The annual ICAP study shows that in the “year of inflation”, 500 Greek companies recorded an impressive EBITDA (earnings before interest, taxes, depreciation and amortization) growth of 75.5%, reaching 25.1 billion euros!

In addition, total profit before tax was 19.9 billion euros – a figure that covers about 90% of the profits of all 20,470 companies with available balance sheets for 2022.

It’s worth noting that the ICAP study data processed and released today “bs” is for fiscal year 2022. To many, they may seem like last year’s sour grapes, but they are extremely important because, on the one hand, they relate to a period when the inflationary cycle opened, the energy crisis raged, and the prices of raw materials and secondary materials skyrocketed.

On the other hand, they are also the first collective publication, since a flurry of extensions to the deadline for publishing the balance sheet for the financial year 2022 has allowed many companies not to publish financial statements for this financial year even today! There must be some end to this phenomenon as it acts as a deterrent to market transparency…

However, the explanations for the excess profits of many companies in the sensitive food, beverage and organized retail industries, despite profit margin constraints on core commodities, are many and varied. From the ability of companies to adapt and compete for other growth avenues, overseas or in other sectors, to the outcome of the so-called “greed inflation”which, according to the latest report from the Bank of Greece, is the biggest factor influencing price increases and the main risk of disrupting the growth dynamics of the Greek economy!

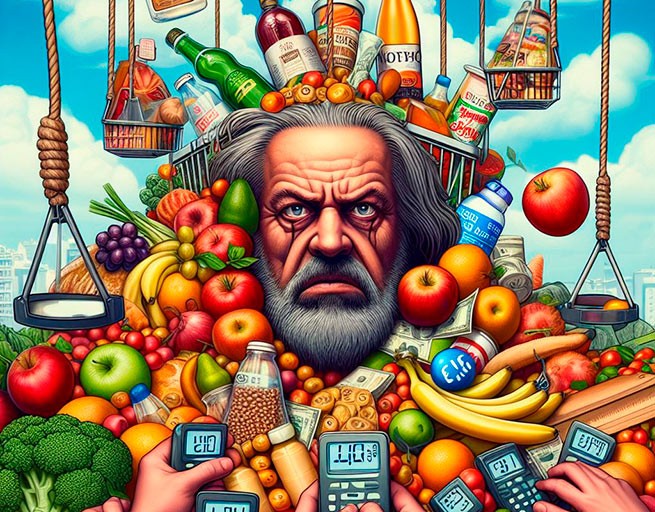

This is how AI represents “greed inflation”

In particular, according to the Bank of Greece report, the net profit share (defined as the ratio of net operating surplus to net value added and expressing the performance of a business sector in terms of operating profit) remained significantly higher in the first quarter of 2023 (28%) compared to its level in 2019 (24.9%). However, it is at the same level as the average for the period 2017-2019. Note that after the increase recorded in the first year of the pandemic, the share of net profit of products remained high in 2021 (33.7%) and in 2022 (33.2%), and then seemed to decline .

The maintenance of the profit share from products at a high level can be explained by a number of factors, such as (a) high demand, which exceeded limited supply in certain sectors of the economy (food products, industrial goods), (b) the accumulation of household savings during the pandemic, which fueled consumer demand dynamics, (c) a strong inflationary environment dominated by strong increases in import prices (for example, the cost of imported energy), which further increased inflation expectations and could make it easier for firms to pass on their increased costs to targets!

That is why, in addition to containment issues, the head of the Bank of Greece, Yiannis Stournaras, also called for stronger controls on excess profits. A clearer picture of the dynamics of corporate profits is provided by the ICAP survey, according to which all business sectors are demonstrating a significant increase in profitability.

More Stories

What influenced Greece’s decision to help Kyiv with weapons?

The Minister of Health called the protesters "insignificant people, kafirs"

Gold Switzerland: “We are in the last 5 minutes of our financial system – the collapse of everything is approaching”