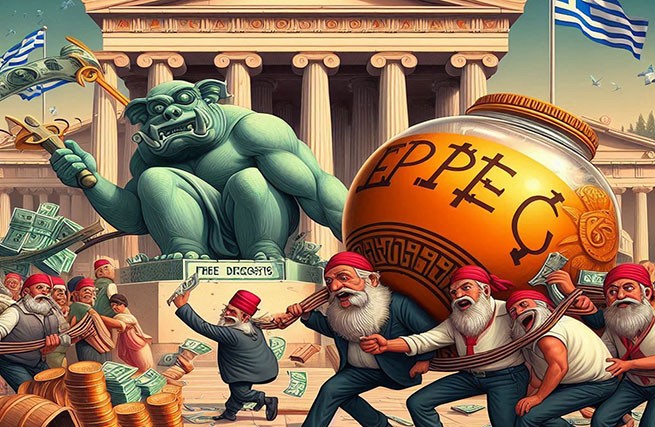

Banks are literally “fattening up” on depositors’ money: after all, while they are issuing loans at 5.78% (new increase), the interest rate they give to depositors is only 0.57%!

And they consider it such a success that they even paid dividends to shareholders due to the explosive growth in profits of 814 million euros!

Banks kept deposit rates unchanged and increased lending, causing the interest rate gap to widen again in July. In particular, according to Bank of Greece data for June 2024, the weighted average the interest rate on new deposits remained virtually unchanged at 0.57%, while the corresponding interest rate on new loans rose to 5.78%, As a result, the interest rate spread between new deposits and loans widened to 5.21% from 4.98% in May.

In particular, the average interest rate on overnight deposits from the population remained unchanged at 0.03%, while the corresponding interest rate on deposits from enterprises was 0.20% from 0.17% in the previous month.

Average interest rates on deposits with a specified maturity of up to 1 year from individuals and businesses remained almost unchanged and amounted to 1.86% and 3.16%, respectively.

In terms of lending, the weighted average interest rate on all new loans to households and businesses increased by 24 basis points (0.24%) to 5.78%. The average interest rate on consumer loans without a fixed repayment period (a category that includes credit card loans, open loans and current account overdrafts) decreased by 7 basis points to 14.92%.

The average fixed-term and variable-rate consumer loan interest rate increased by 12 basis points (0.12%) to 12.23%, while the average variable-rate mortgage interest rate decreased by 26 basis points (0.26%) to 4.70%.

The average interest rate on business loans with no fixed maturity fell by 6 basis points to 6.61%. The corresponding interest rate on business loans also fell by 6 basis points to 7.55%.

The average interest rate on new fixed-term and variable-rate business loans remained virtually unchanged at 5.41%.

The average interest rate on loans to small and medium-sized enterprises (SMEs), with a floating interest rate on regular maturities, fell by 29 basis points to 5.88%.

In terms of the interest rate structure depending on the loan amount, the average interest rate on loans up to EUR 250,000 increased by 19 basis points to 5.95%, on loans from EUR 250,001 to EUR 1 million it decreased by 15 basis points to 5.99%, and on loans over EUR 1 million it increased by 12 basis points to 5.37%.

At the same time, Eurobank will pay total dividends of EUR 342 million, ΕΤΝΙΚΙ Bank – EUR 332 million, Piraeus – EUR 79 million, and Alpha Bank – EUR 61 million. General profit of four systemic banks amounted to EUR 1.09 billion in the first quarter of 2024, compared to EUR 788 million in the corresponding quarter of 2023, which is +38.4% more.

Ethniki reported a net profit of €358 million (+38%), Eurobank – €287 million (+21.4%), Piraeus – €233 million (+29.4%) and Alpha Bank – €211 million (+89.91%).

More Stories

Medicines: rising costs for citizens

BRICS and G7: New Energy Race and Struggle for Resources

AADE Prepares Digital Client List for Freelancers – Who Does It Concern?