“Your own roof over your head” has always been the goal of life for the vast majority of Greeks, as well as for a significant part of Europeans. Buying a house was an end in itself. However, a lot has changed in recent years.

Rising property prices have made owning a home an increasingly unattainable dream for many Europeans, a problem compounded by a cost of living crisis that has hit city dwellers and poorer families particularly hard.

“The rise in house prices is terrible and even worse in cities, especially large ones.”Lamia Kamal-Chaoui, director of the OECD Center for Enterprise, Small and Medium-Sized Enterprises, Regions and Cities, told POLITICO. “And this is already affecting not only the poor, but also the middle class.”.

Home prices and rents have risen steadily since 2014, even during the COVID-19 pandemic when, despite the financial crisis, demand for housing increased as long power outages and the rise of remote work kept people at home.

In 2022, as the economy began to recover, Russia’s invasion of Ukraine brought new budget problems for governments and a severe cost-of-living crisis for households. Housing is not only becoming more expensive, but it is also becoming increasingly difficult to afford quality housing.

Many Europeans found themselves in mortgage or rent debt last winter and finding it very difficult to keep their homes warm.

Stunning prices

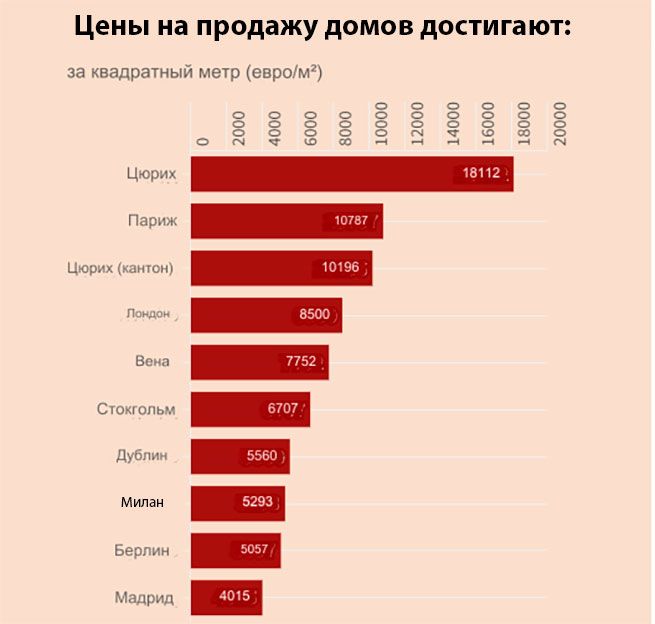

The situation is evidenced by the fact that unprecedented amounts are being asked for housing in the central areas of European cities such as Zurich, Paris and London, reaching up to 18,000 euros per square meter. Prices in the Swiss city reached 18,100 euros, in Paris – 10,000 euros per square meter, followed by London – 8,500 euros, Vienna – 7,750, Stockholm – 6,700, Dublin – 5,550, Milan – 5,300, Berlin – 5 000 and Madrid – about 4,000 euros, according to new Bloomberg research.

In Zurich in particular, city center apartments are selling for near record prices, more than double those in London, while even in the rest of the canton, which includes remote mountain villages, asking prices are almost equal to those in Paris. Prices rose 5.8% in August compared with the previous year, recording their biggest increase in 16 months.

A blow to youth

According to Eurofound, young residents are suffering the most from the housing crisis. Young Europeans are more likely to live with their parents, are more likely to rent than to buy, and are often reluctant to look for work in areas with better opportunities because they cannot afford to live there.

This is a “major problem” for cities where “young people are needed to remain competitive,” said the OECD’s Kamal-Chaoui, noting that “if they can’t afford an apartment, they will never move to a city, no matter how attractive it is.” .

Real estate bubble

As POLITICO notes, one of the key issues that makes housing unaffordable—lack of adequate housing—remains unresolved and may be exacerbated by the cost of living crisis.

“Demand for housing is growing, but supply is not keeping up,” says Kamal-Chaoui of the OECD.

Restrictions

According to the OECD, addressing the housing shortage by building new housing is difficult, largely due to regulatory and land use constraints that are particularly acute in large cities.

Construction of new housing has also become significantly more expensive over the past decade, especially since the onset of the pandemic. The sector recovered in 2021, but last year saw a further decline in the number of residential buildings approved for construction, although the number is still well above pre-pandemic levels.

