In complex systems “offshore cross-border centers” the planet hides the interests of many businessmen from different countries of the world. Offshore funds of Greek businessmen are valued at 140 billion euros.

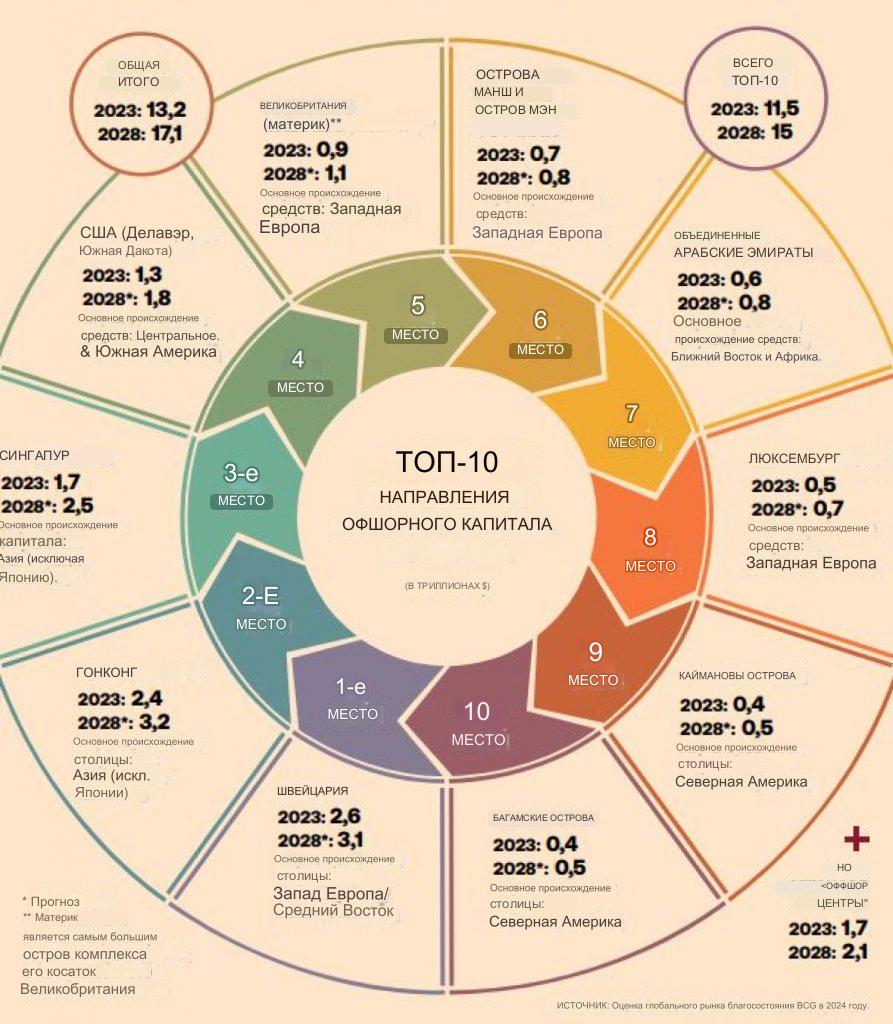

Offshore wealth totaling $13.2 trillion, up 5.3% over the past 12 months, is “hidden” in the world's largest “offshore cross-border centers”according to a study published a few days ago by the Boston Consulting Group (BCG).

Condition only “10 Largest Offshore Centers” is in the $11.5 trillion range. Of that, $2.6 trillion is in Switzerland, whose offshore banking activity draws mostly funds from Western Europe, as well as the Middle East, which will give way to Hong Kong (currently $2.4 trillion) by 2028.

However, over the past 12 months capital inflows into Hong Kong from China have been restricted, which increases the likelihood that it will be challenged in the long term by Singapore, which is also expected to benefit from rising wealth in Asia-Pacific countries and from its role as a gateway for cross-border capital to Asia, attracting $2.4 trillion in offshore funds by 2028 (from $1.7 trillion today).

“New Switzerland”

The US is currently ranked 4th with $1.3 trillion. In 5th place with $900 billion in offshore wealth is the mainland, the largest island of the British Orkney island complex, and in 6th place with $700 billion are the Channel Islands and the Isle of Man, which is expected to lose its position by 2028.

