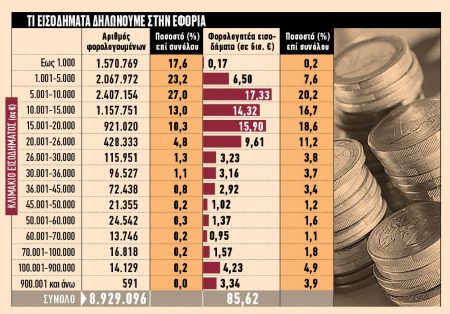

The “x-ray” of income, based on the annual checks of the tax returns of the inhabitants of Greece, shows impressive numbers.

Over six million out of nine taxpayers (7 out of 10 ratio) declare an annual income of less than 10,000 euros to the tax officewith a total of 18.3 billion euros.

However, due to the fact that about two million taxpayers declare incomes below those determined by the Internal Revenue Service based on the presumption of a living wage (βάσει των τεκμηρίων διαβίωσης), the total taxable income of those who declare up to 10,000 euros per year ends up being 24 billion euros, i.e. 5.7 billion euros more than what is indicated.

These impressive figures are the result of annual tax audits filed annually by 8,929,000 citizens in Greece with a VAT number, with a total taxable income of around 86 billion euros.

It is worth emphasizing that income below 10,000 euros is not taxed, since it is mainly wages or pensions. Bthe tax-free limit of 10,000 euros was on the electoral agenda of the partiesbecause both New Democracy and SYRIZA pledged before the elections to increase the tax-free limit in the next 4 years in order to exempt even more people from taxation. New Democracy included in its agenda for the next four years a commitment to increase tax-free income per 1000 euros for each child.

According to the latest available AADE data, out of 8,929,096 taxpayers, those who declare an annual income below 10,000 euros are 6,045,895 citizens. Nevertheless, the Ministry of Finance has not required “evidence” for many years, although suggests that many of the above citizens do not declare their real incomes And evade taxes.

On the other hand, there are taxpayers who annually declare everything they collect to the tax office, but because of some of the assets they may have inherited, such as real estate or a car, the state believes that they cannot justify their maintenance with their declared income and therefore evade taxes. That is why they are subject to a fictitious imputed tax (πλασματικού-τεκμαρτού).

The fact that 1,570,769 taxpayers present the tax office with an annual income of up to 1,000 euros, while the total amount of this income is 170 million euros, is very impressive. In fact, 803,685 of them do not claim to receive even 1 euro per year.

Accordingly, about very low incomes, from 1,001 to 5,000 euros, reported annually by 2,067,972 of our fellow citizens. In addition, 2,407,154 taxpayers present to the tax office an annual income of between 5,001 and 10,000 euros.

It is worth noting the fact that 14,720 taxpayers declare an annual income of more than 100,000 euros. Greece also has 591 taxpayers who declare an annual income of more than 900,000 euros each, for a total of 3.34 billion euros. That is an average of 5.6 million euros.

The number of citizens who declared an annual income of more than 36,000 euros is only 3% of the country’s population, or 260,146 people. This 3% is 21.7% of total taxable income.

More Stories

Digital Currencies: Global Control or New Opportunities? What's Behind the Introduction of Digital Money

BRICS + ACEAN: A New Era of World Currencies

How much does a square meter of housing cost in the Cyclades