“The best days of the Greek economy are ahead,” Prime Minister Kyriakos Mitsotakis said as he arrived at the European Council in Brussels on Thursday.

Earlier, he commented on a Bloomberg article on the Greek economy – “there will be more good news soon.”

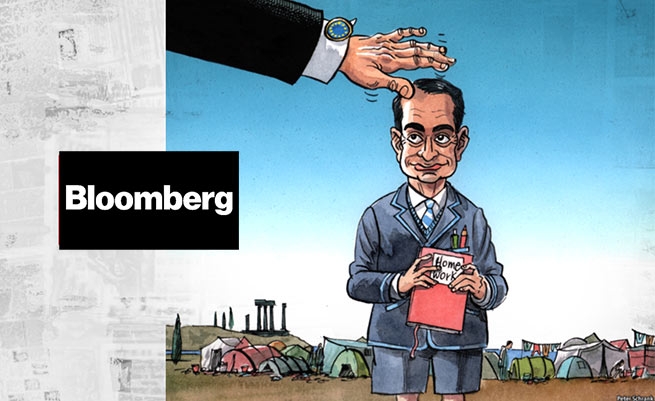

Greece’s GDP growth has “outperformed major economies” since 2019, according to data compiled by Bloomberg, and the rate of reduction in NPLs is due to “an unrivaled banking industry, the best anywhere.” Good news and more good news coming soon,” the Prime Minister tweeted, citing a Bloomberg article.

Greece’s GDP expansion “outpacing major economies” since 2019 and an NPL’s reduction rate “unsurpassed by the banking industry anywhere, according to data compiled by Bloomberg”.

Good news and more good news to come soon. https://t.co/BnqHrTJ6oY

—Prime Minister GR (@PrimeministerGR) March 23, 2023

The subtitle of a Bloomberg article titled “With Grexit Averted, Guess Whose Whose Debt Outperforms?” notes that “Grexit’s economic recovery is confirmed by low borrowing costs, which are below the average for investment-grade borrowers in the world “, and according to the caption under the photo accompanying the article, “the return of Greece is complete.”

The enthusiastic author of the article added a caption under the photo accompanying the article “The return of Greece is complete.”

“Remember Grexit? That was in 2015, and unlike Brexit a year later, Greece’s pejorative name is a vanishing figure of speech made up by the London news media,” the article reads at the beginning, noting that even “the former Federal Reserve chairman US system Alan Greenspan told the British Broadcasting Corporation that “Greece’s withdrawal from the monetary union and the collapse of the euro is only a matter of time.”

According to the author, “Grexit will never happen because the bond market said so.” The following describes the history of underlying Greek debt yields from the April 2012 low to investors’ “favorite sovereign debt”.

“A country with a population of 10.3 million, despite all credit ratings, has been an investment grade economy since December 2021, based on favorable trends in inflation, high per capita gross domestic product, GDP growth, non-performing loans and political stability, according to In the bond market, Greece trades at least three grades above what investors consider high-risk, high-yield debt and should soon regain its investment grade rating, which was last awarded by Moody’s Investors Service, S&P Global Ratings and Fitch Ratings in 2008.

“Since Prime Minister Kyriakos Mitsotakis entered the Megaro Maximos mansion in 2019, the country’s GDP per capita has grown by 7%, outpacing major economies including Germany (1%), France (1%), Italy (2%). %), Spain (-2%), the UK (1%) and the US (4%), according to data compiled by Bloomberg. 47% in 2017 and the lowest since 2011. The NPL ratio fell by at least 32 percentage points, an unrivaled improvement for the banking industry in any country, according to the data.

The article also notes that Greece is now ahead of many European countries in terms of political risk, which has improved by 25% since Prime Minister Kyriakos Mitsotakis took office, as well as the Prime Minister’s own statement that Greece is currently ” the second fastest growing economy in the Eurozone” with active tourism and “record foreign direct investment”.

“The recovery of the country’s economy is evidenced by the low cost of borrowing, which fell to 3.9% from 15% in 2015 and 63% in 2012, according to data compiled by Bloomberg.

Today, Greece can borrow at an average price of 10 basis points lower than investment-grade borrowers. The last time its debt traded so favorably was in 2005, when the country was rated ‘A’, the sixth highest investment grade rating and five notches above what is considered risky high-yield debt.

The combination of declining yields and a strengthening economy has made Greek bonds “the best in the world,” the article concludes. Someone who bought Greek debt in 2013 got “an unbeatable advanced economy return of 214%” and the 60 Greek companies listed on the Athens Stock Exchange “turned out to be the best in the world this year, with a return of 12%”.

PS If things are going so well and the outlook is even better, why are Greek citizens dependent on government subsidies and allowances for food/markets/fuel? It must be one of the Greek miracles. Or, most likely, the article by the “great and independent Bloomberg” is a banal paid publication. And what do you think?

More Stories

Poll: which European countries are ready to defend their homeland to the last

K. Mitsotakis announced readiness for the fire season

Greece must transfer the Patriot PAC-3 system to Ukraine with US “guarantees” against the Turkish threat