The actual owner of the Saudi throne, Crown Prince Mohammed bin Salman, did not accept the invitation to attend the BRICS summit, which will take place on October 22-24 in Kazan and threatened to drop oil to $50.

The Kremlin’s desire to see bin Salman, its key partner in the oil market, at the summit in Kazan, “the most significant foreign policy event” in history, was announced in September by Russian Foreign Minister Sergei Lavrov. However, Riyadh refused. Russian Presidential Assistant for International Affairs Yuri Ushakov, commenting on the preparations for the summit last week, said:

“Saudi Arabia will send a foreign minister.”

He didn't specify writes The Moscow Times, what is the reason for the prince’s decision, however, casually noted that Western countries are putting pressure on Russia’s “partners”, threatening consequences if they travel to Kazan.

Having not joined the sanctions, Saudi Arabia remained a key ally of the Kremlin in the oil market after the start of the war.. The Biden administration in the fall of 2022 persuaded the Saudis to increase production to replace embargoed Russian barrels, however Bin Salman remained faithful to his alliance with Putin and, on the contrary, reduced supplies by 2 million barrels per day, with the goal of keeping quotes close to $100 per barrel.

Two years later the mood in Riyadh began to change. Kingdom in earnest concerned about its declining market share and intends to switch to a policy of increasing production, even if this means enduring low prices for a long time. People familiar with the situation spoke about this at the end of September. sources Financial Times.

Prince Abdulaziz bin Salman, Saudi Arabia's energy minister, said some OPEC+ countries, such as Kazakhstan and Iraq, were not meeting their quotas and threatened that the price of a barrel could fall to $50.

London School of Economics research fellow Luke Cooper notes that for Russia this is the worst possible scenario: collapse of oil prices to 2014–16 levels. will significantly complicate the “financing of the war machine.” In the current year's budget, the government budgeted oil for $70 and expects approximately the same price ($69.7) next year.

Saudi Arabia, unlike Russia, can more easily survive cheap oilCooper explains: deposits in the Arabian Desert are much closer to the surface than Siberian deposits in permafrost, and therefore the cost of Saudi barrels is lower. In addition, Riyadh can easily and quickly increase production and compensate for price losses through volumes. Cooper notes:

“Unlike Saudi oil, Russian oil is not cheap to produce. Therefore (the Russian Federation) is poorly prepared for a situation of low prices. This explains the Russian logic of military escalation, which requires quick successes on the battlefield – before oil prices fall.”

Currently, Saudi Arabia pumps 8.9 million barrels per day – and this is the minimum production since 2011. From December, the kingdom will begin adding 83 thousand barrels per day to the market every month and by the end of December 2025 will increase supplies by 1 million barrels per day. According to FT sources, Production growth may occur even faster if OPEC+ countries do not adhere to quotas.

More Stories

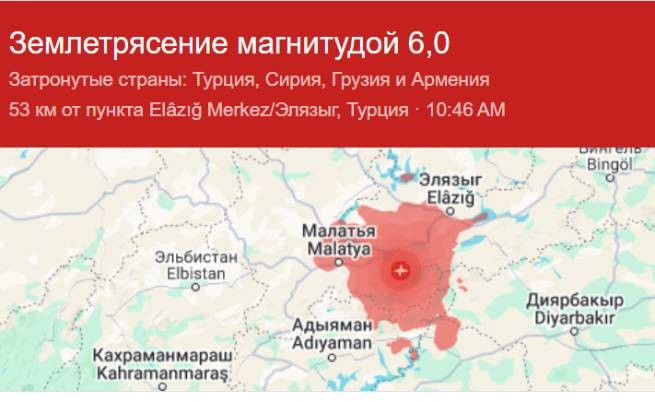

6.1 magnitude earthquake in Turkey

The European Union imposed sanctions against Iran (video)

USA: a policeman shoots and kills a black woman who attacked him with a knife (video)