The dynamics of the Greek construction sector continued into 2023, as reflected in the dynamics of various economic indicators such as output, investment, private construction activity and employment.

In contrast, at the European level, high input costs, tighter financing conditions and labor shortages have slowed construction activity, particularly for residential buildings, and limited investment, Alpha Bank said.

The bank’s analysis notes that despite the recovery of the sector, especially in the last three years, construction activity in Greece is still far from the high levels recorded before the country’s financial crisis. The upward trend in the Greek construction sector is reflected in the dynamics of the following indicators:

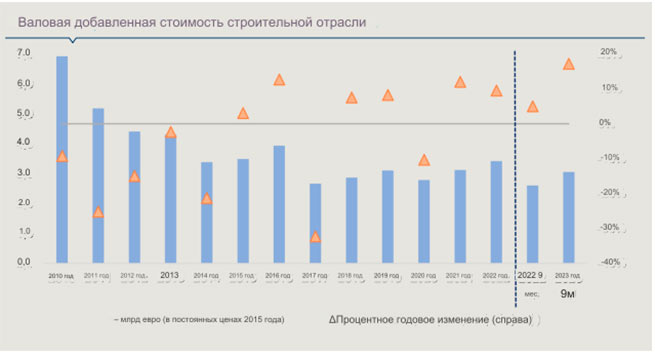

The gross value added (GVA) of the construction sector grew at a high rate from 2018 onwards – with the exception of 2020 due to the pandemic – contributing to the country’s economic growth. In particular, the GVA of construction in Greece grew by almost 11% per year in 2021-2022 and by 17.2% per year in the first nine months of 2023.

Source: ELSTATEurostat

Construction sector output at the European Union (EU-27) level increased by 2.8% in 2021, before slowing to 1.3% in 2022 and 0.5% in the first nine months of 2023. However, the GVA of this sector in Greece is significantly lower in real terms compared to levels recorded before 2010. In 2006, the GVA of construction was €12.3 billion (constant 2015 prices), or 5.3% of GDP, in 2017 it gradually decreased to €2.7 billion, or 1.5% of GDP, and in 2022 it was 3.4 billion euros. It is worth noting that in the first nine months of 2023, construction GVA approached 89% of the corresponding figure for the entire 2022, and its share in GDP increased to 2.1%.

The construction production index grew by more than 24% in 2022, which is the highest among EU-27 countries. In the first nine months of 2023, the index continued to grow by 13.4% year-on-year, while among the individual categories that make up the index, construction production (buildings), related mainly to private construction, increased by 16.7%, and production of civil engineering work related to state construction – by 11.3%.

This positive picture is also reflected in the dynamic growth of construction investments, which have been increasing since 2020.

Source: ELSTAT

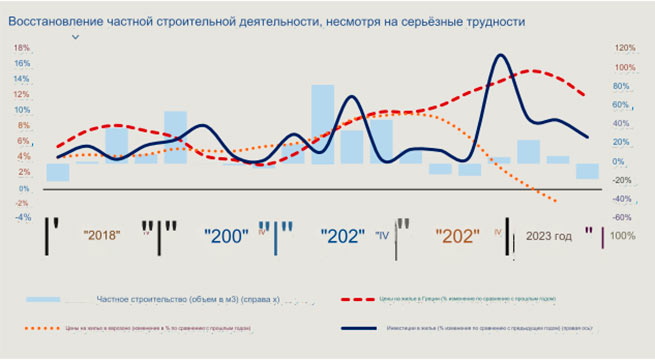

Investment in residential buildings grew by 33.7% in 2022 and 40.2% in the first nine months of 2023, while investment in other construction showed growth of 9.5% and 5.5%, respectively. Overall, in the first nine months of 2023, construction investment approached 84% of the 2022 total and was up about 16% compared to the same period in 2022.

Despite the upward trend in investment in housing construction in recent years, it still lags significantly behind the indicators of the period before the economic crisis in the country, and, in addition, there is a change in the structure of investment in construction. In particular, since 2012, investment in housing construction accounts for about 26% of total construction investment (in the first nine months of 2023 there is an increase, and the share of investment in housing construction is approaching 37% of total construction investment), while the corresponding figure for the period from 1995 to 2011 was 61%.

From 2017 onwards, with the exception of 2022, there has been a significant increase in private construction activity, despite unexpectedly unfavorable conditions associated with both restrictive measures during the pandemic and rising price levels, which have intensified due to Russia’s invasion of Ukraine . A significant increase of 46% in 2021 was followed by a slight decrease of 2.2% in 2022, while in the first nine months of 2023 private construction activity (by volume, m3) showed a significant increase of 18% compared to the same period in 2022, already exceeding 80% of the 2022 total.

Source: ELSTAT, Bank of Greece, ΟΟΣΑ

Finally, the upward trend in construction is reflected in employment growth in this sector – by 9.4% per year in the first nine months of 2023. This corresponds to a 17.1 percent increase in new business registrations in the construction sector over the same period, according to the latest ELSTAT data.

At the same time, the real estate market continues to recover actively. In particular, residential property prices rose 11.9% in the third quarter of 2023 compared to the same quarter in 2022, and in the first nine months of 2023 the annual increase was 13.9%. Important factors for rising prices in the real estate market are, in particular, the positive economic growth rate since 2017 and especially in 2021-2022, increased investment in construction, foreign direct investment (FDI) in real estate and the Golden Visa program.

Tellingly, the growth in the number of Golden Visa applicants in 2022 was 118% compared to 2021, while FDI in real estate also grew at a very high rate: by 68% in 2022, reaching €2 billion, and by 29 % for the first nine months of 2023 compared to the same period in 2022, exceeding 1.6 billion euros.

Villa in Faiakes (Fayakes) Corfu 1,500,000€

From 2022 onwards, especially from the third quarter, there is a significant difference in house price developments between Greece and the Eurozone. Thus, in 2022, the average annual growth rate of housing prices was 11.9% in Greece, compared to 7.2% in the Eurozone. Moreover, data currently available suggests the opposite trend in 2023, as house prices in Greece continue to rise in the first nine months, while in the Eurozone they fell marginally by 0.6% based on data for the first half a year The distinctive upward trend in prices in Greece, compared to the rest of the Eurozone, is largely due to the fact that in Greece, housing prices are gradually regaining lost ground due to the protracted economic crisis of the last decade.

In particular, according to the latest available data, in the third quarter of 2023, residential property prices in Greece have collectively recovered by approximately 57.8% from their lows (third quarter of 2017), however, lagging 9.1% from its peak (third quarter of 2008). In contrast, house prices in the eurozone began to recover from 2014 and exceeded 2008 levels as early as 2016, when prices in Greece continued to decline.

More Stories

Greece: 400 people died at sea in 2023

Greece is at the bottom of the EU in information and communication technologies

Real wages in Greece fell by 30%