For property owners you should be careful when filing your E2 returnbecause every year unpaid rent is a big “thorn” for taxpayers – she will be considered incomeif the tax authority will not be notified that they have not received it within a year.

Uncollected rent is not included in gross taxable income and is not subject to income tax.if, by the time the income tax return was due, a payment order or order for the return of the use of rent, or a court order for eviction or judgment of rent has been issued, or an action for eviction or judgment of rent has been filed against the tenant, and a clear copy thereof has been provided to the tax authorities prior to filing the return, depending on the circumstances.

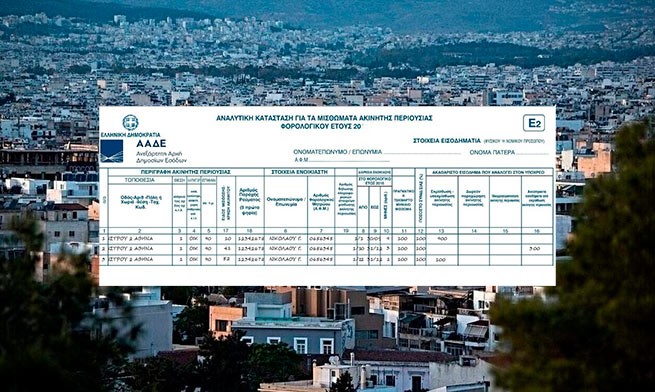

In particular, if the tenant has become bankrupt, it is enough to provide a copy of the list of debts in which the landlord’s claim appears. If the necessary documents for the declaration of unpaid rent are not submitted, their owners will also pay tax on this income (even if they have not received it) from the first euro at rates of 15% for the first 12,000 euros of income, 35% for income from 12 001 up to 35,000 euros and 45% for part of the income over 35,000 euros. The amounts of unpaid rent are completed in box 16 of Form E2.

According to statement POMIDA on the protection of ownersunearned income from the rental of real estate by individuals is not subject to declaration if this income is received from compensation for the use of real estate, as well as from carrying out business activities (for example, organizing events in halls or estates, tourist operation, etc.).

In other words, the tax service, without providing for this in the law, although compensation for the use of real estate is everywhere considered as rent for tax purposes, has limited this opportunity only to unpaid rent payments from an existing lease and does not accept them when they are in the nature of compensation for use, that is for the period after the lease expires.

In addition, neither the law nor the relevant circulars provide for a mandatory discussion of the filed claim, as some tax authorities arbitrarily require, which would be pointless and only an additional financial burden for the unfortunate landlord, since in most cases, tenants, upon leaving the lease, refuse to pay anything -from what is due, and the landlord has virtually no opportunity to collect anything, notes POMIDA.

More Stories

"Youth pass 2024" more than 145,000 young people aged 18 and 19 will receive

Greeks pay 50% more for the same products than consumers abroad

Optimism about olive oil production this year. The price is gradually falling