Created by AI

Income tax rates by themselves do not tell the whole truth about the tax burden and how fairly it is distributed. However, this does not change the fact that it “eats” income and causes discomfort, especially when taxation is unfair.

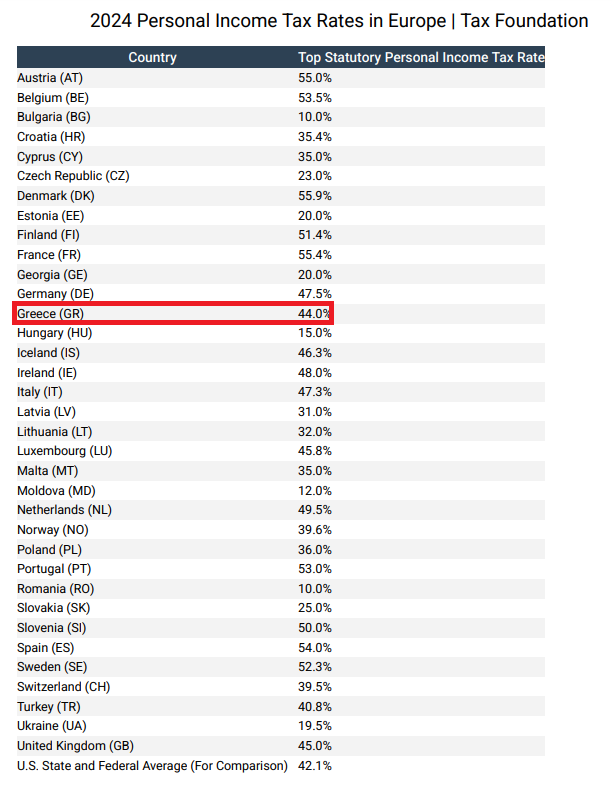

Just 3 years ago Greece was among the European countries with the highest income tax rates. With a final scaling factor of 44% and a maximum solidarity contribution rate of 10%, Greece came in 4th place with an overall “score” of 54% (tied with Spain).

Now, according to the Tax Foundation, Greece is in 17th place, that is, right in the middle of the ranking. How was this accomplished? Yes, very simple! It was enough to cancel the solidarity gathering for employees, pensioners and specialists.

Among European OECD countries, the average statutory top personal income tax rate in 2024 will be 42.8%. Denmark (55.9%), France (55.4%) and Austria (55%) have the highest maximum rates. In contrast, non-OECD European countries tend to have lower rates and tax personal income at a flat rate. The lowest rate is set in Bulgaria and Romania (10%), followed by Moldova (12%), Ukraine (19.5%) and Georgia (20%).

More Stories

Greek products on their way to France

Reduced fees for POS transactions, limited bank fees

Easter 2024: more expensive than travel, more modest table