Electronic fraud in Greece is gaining momentum, which is due not only to the high level of development of the Internet (including mobile), but also to the fact that cybercriminals are constantly discovering new ways to “take money” from naive citizens.

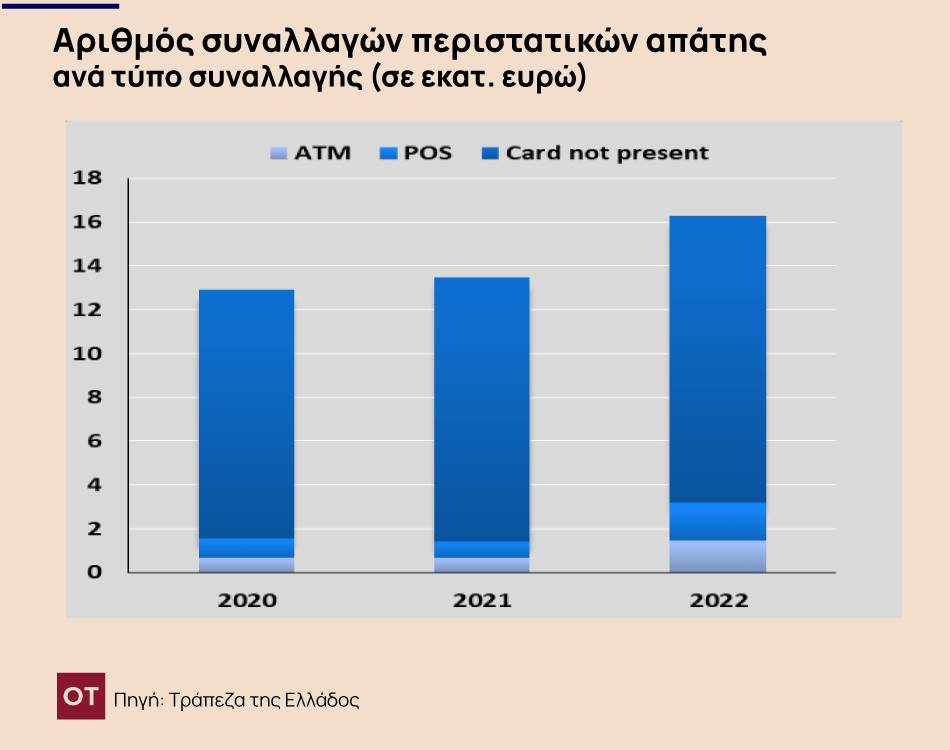

The data of the Bank of Greece for 2022 is indicative, according to which citizens lost about 16 million euros due to fraud in transactions with payment cards.

Currently has become a daily occurrenceWhen people receive emails (on behalf of the Greek post ELTA or the tax office), in which the supposedly responsible person asks the customer to enter their bank code details (in order to get the data), convincing his victim that it is necessary to “perform verification”. Naive citizens report information, which, of course, is immediately used by attackers.

Attacks are carried out by e-mail, SMS and telephone, as a result of which potential victims in a number of cases lose large sums of money.

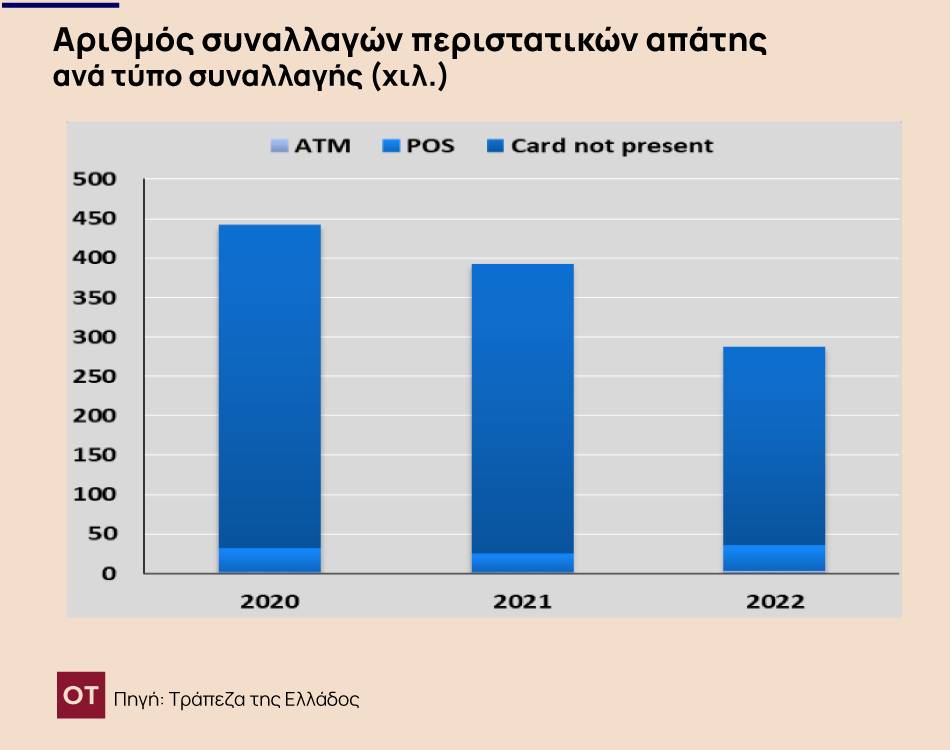

Cases of payment card transaction fraud in 2022 showed a decrease of 27% compared to 2021. And only one in 6,700 transactions is fraud. However, the total amount of money stolen from accounts has increased.

