Total investment in Greece’s office and retail sectors amounted to EUR 130 million, according to the Cushman & Wakefield Proprius report for the third quarter of 2023.

In retail specifically, there were 52 national leasing transactions in the third quarter of 2023, up 30% from the previous quarter and up 25% year over year.

The volume of investments in the retail market amounted to about 40 million euros

A significant transaction, which, however, was not reflected in this quarter as it was officially closed in previous days, is the sale by Reds (a subsidiary of the Hellactor Group) of the Smart Park retail park, with a total leasable area of 50,592 sq. m. m, to Trade Estates for €110 million (on a debt-free and cash-free basis), while Reds received €95.8 million.

Which chains have opened new stores?

In the third quarter, significant commercial leasing transactions were signed at the country level. Among them are the Juicy Couture and JD Sports stores in Glyfada, the Kiko Milano store in Neo Psychiko, the Oysho store on Tsimiski Street in Thessaloniki, the new Tike sports shoe store! at the intersection of Mitropoleos and Nikis streets in the center of Athens, the Folli Follie store in Heraklion in Crete and the Intersport store in Pagrati.

Lease agreements in retail parks and outlets include the opening of Sinsay and Ikea stores in Florida 1 Park in Thessaloniki, Sinsay and Moustakas Toys in Fashion City Outlet in Larissa and a new Massimo Dutti store in Smart Park.

As for malls, performance remains very strong, with new stores opening this quarter including the Porsche pop-up store at Golden Hall, the new The Big Bad Wolf at The Mall and clothing stores Alter and Mat at River West.

New stores from luxury brands

Mykonos and Santorini, as well as several other famous resorts, are hot destinations for luxury shopping, with notable stores opening here such as the Moschino pop-up boutique at the Cavo Tagoo Hotel in Mykonos, the expansion of Milanese luxury fashion brand Palm Angels and Danish cosmetics brand Alûstre in Mykonos, the Kiton store in Sani Marina in Halkidiki and the new Hublot store in Santorini.

Rents remain stable

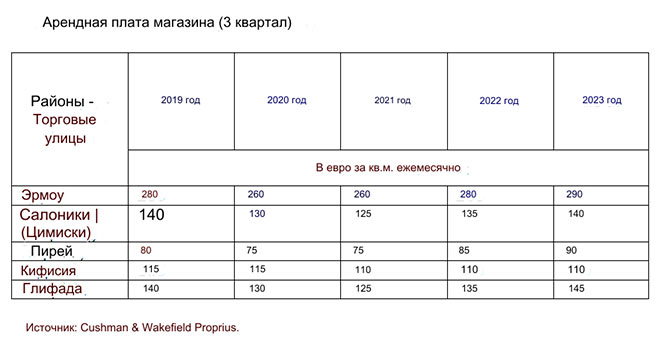

In terms of rental trends, rental prices remained stable in Q3 2023 on most popular shopping streets, which performed well during the summer season thanks to significant tourist numbers. Very little growth has been recorded in prestigious areas in the center of Athens, where supply remains low.

In particular, on Ermu, the most expensive commercial street in the country, monthly rent increased from 285 euros/sq. m in the second quarter of 2023 to 290 euros/sq. m in the third quarter. In other areas, such as Tsimiski in Thessaloniki, Kolonaki, Glyfada, Kifissia and Piraeus, there were no changes.

Rising rents in the office market

The office market continues to show positive dynamics, with competition driving up rents for prime space.

In the third quarter of 2023, absorption volume was approximately 50,000 sq. m. feet, which is the same as the previous quarter, but 100% higher than the same period in 2022.

This figure was mainly influenced by the agreement of the Mytilineos Group to lease 29,000 sq. m. m of office space with 1,100 parking spaces along Attica Odos in Peania.

Note that the number of transactions concluded over the 9 months of 2023 increased by approximately 40% compared to the same period in 2022. The technology sector is leading the demand in Athens, although this sector has a high percentage of remote work.

There has been some polarization regarding rents for premium space, as a shortage of quality space is driving up rents. The average base rent in the 3rd quarter of 2023 increased to 28 euros/sq.m. m per month, and some transactions exceeded the threshold of 30 euros/sq. m per month. It is important to note that the quality of the building plays a key role in setting rent levels. Thus, in the same area there may be buildings that exhibit different rent dynamics compared to others.

Supply is shrinking

In general, in the office sector, the vacancy rate has decreased and averages 11.7% in Athens-Piraeus, especially in the central area and in the L. Vasilissa Sophias area, in the north (Kifissia, Attiki Street, Messogeion Street), on National Street, Singru, Vouliagmeni and in the port of Piraeus.

The lowest figure was recorded in the center (5.7%) and the highest on the National Road, 25%, as is the case with rent. In the center and north the highest rental prices are 28 euros per sq. m. m for high-quality premises, while on the National Road the corresponding figure averages 16 euros per sq. m. m at the moment.

Investments

The volume of investment in office premises in the 3rd quarter of 2023 reached 90 million euros, which is 25% more than last year. However, these have mostly been special interest deals and it is clear that investors are being cautious due to the recent rise in funding costs.

The largest transaction was the acquisition of three buildings by NBG for €180 million, which is expected to be completed by the end of the year. Rent of Lakis Gavalas studio on Bucurestiou street with a total area of 800 sq. m, which will house Hugo Boss.

Average rent remained stable with an upward trend in certified space

Market performance in the Greek office sector continues to remain consistently weak compared to other European markets. The availability of investment grade green buildings is also very low, while the demand for such space is growing.

In 2024, new office building construction will remain low relative to demand, with a significant portion of space already pre-occupied.

More Stories

Fruits and vegetables: imports up 50.2% in April

Greek products on their way to France

Reduced fees for POS transactions, limited bank fees