Saudi Arabia and other Middle Eastern countries currently rank 7th with $600 billion. “ten” Luxembourg with $500 billion, the Cayman Islands with $400 billion and the Bahamas with $400 billion.

The offshore system, as they say, “devilishly complex” by nature. However, since the 1960s, when there were only 12 offshore destinations, the global “offshore wealth” industry has expanded dramatically, with an estimated There are over 100 offshore capital destinationswhich also act as “communicating vessels”.

According to calculations Tax Justice Network, Governments have lost $4.8 trillion in tax revenue from the offshore wealth of the rich over the past 10 years.

On the other hand, according to informal surveys conducted from time to time by asset management departments of Swiss banks, as well as according to professors Gabriel Zucman (University of Berkeley), Anete Alstadsetter (Norwegian University of Life Sciences – NMBU) and Niels Johansen (University of Copenhagen), unregistered funds of Greek interests located in various powerful offshore centres amount to 140 billion euros.

AADE List

It is noted that the list “tax havens” Independent Management of State Revenues (AADE) Currently, there are 42 states, which practically means that any transaction with them falls under the “microscope” of the tax audit mechanism every time cases of money laundering are detected.

In particular, the list looks like this:

- Agios Efstathios,

- Albania,

- East Timor,

- Anguilla,

- Andorra,

- Vanuatu,

- Bermuda,

- North Macedonia,

- Bosnia and Herzegovina,

- Bulgaria,

- British Virgin Islands,

- Gibraltar,

- Guernsey,

- United Arab Emirates,

- Ireland,

- Qatar,

- Kyrgyzstan,

- Kosovo,

- Cyprus,

- Liechtenstein,

- Macau,

- Maldives,

- Montenegro,

- Moldova,

- Mongolia,

- Monaco,

- Barbados,

- Bahamas,

- Bahrain,

- Belize,

- Bonner,

- Cayman Islands,

- Marshall Islands,

- Turks and Caicos Islands,

- Isle of Man,

- Hungary,

- Paraguay,

- Samba,

- Saudi Arabia,

- Jersey,

- Turkmenistan.

Derussification of the Cypriot economy

The debate on the de-Russification of the Cypriot economy and how the economic footprint of Russians and Russian-speaking citizens in Cyprus has been radically transformed has become the subject of a study recently presented by the PACE think tank (Centre for Analysis and Strategy in Europe). In Cyprus the historical imprint of Russian communities dates back to the early 1990s, when they flooded the island because of its tax peculiarities and the offshore nature of its economy, characterizing it as the most “Russified” state in EU. In his Almost 6% of the population is of Russian origin.

The report notes that former companies with Russian interests that were linked to Russian oligarchs or directly to the Kremlin are no longer operating or have effectively been repatriated to offshore economic zoneswhich the Russian president created after 2020 to control Russia's economic activity abroad. In particular, this applies to companies such as FixPrice, United Medical Group, Etalon Group and TCS Group Holding, which for many years had a strong influence in Cyprus through local companies that have now closed down and concludes that there is now a trend in Cyprus towards creating technology companies with a “healthier” profile.

The study analyzes the transformation of parts of the Cypriot economy after 2022 and the Russian invasion of Ukraine into a hub for technology, IT and communications services, as well as the growing trend of attracting Russian and Russian-speaking specialists. Russia's invasion of Ukraine had crucial for the repatriation of Russian, Ukrainian and Belarusian companies to Cyprus: The number of Russian technology professionals in Cyprus increased by 63% in 2022, while their colleagues from Belarus increased by 76%.

The success of the model of attracting Russian technological “economic migrants”, largely due to the decisive role of a healthier incentive system, has led to the Republic of Cyprus winning in terms of GDP growth rates (5.1% in 2022 and 2.5% in 2022) for 2023 (while these rates are record-breaking in the eurozone), and the forecast for 2024 is even more optimistic.

Source of information tovima.gr.

More Stories

New Assassination Attempt? Car With Explosives Found At Trump Speech Site

The Struggle for the Arctic: Russia, China and the US

More than 2,800 people were injured in Lebanon in the mass explosions of pagers belonging to militants from "Hezbollah" (video)