14 years after the start of the debt crisis that nearly pulled Greece out of the euro, single mother Niki Claudatu says she is now is in a worse position than in the most difficult years of the country’s economic collapse.

In the run-up to the elections to be held on May 21, a cost-of-living crisis that cuts incomes is high on the minds of voters. For Claudat, this means voting forand anyone other than the ruling conservative New Democracy party or the opposition left-wing party Syriza.

“I’m going to vote for a small party to show that I’m not happy with the big parties”she said, confirming opinion polls that suggest a hung parliament will result from the election.

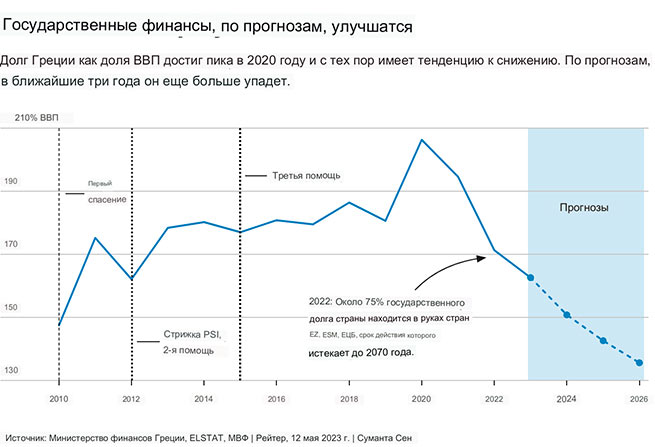

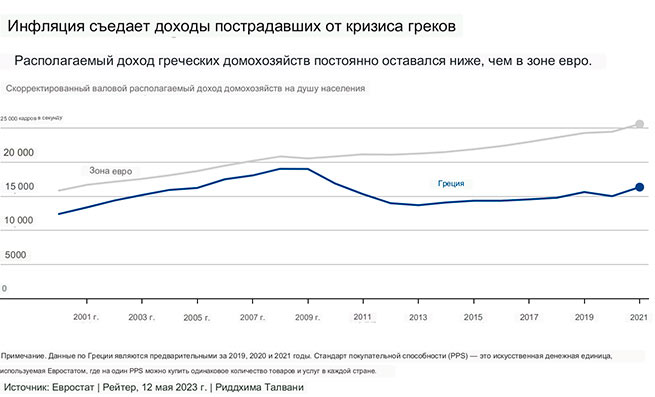

Three international bailouts kept Greece out of the eurozone during a decade-long debt crisis that peaked in 2015. However, the austerity measures introduced in exchange for financial aid have resulted in millions of Greeks losing their livelihoods, as taxes rose and salaries and pensions were recalculated.

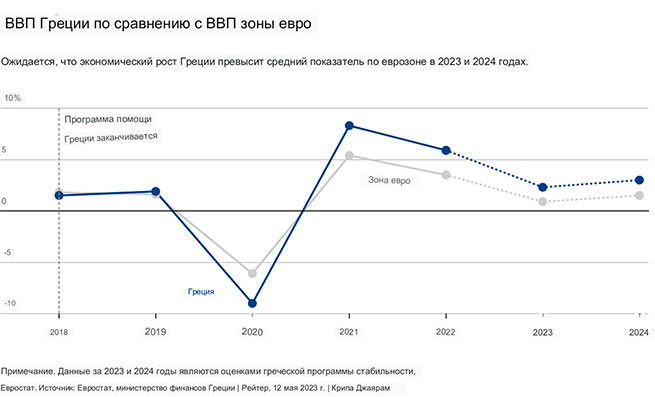

It was a painful adjustment to get the country’s finances back on track for creditors. After the completion of the rescue program in 2018, Greece regained market access, and the country’s growth rate will outpace the Eurozone average. However, at the same time, the country not only did not reduce its record debt, but, on the contrary, significantly increased it.

Many voters consider reports published by the national statistical agency ΕΛΣΤΑΤ false, and all assurances that the standard of living is growing – outright deceit. Residents expressed their opinion KAPA Research in a recent survey.

