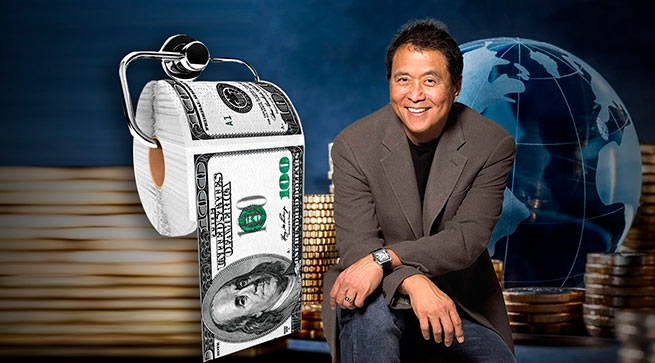

Renowned economist Robert Kiyosaki mentioned US inflation and said it was expected to worsen and the US dollar would turn into “toilet paper”.

In the current macroeconomic climate, he urged investors to invest in investment products such as bitcoin (BTC), gold and luxury goods – before “systemic inflation” drove up their prices.

The author also noted that capitalism is facing a serious existential threat due to rising interest rates…

Interestingly, he recently sounded the alarm about the interest rate risk facing US banks that could lead to a crash.

“Buy till you drop. Retail prices are falling. Rising interest rates are killing capitalism.

Selling rich brands. Buy before systemic inflation takes control.

Inflation is systemic, not temporary. Buy Prada, Panerai, Polo, gold, silver, BC before brands go up.”

At the same time, Robert Kiyosaki took the opportunity to clarify the target audience of his tweets.

The author, who has long urged to be prepared for a possible global economic collapse, said his messages are not intended for “people with a poor or middle class mentality.”

“FYI. My tweets are not for people with a poor or middle class mentality:

- This is food for thought.

- If you think being poor is the best thing and money is bad, then stay poor.

- If you think middle class is the best for you, stay in school.

- If you want to be rich, your mindset has to be rich people oriented,” he added.

Robert Kiyosaki accused Federal Reserve Chairman Jerome Powell of lying about the inflation situation. Contrary to the assertions of US officials, it will continue to grow, and the recent banking crisis is likely to exacerbate the situation.

According to Kiyosaki, the US will print more money to bail out failing banks, which will lead to higher inflation. In this regard, he believes that monetary policy is likely to lead to further depreciation of the dollar, equating it in value with “toilet paper”.

America has been breaking all the money laws for years and people are saying, “We’ve had enough.” Therefore, they join the BRICS. (…) This means that 70% of the world’s population who used to use the dollar will say: “We don’t need it anymore.”

According to Robert Kiyosaki, what is happening now is the influence of the so-called Triffin dilemma, named after the Belgian-American economist Robert Triffin, who in 1960 posed a fundamental problem for the world monetary system.

The Triffin dilemma, or Triffin paradox, refers to an open conflict of interest in a country whose currency is used as the world’s reserve currency, such as the United States, after World War II. A dilemma arises when a country whose currency is used as the world’s reserve currency must choose between short-term domestic needs and long-term international goals. When a national currency is used as an international reserve currency, there is a conflict of interest for the dominant country between maintaining its domestic monetary policy while maintaining its international monetary role.

As the author of Rich Dad Poor Dad explained, holding a US dollar bill in his hand meant that in order for the US dollar to become the money of the world, the reserve currency in 1944, they had to print it in large quantities so that the whole world had it in their banks (…), they had more of this commodity than any other commodity in history.”

This is toilet paper. If I had to choose between a $35 silver coin and toilet paper, I’d rather this one than this one. [доллар]”.

Robert Kiyosaki continues to post worrisome information about the outlook for the financial sector, and he continues to advocate investing in gold and silver to protect wealth in times of uncertainty. Precious metals aside, Robert Kiyosaki remains positive about bitcoin as a valuable asset for investors. He views the main cryptocurrency as a safe haven amid inflationary pressures.

More Stories

Greek products on their way to France

Reduced fees for POS transactions, limited bank fees

Easter 2024: more expensive than travel, more modest table