It seems that the banking crisis that has erupted in the United States in recent days is much more serious than it has been thought so far, since the American President D. Biden addressed the American people, and former President D. Trump believes that the country is on the verge of a new major recession, worse than in 1929, as he stated on his social network Truth Social.

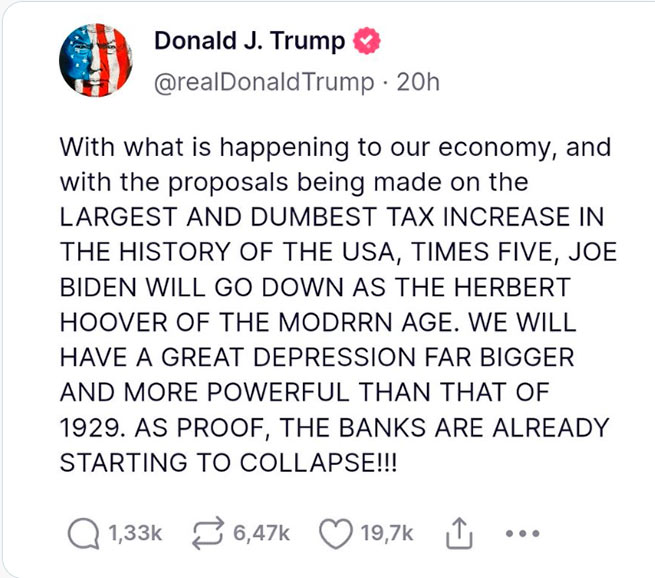

“Based on what is happening to our economy and based on proposals for the biggest and most stupid tax increase in US history, Joe Biden will become a modern-day Herbert Hoover. We will have a Great Depression much worse than in 1929. As evidence, the banks have already begun to collapse,” former US President Donald Trump wrote in Truth Social.

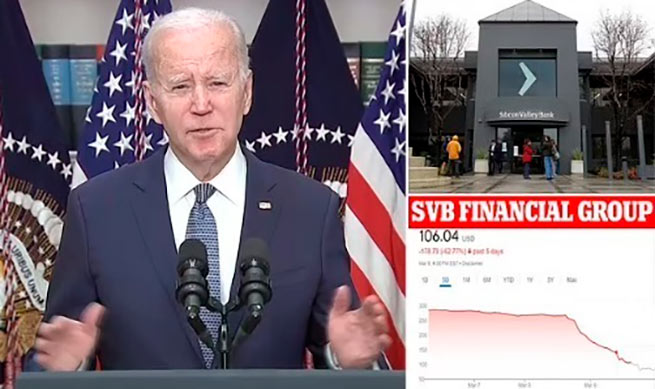

President Joe Biden, for his part, addressed the American people about the sudden collapse of Silicon Valley Bank (SVB), which was the largest American bank failure since the 2008 global financial crisis and the second largest in American history, and tried to calm the American public.

In a statement, the president said he would “remark on how we will maintain a sound banking system to protect our historic economic recovery” in an address to the American people on Monday morning (New York time).

“Over the weekend, under my leadership, the secretary of the treasury and the director of the National Economic Council worked diligently with banking regulators to resolve the problems at Silicon Valley Bank and Signature Bank,” the US president said.

“I am delighted that they have found an immediate solution that protects American workers and small businesses and keeps our financial system safe. The decision also ensures that taxpayer dollars are not at risk. The American people and American businesses can be sure that their bank deposits will be there when they need them. I am determined to hold the perpetrators of this mess accountable and continue our efforts to increase oversight and regulation of the biggest banks so we don’t find ourselves in this position again.”

We remind you that California regulators shut down Silicon Valley Bank (SVB) on March 10. It was the largest bank failure in the US since the 2008 financial crisis. The beginning of the end for California bank SVB was the public announcement of a $1.8 billion loss on March 9. After this message, some of the bank’s customers immediately decided to empty their accounts as a precaution. The raid of depositors led to the fact that SVB was left with a negative balance of $ 1 billion. As a result, the bank’s capitalization collapsed by 63%. SVB was home to the money of half of all American companies with venture capital investments. He has worked in the US, Canada, UK, Europe, Asia and the Middle East.

The collapse of SVB coincided with the news of the voluntary liquidation of Silvergate, another California bank. It was one of the largest crypto-currency banks in the United States, cooperating with the Binance US and Coinbase crypto-exchanges. The bank’s management attributed the liquidation decision to “recent changes in the industry and its regulation,” but Custodia CEO Kathleen Long says Silvergate’s cash gap between deposits and cash was the reason.

