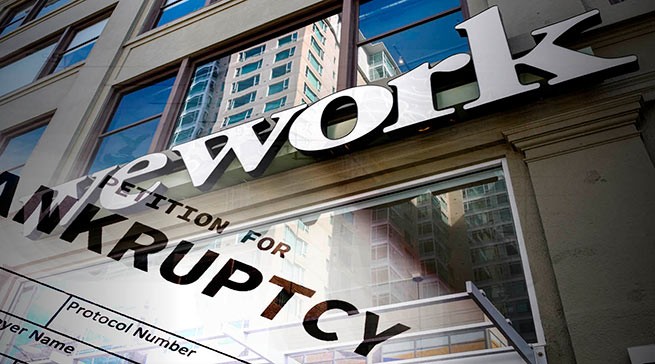

American real estate giant WeWork has filed for bankruptcy under US law, which raises serious concerns as there are many predictions that the real estate bubble (soaring prices for real estate is not normal) will burst, which could lead to a global financial crisis .

For those who have not yet understood, let us remind you that the financial crisis begins and ends with the real estate market. It should be noted that in recent days three of the “Big Five” American banks: Wells Fargo, JP Morgan and BlackRock. That’s because the humanitarian crisis caused by the wars in the Middle East and Ukraine is exacerbating the challenges already facing a fragile international economy, the first two companies say, and the Fed’s aggressive interest rate hikes could trigger a housing market crisis similar to the 1980s, according to Wells Fargo, sounding the alarm about “bursting” housing bubble.

Trading in WeWork shares was suspended until the stock market opened Monday morning. At that time, the stock price was 84 cents. The bankruptcy filing was expected after a Wall Street Journal article reported on Oct. 31 that the company planned to file for bankruptcy. WeWork said it had reached an agreement with creditors to extend a 30-day grace period for repaying part of its debt until November 6.

In a statement, the company said it had entered into a restructuring agreement with shareholders representing about 92% of the guaranteed notes. The bankruptcy filing will not affect WeWork’s operations outside the United States and Canada. The company added that its facilities remain open and operational. However, the company said that as part of the restructuring “further optimization of the portfolio of commercial offices for rent will be carried out.”

According to Businessinsider, the company’s portfolio includes 777 offices in 39 countries. “Now is the time to move into the future by aggressively addressing issues related to our legacy leases and significantly improving our balance sheet.”said David Tolley, CEO of WeWork.

In turn, the company’s co-founder and former CEO Adam Neumann, who left his post in 2019, citing the fact that the public closely monitors his activities, which makes it difficult to manage the company, called the news about the impending bankruptcy “disappointing”.

“It was difficult for me to watch from the sidelines as WeWork failed in 2019 to capitalize on a product that is now more relevant than ever.”says his statement.

At its height, the company was valued at $47 billion. But since plans to go public in 2019 fell apart amid concerns about the company’s profitability and Neumann’s inappropriate behavior, the startup has been in turmoil.

Japanese investor SoftBank has poured billions of dollars into the real estate startup and remains its majority shareholder, according to Insider. However, WeWork never made a profit. In the first half of the year, the company lost $696 million. Since 2019, the company’s value has continued to fall. In April, the share price fell below $1 and was threatened with delisting from the New York Stock Exchange. And in August, WeWork announced that “substantially doubts” that it can last for a long time.

WeWork’s bankruptcy comes amid a years-long shakeup of the office leasing industry. Commercial real estate companies are struggling to recover from changes amid the remote work pandemic that has dampened demand for offices around the world, even as many companies switched to a hybrid model or required employees to return to the office full-time. day. WeWork currently operates in more than 300 locations worldwide

The bankruptcy process in the United States allows companies to write off some of their debts and reorganize. In 2019 and early 2020, WeWork laid off thousands of employees and cut dozens of office leases and employee benefits, all amid multiple government investigations. WeWork’s failures continued. Less than a month into the new CEO’s tenure, the pandemic began in 2020 (one of the first public cases of coronavirus in New York was identified in a person who worked at one of WeWork’s offices). Offices around the world emptied, and the once stable real estate industry plunged into unprecedented chaos from which it never recovered.

More Stories

Greek products on their way to France

Reduced fees for POS transactions, limited bank fees

Easter 2024: more expensive than travel, more modest table