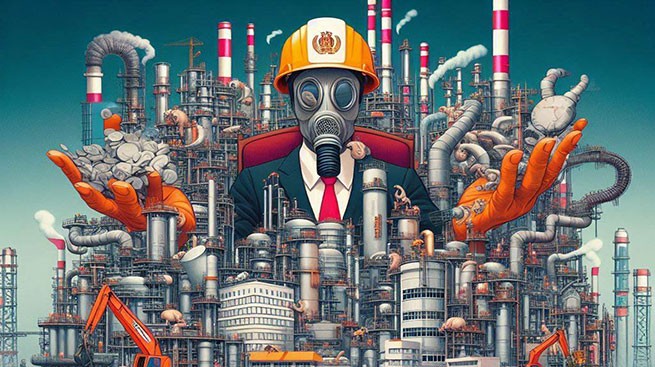

The Ministry of National Economy and Finance on Thursday morning announced the introduction of a temporary 33% solidarity contribution for oil refining companies based on excess profits for the 2023 tax year, as well as permanent introduction of reduced VAT rates on taxis and coffee delivery (take away & delivery).

A. Introduction of a temporary solidarity contribution

Following the introduction of an emergency temporary solidarity contribution for oil refineries for 2022, an emergency temporary solidarity contribution (ETS) for oil refineries based on excess profits is being introduced for the 2023 tax year.

The temporary solidarity contribution will be calculated on the basis of excess profits for tax year 2023, as defined in the Regulations (EU) 2022/1854, that is, 33% of the taxable profit for 2023, which exceeds 20% of the average of the results for 2018-2021.

It is noted that the temporary solidarity contribution, calculated on the basis of excess profits for 2023, will be established in 2024 and reflected in company declarations for the 2024 tax year. The proceeds will be used mainly to provide financial support to pensioners in December who, due to personal differences, will not be able to benefit from the new pension increase from 1/1/2025, as well as to strengthen the allocations of the national public investment program.

Β. Harmonization of reduced VAT rates

We remind you that from 1/1/2024 a permanent reduction in VAT rates was introduced on a number of goods applied during the pandemic, such as transport, gyms, dance schools, cinemas and a number of health-related goods, amounting to 305 million euros per year .

In addition, the reduced rate was extended for coffee, cocoa, tea offered in restaurants and cafes until 30/06/2024 with an estimated value for six months of 77 million euros. In addition, the reduced rate on non-alcoholic drinks was permanently set at 13% for those that are supplies of goods (takeaway and delivery), while for non-alcoholic drinks served, it was returned to 24%.

From 1/07/2024 the reduced rate for taxis becomes permanent (from 24 to 13%), with an annual fiscal cost of 45 million euros. In addition, the reduced VAT rate (13%) remains for coffee, cocoa, tea and chamomile tea , which are goods supplies (takeaway and delivery), with an estimated fiscal cost of 65 million per year, and returns to 24% for takeaway drinks only, in line with other soft drinks, with an estimated saving of 43 million per year.

The Minister of National Economy and Finance, Kostis Hatzidakis, made the following statement:

“As the picture of refinery accounting profits for 2023 emerges, it becomes clear that they, although partially down from 2022, remain significantly higher than pre-crisis levels, indicating the presence of excess profits .

Therefore, the emergency levy introduced in 2022 will also be levied in 2023, as permitted by EU Regulation 2022/1854, adopted in response to the energy crisis and its consequences. These revenues will be used to meet the needs of retirees and to increase public investment. In addition, the reduced VAT rate on taxis and on the delivery of takeaway and delivery coffee becomes permanent.

The government is doing everything it can to support vulnerable social groups in difficult circumstances, while achieving its fiscal targets at a time when many other EU economies are being tested.”

More Stories

Prices for green electricity are “biting”

Six-day work: the measure comes into force today, July 1

Four-digit number and platform for smoking complaints