7,447 euros for all other needs.

However, in Italy, with an average annual nominal salary of €31,833, €12,001 is spent on housing and energy and €6,462 on food, leaving €13,370 for all other needs.

So the residents of Greece other needswhich also determine the quality of life, there are 7437 euros, and in Italy – 13370 (big difference!). In fact, if prices for these two categories in Greece and Italy increase by 10%, this means that in Greece people will lose 628 euros, in Italy 1846 euros, but in the end they will be left with 6819 euros and 11524 euros (in Italy almost double times more than in Greece).

In other words, the negative effect of price increases may be proportional in both countries, but Remaining income in Greece falls to particularly low levelsalthough of course human nature is the same here and in Italy, with similar needs and lifestyles.

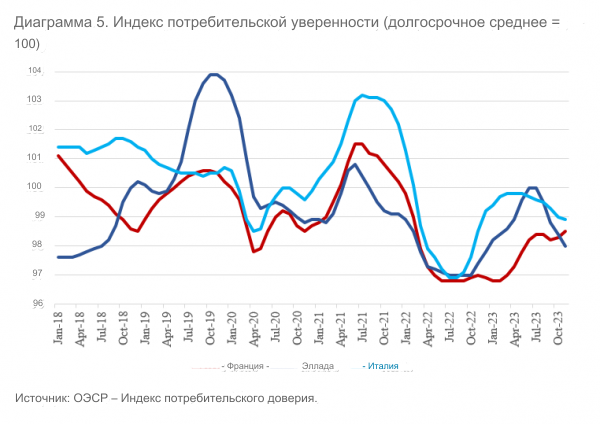

The second concern is how price dynamics affect consumer confidence. Graph 5 shows the evolution of the consumer confidence index for the three economies from 2018 to 2023. The index is an important economic indicator that reflects the degree of optimism or pessimism that consumers feel about their country’s economic situation in the near future.

Regarding the Greek economy, the index shows a significant upward trend from mid-2018 to mid-2019, indicating increased optimism. However, after the onset of the pandemic, there is a period of stabilization and then decline, indicating concerns about the health and economic consequences of the COVID-19 pandemic.

The period from 2021 to 2023 looks set to be a period of stabilization and modest recovery, although levels do not return to pre-pandemic levels, possibly indicating longer-term challenges for the economy. Thus, a sudden increase in inflation in 2021-2022 led to a decline in real household incomes, which put a significant burden on their financial situation.

In an environment where nominal wages and sources of wealth have not adjusted adequately to cope with rising costs of living, basic needs such as shelter, food and energy have become more important to households than ever. The need for these basic goods became a priority as declining disposable income meant that a smaller percentage of income could be allocated to other consumer spending. Providing housing, adequate food and the necessary energy for heating and transport is now a major financial issue for many households, leading to a reassessment of their spending to reflect more pressing needs.

What is the reason for the decline in consumer confidence? Possibly for several reasons: citizens do not believe that inflation will continue to decline. They also find that their disposable income has not yet been replenished, so they may believe that a more lasting decline in their quality of life is now coming. In any case, today the price level is reducing their disposable income (falling inflation does not mean deflation is approaching). Finally, there may be a distrust (which already exists) in the economic policies being pursued, or a more general perception of denial of the “saving” government intervention that has not come to this day.

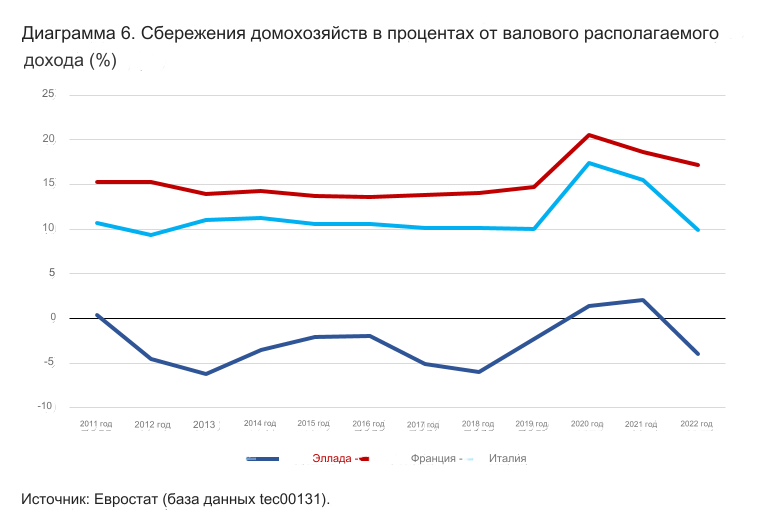

But if the argument made so far is correct, then we should see a decline in household savings in the three economies. Indeed, this is happening. In fact, the chart shows a rather alarming trend for Greece in 2022, when the savings rate will be negative. It means that households spent more than they had disposable income, possibly drawing on previous savings or increasing their borrowing. Growing economic pressures, compounded by inflation, have reduced people’s real disposable income, forcing them to spend more of it on meeting basic needs.

Negative savings rate also reflects deeper concerns about household financial security, as a lack of savings means a reduced ability to meet unforeseen financial needs or emergencies in the future. This situation could have further implications as concerns about future financial security could lead to lower consumer spending, increasing economic uncertainty.

More Stories

Digital Currencies: Global Control or New Opportunities? What's Behind the Introduction of Digital Money

BRICS + ACEAN: A New Era of World Currencies

How much does a square meter of housing cost in the Cyclades