JP Morgan is recommending investors remain long Greek bonds as opposed to Italian bonds, reiterating its confidence in Greek assets and its assessment that Moody’s will upgrade the country’s investment grade rating during 2024.

JP Morgan expects continued passive capital flows due to the inclusion of Greek bonds in global indices in January. However, the company cites anecdotal data indicating insignificant flows in the Greek bond market due to their inclusion in major indices from the beginning of 2024. With this in mind, Greek bonds have remained under pressure in recent sessions, likely due to selling flows in anticipation of a potential rating upgrade.

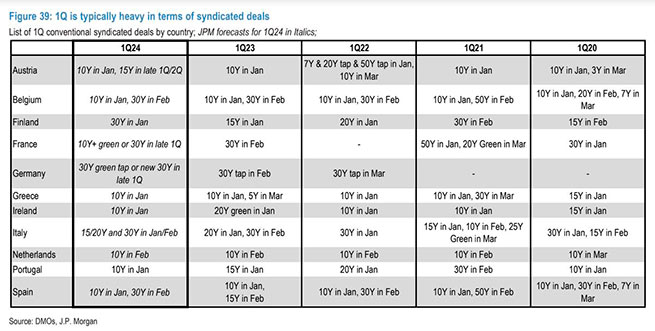

JP Morgan also expects Greece to issue new 10-year bonds in the coming weeks. Thus, the recent pullback is expected to be reversed once the issuance is announced and generates good yields, with further support from passive flows that will be used to purchase new bonds for the first time.

He also believes that in a broader risk scenario, Greece is likely to behave with a low beta relative to Italy.

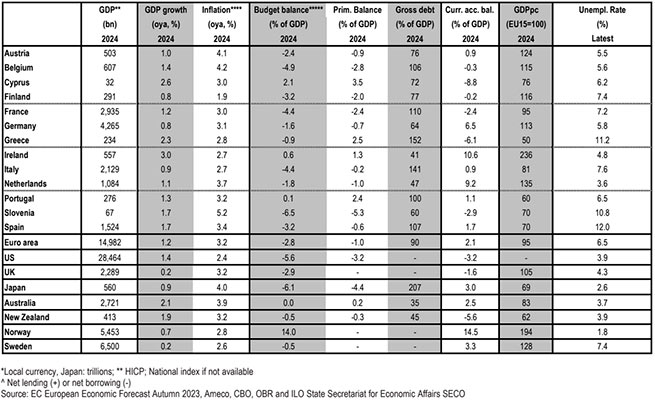

On January 4, in another analysis, JP Morgan estimated the likelihood of Moody’s upgrading the Greek economy’s rating in 2024 to be 90% (likely 15/3), while the likelihood of upgrades by other agencies was 30%. Additionally, overall, JP Morgan expects rating actions on eurozone sovereigns to be limited in 2024, given that the eurozone had several positive ratings in 2023, with Cyprus, Greece, Ireland, Portugal and Austria benefiting from improved outlooks and /or rating increase.

More Stories

Office rental… hourly

Investors are buying up rural real estate en masse

IRIS: large fine for freelancers who did not activate it before June 30