According to the Bank of Greece, the volume of fraudulent transactions increased by 21% compared to the previous year. Despite this, the transaction value ratio remained at a low level of 0.002%, which corresponds to 1 euro of fraud per 5,700 euros of transaction value.

Regarding the increase in fraudulent transactions with ATMs and POS terminals compared to 2021, it is noted that the main reason for the increase was cases of fraud as a result of illegal transactions at ATMs or through payment through a POS terminal (using a lost / stolen card).

In particular, the amount of fraudulent transactions carried out using a lost/stolen card at an ATM increased by 92%, to 1.3 million euros from 705 thousand euros in 2021, and the value of fraudulent transactions in POS increased by 147%, to 1. 7 million euros, up from 701 thousand euros in 2021.

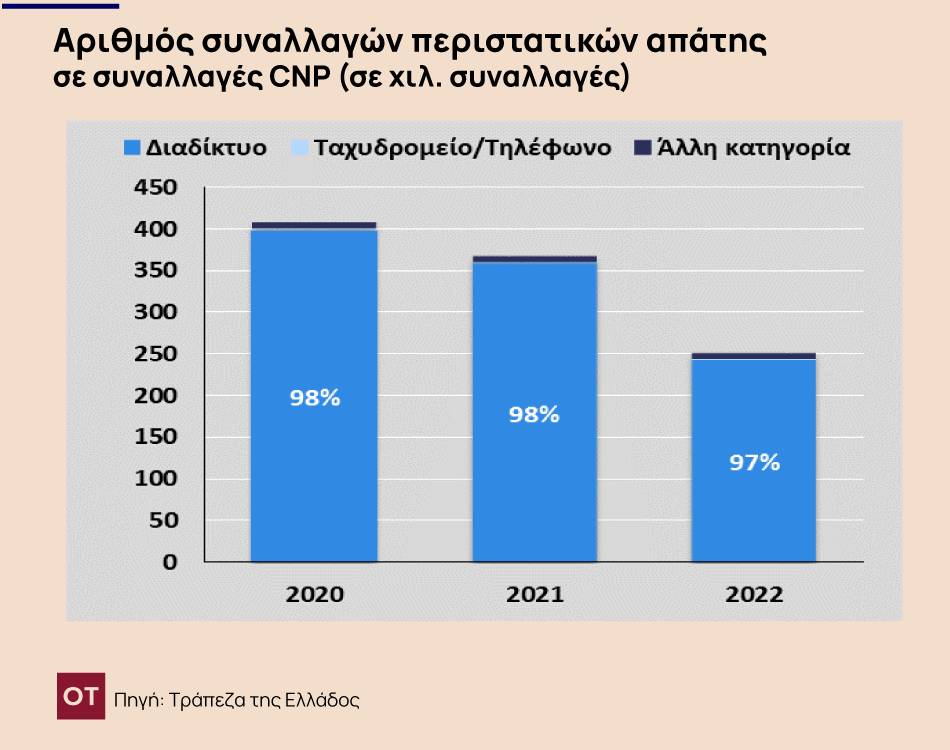

With regard to fraud in remote transactions, it was found that the majority concerns payments on the Internet and mainly online transactions with foreign companies, as in previous years.

The police report on the main forms of Internet fraud:

- Phishing of personal information. This is usually done by sending emails from a supposedly existing and legitimate company that contain a suspicious link or file attachment.

- Credit card fraud by intercepting (phishing) sensitive personal data and, in general, bank account details on the Internet through a hyperlink, which usually leads to a fictitious bank website.

- “Nigerian” scam. In this case, emails are sent informing you that someone needs your help to transfer a large amount of money (or inheritance) for a large promised fee.

- Internet shops. They post offers that are too good to be true and are only available for a limited time.

- Spanish lotto. Email notification that you have won a large amount of money in an online lottery.

- Providing loans. Posting on social networking pages information about loans on favorable terms from unlicensed operators.

- Online ads. Placing fraudulent advertisements on the Internet about renting a home, looking for a job, or buying and selling goods.

More Stories

Greek mafia: photographs of eight arrested released

"Bloody" fountain on May 1

They cut it off or bit it off, but… part of the ear is missing