The Silvergate liquidation and then the collapse of SVB contributed to the largest sell-off in bank stocks – they survived the worst day in two years. The KBW Bank Index (takes into account the performance of 24 US banks) sank 7% – the largest drop since June 2020.

Since 2020, the US economy has been “showered with money,” HSE Professor Ivan Rodionov said in an interview with RTVI. During the COVID-19 pandemic, the US government gave away about $4 trillion in “helicopter money” as anti-crisis assistance. And US companies have raised a record amount of venture capital in 2020-2021. This caused the rise and fall of Silicon Valley Bank (SVB). The boom allowed the bank to grow rapidly, attracting deposits from startups. The volume of bank deposits has doubled in the last 12 months alone. SVB invested in long-term bonds under the delusion that US Federal Reserve (Fed) rates would be stable.

A wave of bankruptcies? Events in the US are moving fast as a second US bank, Signature Bank, also collapsed. The financial regulator in New York announced Sunday that it has acquired Signature Bank. Its receiver is the Federal Deposit Insurance Corporation (FDIC). As of December 31, 2022, Signature Bank had $88.59 billion in savings, according to the agency.

The US Treasury Department assured in a press release issued jointly with the two aforementioned regulators that all Signature Bank depositors will receive their money in full and “there will be no loss for taxpayers”. However, despite assurances from the US Treasury Department, something went wrong.

Billionaire investor Bill Ekman warned in dramatic terms yesterday of a huge wave of withdrawals that could overwhelm US banks on Monday if the US administration does not take immediate action within the next few hours.

The gov’t has about 48 hours to fix a-soon-to-be-irreversible mistake. By allowing @SVB_Financial to fail without protecting all depositors, the world has woken up to what an uninsured deposit is – an unsecured illiquid claim on a failed bank. Absent @jpmorgan @city or… https://t.co/SqdkFK7Fld

— Bill Ackman (@BillAckman) March 11, 2023

In a bizarre one-paragraph tweet on Saturday, the billionaire predicted that uninsured bank customers (those who had not insured their money) would rush to withdraw cash on Monday, unless the US government intervened to guarantee their funds and “correct the mistake as soon as possible.” so that it does not become irreversible. The issue appears to be spreading to other banks after California-based First Republic Bank sent an email to its customers saying it needs some time “to build its safety and stability, which is reflected in our capital strength.” , liquidity and operations”. The memorandum is attributed to Jim Herbert, founder and executive chairman of the San Francisco bank, and Mike Roffler, CEO and chairman of the board.

But what is of particular concern is the Chinese gold markets and the rapid divestment of US bonds. Credit Suisse has postponed its annual report after a last-minute call from the US Securities and Exchange Commission (SEC) that raised questions about its past financial reports! The unusual intervention by the US regulator comes as another blow to the long-suffering bank Credit Suisse, which has been going through a series of scandals and setbacks that have sent its share price plummeting amid massive outflows.

Credit Suisse (the second largest Swiss bank) said at the time that it had decided to postpone the publication of its annual report. “Management deems it appropriate to delay the publication of its financial statements for some time in order to fully understand the comments received,” the statement said, adding that the 2022 financial results were “unaffected.” It is not yet clear when the 2022 annual report will be released.

Credit Suisse is down 13%

UniCredit Shares are now halted after a 7% drop

Buckle up…#CreditSuisse #UniCredit pic.twitter.com/VMrqayNf37— DaxBulls (@DaxBulls) March 13, 2023

Vontobel analyst Andreas Venditti said the development “does not improve the investment climate or help restore confidence.”

This share price is at a record low – Is this a buy now ?#CreditSuisse #CS $CS $2.46https://t.co/RfuE8it3YH

Andhttps://t.co/jSYxV5o9gW https://t.co/h0W5JszH1A— Wealth Generator (@Wealth_G3n) March 13, 2023

Credit Suisse has warned of significant losses this year as clients withdrew funds – a record – in the last quarter of 2022, leading to the Swiss bank’s worst annual performance since the global financial crisis. The bank posted a net loss of 1.39 billion Swiss francs (about 1.5 billion euros) in the October-December quarter, reflecting strong pressure in the asset management and investment banking sectors.

Today, Credit Suisse shares lost 13% and settled at 7%!

More Stories

Modern Germans are far from the most hardworking in Europe

Georgia: Opposition leaders were brutally beaten by security forces (video)

Congressmen warn ICC about sanctions because of Netanyahu