Since 2015, Bitcoin's purchasing power has increased from 51 to 10,500 Big Macs. This phenomenal growth underscores its uniqueness as an asset and a hedge against inflation.

Bitcoin's purchasing power, as measured by the Big Mac Index, has increased significantly over the past decade.

In 2024, one Bitcoin can buy approximately 10,500 Big Macs, an increase of 20,488% from 51 Big Macs in 2015. This increase highlights the significant increase in the value of Bitcoin relative to a consumer good like a Big Mac.

Big Mac Index (source: inflationchart.com)

Big Mac Index

The Big Mac Index, originally developed by The Economist, is an unofficial measure of purchasing power parity that compares the cost of a Big Mac across countries to assess the value of currencies. The index shows that while Bitcoin has soared, traditional assets like gold have also risen in value, but at a much slower rate. Over the same period, gold’s purchasing power in Big Macs has increased by about 35%, a more modest increase than Bitcoin’s.

Big Macs per ounce of gold (source inflationchart.com)

The Economist's official Big Mac index also highlights trends in currency valuations, with the British pound overvalued by 3.6% against the US dollar as of July 2024. The index provides information on global economic conditions and currency movements, reflecting broader market trends. Among all the currencies tracked, only the British pound, Swiss franc, Uruguayan peso, Argentine peso, Norwegian krone and euro are currently overvalued against the dollar.

The Big Mac Index (source The Economist)

The Big Mac Index (source The Economist)

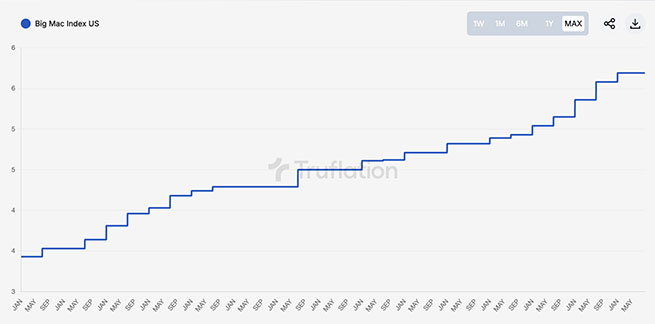

The data highlights the volatile but upward trajectory of Bitcoin, which has positioned itself as a unique asset class with significant growth in purchasing power over the past decade. The price of a Big Mac in the US was $4.29 in 2015 and is now $5.69, an increase of 32%.

Big Mac price since 2010 (source Truflation)

Bitcoin is not an inflation hedge(?)

The argument that Bitcoin is not an inflation hedge only holds true when looking at short time frames. Over a single day or month, Bitcoin rarely competes with more stable assets like U.S. Treasuries or even many fiat currencies. However, over the past decade, Even gold couldn't compete with Bitcoin in terms of pure purchasing power.

If you shorten the time frame to five years, Bitcoin can still buy 8,500 more Big Macs for one coin. So while a stronger argument would be that Bitcoin is a hedge against irresponsible central banking, it could also be argued that Bitcoin beats inflation — at least in terms of Big Macs.

Author's opinion: I believe that gold is undervalued today.

More Stories

Medicines: rising costs for citizens

BRICS and G7: New Energy Race and Struggle for Resources

AADE Prepares Digital Client List for Freelancers – Who Does It Concern?