According to the latest Eurostat data, 58% of the financial resources held by Greek households are held in cash and deposits. At the same time, only 31.2% is accounted for by stocks, funds and bonds.

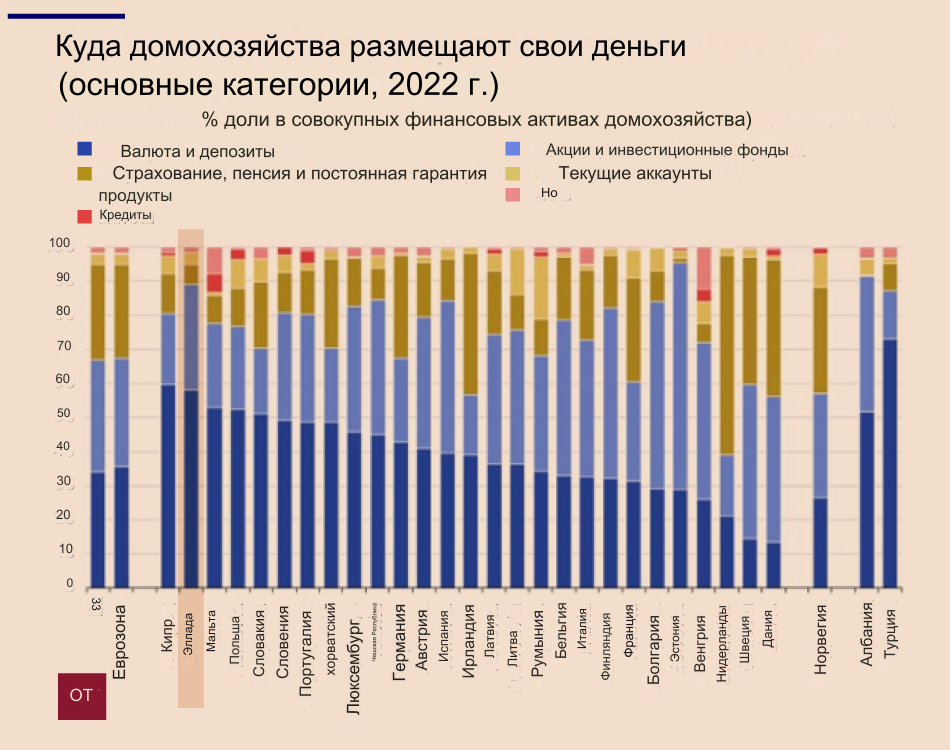

Among member states EU The main types of assets held by households in 2022 tended to be cash and deposits, shares and mutual funds, insurance, pensions and standardized guarantees.

The cash and deposits category was the largest asset held by citizens of 14 EU member states and accounted for more than half of the total in five of them.

In particular, Greece ranked second (58.0%) after Cyprus (59.7%). In Malta, deposits are preferred by 52.9% of citizens, in Poland 52.3% and Slovakia 51.0%.

Greeks may still prefer deposits, but the saver may want to find a better deal. According to the latest ECB data, the average interest rate on deposits in Greece with a maturity of up to one year is 1.75%, while the European average is 3.08%. As a result, Greek investors are increasingly turning to various financial products.

Among the investment opportunities for investors, seeking to earn income from their funds, there are funds (αμοιβαία κεφάλαια). Mutual funds managed by the Greek company AEDAK, showed an increase in total assets by 3.3% compared to the previous quarter and 28.4% at the beginning of the year. At the same time, the total volume of funds under management amounted to €13.97 billion (OSEKA n.4099/12 at €11.27 billion and OSEKA EU at €2.70 billion).

Greek government bonds are becoming increasingly popular as an alternative way of investing. The attractiveness of interest rates is obviously the significantly higher yield compared to fixed deposits. The latest 13-week interest rate bond yielded 3.88%.

Second advantage of interest bearing bills What sets them apart from other financial products is their short maturity, making them much more similar to the time deposits that most savers are more familiar with.

Third the advantage is that they are not taxed. From a tax perspective, interest is superior to deposits because interest on deposits is taxed at 15% per annum, while interest on redemption is tax-free.

More Stories

Greece: growth in deposits from households and businesses in March 2024

How much will it cost a Greek family to celebrate Easter?

EU employment record: Greece "stuck" in a low position