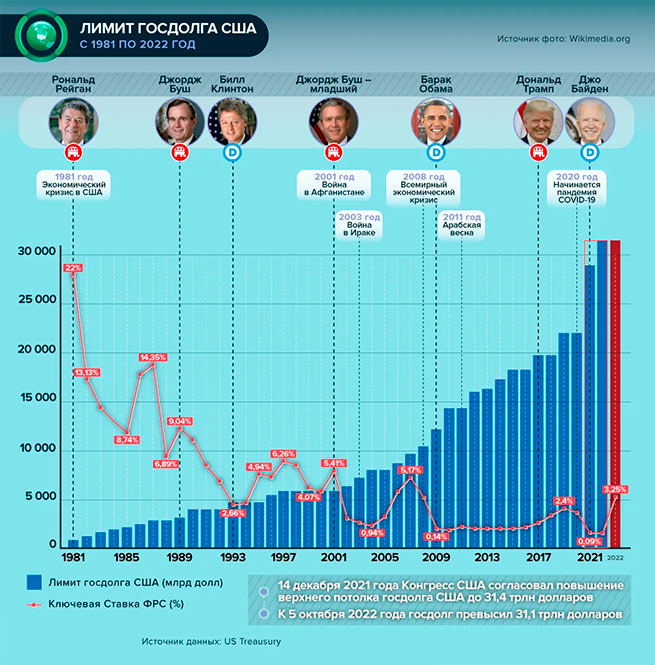

What if the US announces default on June 1st? If the debt limit is not raised, the government will not be able to meet its payment obligations. Seven doomsday scenarioswhich could happen to the US if an agreement is not eventually reached to increase the debt.

Scenario One: Stocks and Bonds Crash

The price of a hedge against a US government default has risen, as have government bonds with near-marginal maturities, reflecting uncertainty about this. But these vibrations are not felt by most households. This is expected to change as the critical date approaches.

If a default occurs, it will be a terrible shock that will first hit the financial system – stocks, bonds, mutual funds, derivatives – before spreading to the wider economy, experts say. Stocks are likely to fall in anticipation of a wider economic downturn as interest rates rise and investors withdraw funds from the market to bolster their cash. Banks that have already restricted lending will restrict it even more.

In 2011, the X-date was less than a week away during the standoff between President Barack Obama and the Republicans in Congress. Wall Street indices then fell by 20%.

Moody’s Analytics has calculated that stock prices could fall by 20%, depriving households of $10 trillion and destroying the retirement accounts of millions of Americans. The White House has calculated that the fall could be as high as 45%. Accordingly, the $46 trillion bond market will begin to falter as the value of existing Treasuries collapses due to higher yields on new ones.

Scenario two: sudden recession

The decline in wealth for households across the country caused by the Wall Street sell-off will cut consumer spending and therefore hurt businesses. And rising interest rates will make getting a loan or starting a small business especially difficult.

These developments could also disrupt an already volatile residential real estate market. A recent Zillow report predicted that foreclosures could result in mortgage rates dropping by more than 8% and home sales falling by 23%. A recession for the construction industry would be horrendous.

Scenario Three: Termination of Social Assistance

However, the most immediate and drastic effect will be the end of the usual federal benefits that tens of millions of American families receive, Medicare for the elderly, Social Security benefits and food stamps. The federal government is projected to spend about $6 trillion this year, which works out to about $16 billion a day.

A 2013 Treasury Department report found that in 2011, volatility caused by debt ceiling doubts resulted in a $2.4 trillion drop in overall household wealth.

According to the White House Council of Economic Advisers, the economy as a whole could shrink by as much as 6%, just like during the Great Recession of 2008.

Scenario Four: Federal Government Workers Go Unpaid

Organizations whose expenses have not been approved lay off workers, leaving only certain “essential” employees who continue to work without pay. There have been three power outages lasting at least a full day in the last decade. Employees usually receive compensation after the fact.

But arguing about raising the debt ceiling may not look like that at all, experts say. The White House Office of Management and Budget has yet to release guidance on shutting down the federal government due to default, which some financial analysts say will be difficult because there is no way to know which payments will not be made. This uncertainty could affect US military personnel, as well as food safety inspectors, air traffic controllers, and workers in other life-critical professions.

The federal government is the nation’s largest employer, with about 4.2 million full-time employees, according to the Congressional Research Service.

Scenario five: Social Security and Medicare payments will end

More than 60 million people receive monthly Social Security payments, mostly seniors. Another 60 million depend on Medicare health insurance. Some Republicans argue that the federal government can continue to make these payments even without borrowing by redirecting incoming tax revenues.

However, budget experts doubt that the Treasury will be able to send these benefits to the elderly in a timely manner, especially if the problem drags on for weeks or months.

If the government can still make some payments from incoming tax revenue, the administration may have to choose between sending checks to the elderly or paying interest on the debt. But forgoing interest payments in order to keep Social Security and Medicare payments will further exacerbate an already severe financial crisis.

Scenario six: The cost of US borrowing will rise sharply

The US federal government is able to borrow money relatively cheaply because US bonds have very low credit risk – no one, under normal circumstances, expects a US default. The reliability of US government bonds has made them a key element of the global financial system. US bonds act as a reserve asset and are bought by everyone from foreign central banks to money market funds because they are highly reliable and liquid investments.

But if the US defaults, US Treasury bonds will lose their credibility, followed by a sharp drop in their prices, leading to instability and uncertainty around the world. The Brookings Institution estimates that exceeding the debt ceiling could increase the cost of US borrowing by $750 billion over the next decade.

Scenario 7: Economic problems will spread around the world

Many countries protect their finances by buying large amounts of US Treasuries, considered one of the safest assets in the world. But exceeding the debt ceiling could lower the value of these bonds held by countries, hurting their reserves.

Economists fear that this development will dramatically increase the number of countries in debt, lead to large popular backlash and global geopolitical instability. The aggressive rate hikes that the Fed has launched since last year to curb inflation have already driven down the value of US bonds held by many other countries.

More Stories

The Minister of Health called the protesters "insignificant people, kafirs"

Gold Switzerland: “We are in the last 5 minutes of our financial system – the collapse of everything is approaching”

Union of Judges: “People’s courts were created against us with the loyal attitude of the government”