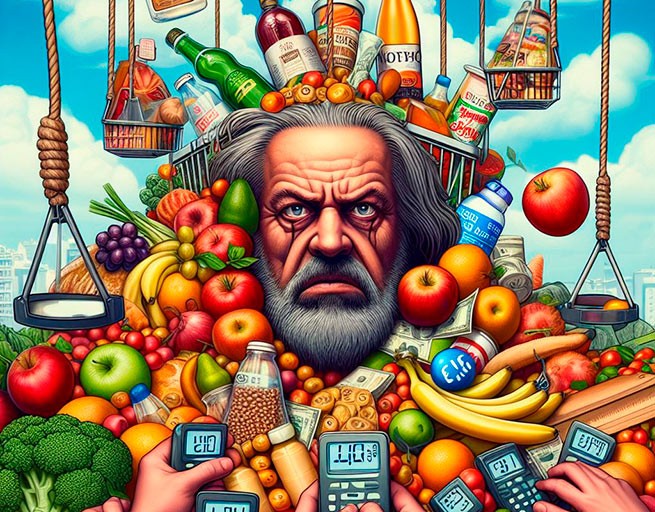

The problem of constantly rising prices is the biggest problem in the daily life of Greeks. In 2023 alone, 73.6% of Greeks will be forced to pay more for food purchases.

The annual ICAP study shows that in 2023, the “year of inflation”, 500 Greek companies recorded an impressive EBITDA (earnings before interest, taxes, depreciation and amortization) growth of 75.5%, reaching 25.1 billion euros!

Although high prices are not exclusively a Greek phenomenon, our country seems to suffer from it more than other European countries, as confirmed by the latest Eurostat data. Greece ranks second in terms of cost, and internal food inflation is the second highest after Malta among EU countries.

As for why the Greek market is subject to rising prices, and why prices remain high in some categories such as food despite even a slight slowdown in inflation, there are many reasons for this.

Factors preventing price reductions

Market representatives and economists trying to explain the current situation describe not only market distortions and possible speculative phenomena, but also a number of factors preventing prices from falling:

1. Structural problems

The small size of the Greek market and its geomorphology, which is not conducive to the development of competition between multinational companies, a high degree of dependence on imports of both raw materials (meat, milk, sugar, seed oils, etc.) and secondary materials (for example, packaging materials), and finished products. For example, the country’s self-sufficiency in beef and pork is in the range of 20-30%, in cow’s milk – 60%, and butter – 23%.

2. Private labels

Penetration of private label products is low (only 23.4% in Greece compared to more than 40% in other countries EU). Greater penetration would create significant competition on branded product shelves, as is the case in other EU countries. This is compounded by high taxes (VAT and VAT) on some categories of goods and high costs for businesses, especially in the primary sector and small businesses, which are ultimately paid by the consumer.

3. Fall in production

Especially in the food market, the decline in agricultural production in the country and geopolitical changes affect the supply chain and provoke an increase in prices of imported goods, which in turn affect the cost of products such as raw materials, fertilizers, agri-food, feed, energy, etc. .

4. Climate change

Climate change is having an impact on farming due to natural disasters that will be with us in the coming years.

5. Competition

Retailers add a number of other factors, including intra-group transactions of transnational corporations, which lead to inflated prices, clauses prohibiting retailers from parallel imports (not buying from subsidiaries of their suppliers in other countries, where they can sell cheaper than on the Greek market). This practice has sometimes been detected by the competition commission and sometimes results in severe fines.

6. “Greed Inflation”

The phenomenon called by researchers “inflation of greed”is associated with the increasing role of international corporations and large retail chains, which, in the race for profit, significantly increase markups, ultimately leading to rising prices for goods and services, which is also reflected in rising food prices.

The annual ICAP study shows that in 2023, the “year of inflation”, 500 Greek companies recorded an impressive EBITDA (earnings before interest, taxes, depreciation and amortization) growth of 75.5%, reaching 25.1 billion euros!

In addition, total profit before tax was 19.9 billion euros – a figure that covers about 90% of the profits of all 20,470 companies with available balance sheets for 2022.

This situation with prices is not a purely Greek factor, but a global trend. An analysis of the financial statements of many of the UK’s largest companies showed that profits far outpaced rising costs, contributing to rising inflation last year to levels not seen since the early 1980s.

The report, prepared by think tanks Institute for Public Policy Research (IPPR) and Common Wealth, states that thePortable profits increased by 30% among UK listed companies, with 11% of firms making excess profits based on their ability to drive excessive price increases – a move dubbed “greedflation” and a tactic that tends to take root. Excessive profits have been even greater in the United States, where many important sectors of the economy are dominated by a few powerful companies.

This surge in profits comes at a time when wage growth has failed to keep pace with inflation and workers have experienced the biggest drop in disposable income since World War II.

In addition, total profit before tax was 19.9 billion euros – a figure that covers about 90% of the profits of all 20,470 companies with available balance sheets for 2022.

This situation with prices is not a purely Greek factor, but a global trend. An analysis of the financial statements of many of the UK’s largest companies showed that profits far outpaced rising costs, contributing to rising inflation last year to levels not seen since the early 1980s.

The report, prepared by think tanks Institute for Public Policy Research (IPPR) and Common Wealth, states that thePortable profits increased by 30% among UK listed companies, with 11% of firms making excess profits based on their ability to drive excessive price increases – a move dubbed “greedflation” and a tactic that tends to take root. Excessive profits have been even greater in the United States, where many important sectors of the economy are dominated by a few powerful companies.

This surge in profits comes at a time when wage growth has failed to keep pace with inflation and workers have experienced the biggest drop in disposable income since World War II.

More Stories

Where will Greeks go for Easter: the best domestic and foreign destinations

Fine 1200 euros for the bad habit of Greeks at Easter, who is at risk

UK: human trial of melanoma vaccine started