Some cities are trying to address housing shortages by converting commercial and office buildings vacated during the pandemic into social housing, but this approach has not been widely adopted because “not all cities have public social housing – many don’t even have housing stock”said Kamal-Shaoui.

He noted that “the quality of life in large cities has decreased, and people realize that they want to live well” in less bustling areas located in suburbs or mid-sized cities that are beginning to experience housing shortages.

“Everything is evolving very quickly – what worked before may not work anymore” and cities are having to reconcile their ambitions with financial constraints caused by the cost of living crisis, says Kamal-Chaoui, adding that mayors, regardless of their political views, are now view the problem of homelessness as a priority.

Towards a new Lehman Brothers?

The European construction sector has entered a serious crisis. Construction activity in many major European markets, especially Germany, France, Sweden and the UK, has slowed at a time when material costs are rising significantly due to runaway inflation reaching or even exceeding 40%. Additionally, soaring prices and lending rates have impacted residential and commercial real estate construction, putting a damper on developers who are now even leaving buildings in the middle.

The slowdown in construction activity in many cases has led to an exacerbation of the housing problem for many families in EUfor whom the cost of purchasing and renting existing real estate is constantly increasing due to certain circumstances – such as high demand and short-term rentals.

Painting in Greece

House prices in Greece are rising at the fastest pace in Europe. The rapid rise in prices in Greece has caused great surprise and upset among the concerned public, since the cost of real estate significantly exceeds the budget of the average Greek household.

According to Bloomberg analysis, rising real estate prices is a Greek phenomenon. Part of the increase is due to the effects of the Greek debt crisis, which are affecting supply. Property prices in Athens rose 12.2 percent in October, while they fell in Paris and Stockholm.

Prices in Athens are calculated based on the Spitogatos index, which Bloomberg used to calculate monthly asking prices in the city’s five districts and then averaged them to calculate prices across the city.

“There is not a single worthy object on the market,” – said Lefteris Potamianos, president of the Athens and Attica Real Estate Association, who also attributed the rise in prices to demand generated by the program “Golden Visa”.

Athens has become one of the hottest real estate markets, and areas that were “forgotten” or run down have come to life and become comparable to wealthy European cities.

Races in the real estate market

Apartment prices (in nominal terms) rose 13.9% in the second quarter of 2023, up from 11.8% in 2022, the Bank of Greece said in its financial stability report.

Prices for new apartments (up to 5 years old) increased by an average of 13.8% year-on-year in the second quarter of 2023, while prices for older apartments increased by 14.1%.

In the short term, it is estimated that investment interest, mainly from abroad, will remain high, especially in relation to specific prime areas in the Attica basin and areas with tourist characteristics.

In the medium term, it is expected that initiatives related to supporting certain categories of households (for example, youth, vulnerable groups of the population) within the framework of the “My Home” program for the purchase of housing will contribute to increased demand, and corresponding initiatives to renovate old houses (for example, the program “Renovate” – “ExoGeo”) will help improve the housing stock.

However, it is noted that the residential real estate market in many EU countries is already experiencing a significant correction in terms of the number of transactions, prices and profitability.

In the second quarter of 2023, apartment prices increased by 13.9%.

They are still far from the all-time high.

In addition, it is reported that housing prices in Greece are still far from the historical highs recorded before the crisis.

According to the apartment price index calculated by the Bank of Greece for the entire country, the maximum value of the index was recorded in 2008 (101.7), after which a steady downward trend was observed, and the minimum value was reached in 2017 (59). Since then, the apartment price index has shown a steady upward trend and will reach 90.6 in the second quarter of 2023, which is 11.1% below its maximum value.

Similar dynamics are observed in relation to the level of rent: the corresponding index is 98.5 according to data for the 3rd quarter of 2023, compared to 94.8 in the 2nd quarter of 2022.

The rent index, in contrast to the housing price index, remains significantly below its highest historical value (124.3, Q3 2011), but the standard of living of the population at that time was significantly higher…

More Stories

Old and rusty road posts are a real danger for drivers and pedestrians

Athens City Train: From Varibobi to Stavros Niarchos Centre

Parliament: bill introduced "About agricultural products and food". What does it concern?