Now Claudat is 40 years old, she works for a telephone company and earns the same money, 850 euros a month, as a 20-year-old supermarket worker in 2004. With a mortgage, two young children and rising food bills, she says she can’t afford the bare necessities. “Even during the crisis – and this is not a joke – I did not think so much before spending even one extra euro,” Claudat told Reuters.

DOUBLE PUNCH

As millions of people across Europe grapple with rising prices, especially for energy and food, the financial turmoil of the last decade has heightened their impact on Greece. “The last 10 years have been static for workers and retirees. Any improvement in growth has not yet been passed on to them,” says Vlassis Misos, a research fellow at the Greek Center for Planning and Economic Research.

Metron Analysis Poll on May 10 showed that the ruling conservative New Democracy party would receive 36.2% of the vote on May 21, compared to 28% for the leftist Syriza, its main rival. However, smaller parties, including the once dominant socialist PASOK, were also gaining strength.

Prime Minister Kyriakos Mitsotakis raised the minimum wage and pensions and promised to do even more if re-elected. His main rival, the leftist Alexis Tsipras, who ruled from 2015-2019, also promised to raise pensions and the minimum wage, and to index wages to inflation.

Greece may formally emerge from the European Union’s fiscal oversight, but its heavy debt burden still leaves creditors wary. This means that any administration must undertake a dangerous act of balancing act: appease an electorate plagued by austerity and now inflation, and keep the markets happy.

We have little room for maneuver.

“From a fiscal point of view, we are still far from the primary (fiscal) surplus, which is necessary for long-term debt sustainability,” the head of the Greek central bank said on May 10 Giannis Sturnaras in an interview Media Imerisia.gr. This information was expressed contrary to what the leader of the ruling “New Democracy” says during the election tour. Kyriakos Mitsotakis.

THE PREVIOUS SALARY IS BARELY ENOUGH FOR THE NEXT

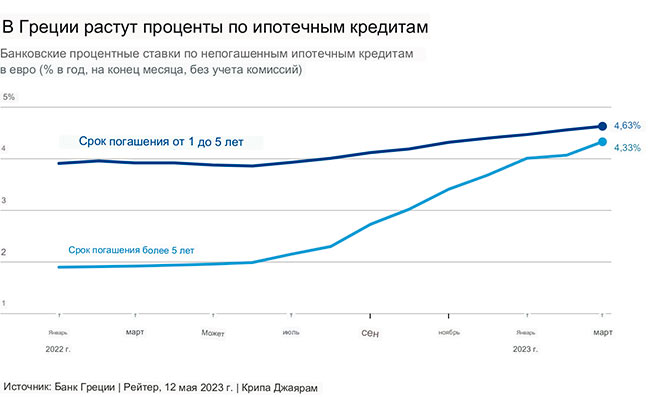

One in two Greek households could barely survive on their monthly income last year. Eurostat, statistical agency EU, reports that 36.4% of Greeks had overdue accounts in 2021, the highest in the block of 27 members. The share of people whose housing costs are more than 40% of their disposable income was also the largest in the EU, at 32.4% of Greek households, compared to the EU average of 10.4%. And those bills have been getting higher in the last year as the European Central Bank raises interest rates at a record pace to curb runaway inflation.

Claudatu, who lives in a small apartment in the Athens suburb of Alimos with her two children and mother, has seen her mortgage loan rise to €450 a month, up €100 from a year ago. She shares the costs with her mother, who receives a monthly pension of around 850 euros. But still, the family cannot make ends meet.

Claudat only drives when absolutely necessary, and recently she had to tell her 12-year-old that he can’t go out with friends because the family doesn’t have enough to eat. “I felt bad. Very, very bad,” she said. “I would never have done that before.”

[Reuters].

More Stories

Financial Times: Russia is actively preparing sabotage in Europe

Shock: Drag queen will carry the Olympic flame in Paris

Greece consistently ranks last in the EU for media freedom