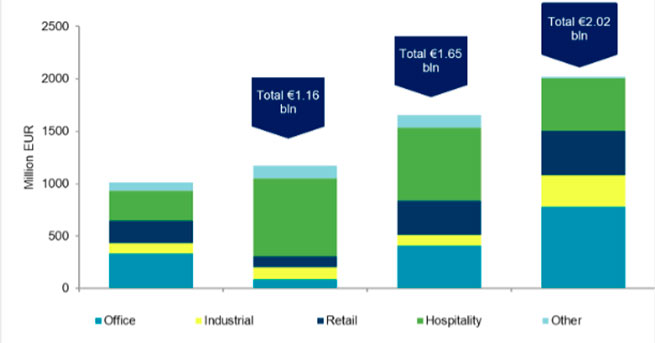

In 2023, investment in the Greek commercial real estate market (offices, shops, hotels and logistics) reached a new all-time high: it exceeded €2 billion, up 22% compared to 2022, according to Proprius.

This is a particularly positive trend, driven almost exclusively by domestic investors, who have proven to be particularly mobile. The most popular category was office buildings, with a total of €780 million invested, followed by hotel/tourism properties, with €500 million invested. A further €425 million was invested in commercial stores and real estate, and a further €300 million in industrial/logistics properties.

Real estate investment volume in 2020, 2021, 2022 and 2023 (Note: office buildings – yellow, logistics – yellow, shops – blue, hotels – green, hotels – blue). Source:Proprius

“During 2023, we saw the completion of major transactions such as the Skyline project from Alpha Bank, the Tethys project from Intrum, as well as other major transactions such as the acquisition of a number of properties by the National Bank group,” says Niki Simboura, head of property consultancy Proprius, which represents Cushman & Wakefield in the Greek market.

As part of the Skyline project, a portfolio of 573 real estate properties worth EUR 440 million was transferred to Alpha Bank Group. The buyers of the new company created for the development of these properties were the group of companies Dimand Real Estate, Premia Properties and the EBRD, and the remaining 35% is still controlled by Alpha Bank itself.

Similarly, as part of the Tethys project, a portfolio of 72 hotel properties owned by Intrum Hellas was sold, which acquired SMERemediumCap, Latonia Enterprises – the family office of Athanasius Laskarides and WHG Europe Limited – the Brown Hotels scheme. This is an alliance between the Laskarides family office, Mr Nikos Karamouzis, who heads SMERemediumCap, and the Brown Hotels group. The transaction value is estimated at more than 250 million euros.

Another important transaction in the market concerned the sale of the Smart Park commercial park from REDS of the Hellaktor group to Trade Estates AEEAP of the Fourlis group. The cost of this transaction was 115 million euros.

The National Bank of Greece group turned out to be especially mobile, investing 300 million euros in the purchase of dozens of properties that it transferred several years ago to Prodea Investments (then known as National Bank of Greece). The two largest properties acquired by the National Bank were the historic building of the Athens Stock Exchange at 10 Sophocleous Street, sold by Papaleikas Group, which in turn acquired it at the end of 2020 from Prodea Investments. The value of this transaction is estimated at almost 67 million euros.

The National Bank Group bought the historical building of the Athens Stock Exchange at 10 Sophocleous Street / INTIME

At the same time, National Bank is currently completing the purchase of 43 of its properties for a total amount of 237.2 million euros. The largest of them, worth 83.2 million euros, concerns the group’s IT center in Gerakas.

According to Proprius analysis, the level of investment made last year is a particularly positive development amid a negative climate in most European markets caused by expensive credit, high inflation and two wars that continue to rage in Europe and the Middle East. This is also the main reason why foreign investors were largely absent from the transactions that took place.

At the same time, private equity funds such as Dromeus and Brook Lane Capital, which have been particularly dynamic in previous years, acted more conservatively last year, focusing on work to modernize existing facilities. Most real estate investment trusts (REITs) have primarily turned to owner-occupied property development projects as one of the “defensive measures” their management has taken in the face of skyrocketing financial costs.

According to Ms. Simbura: “As for the investment trajectory in 2024, I expect it to be at the same level as last year, perhaps a little higher, with even more and larger investment deals. We also expect foreign investors to return. This will be facilitated by the recent receipt of an investment rating for the Greek economy.”

Tourist complex on Samos Island €1,280,000

As for the categories of real estate that will be in greatest demand, Ms. Simbura believes that offices will continue to be “an apple of discord”since there is a significant shortage of new and “green” buildings compared to demand. In other words, it is this category of real estate that offers the greatest opportunities. At the same time, there is a significant supply of older buildings that can be purchased at low prices and upgraded to provide significant capital gains and increased income for new owners.

More Stories

The region of Greece that ranks last in the EU in terms of the number of passenger cars per thousand inhabitants

Greece's shadow economy is estimated at 45-60 billion euros – 20.9% of the country's GDP

Crazy rise in coffee prices