The Greek Tax Authority has provided Greek media with data on what employees, pensioners, professionals, income earners and farmers have declared to the tax office.

Over the four years from 2019 to 2023, Greeks declared 239,867 more cars and 39,709 private homes (primary residence) to the tax office. And 2,142 more people had real estate and deposits abroad than four years ago.

At the same time, there were 7,329 fewer yacht owners (2022 income) on their 2023 tax returns compared to those who reported owning a speedboat in 2019 (2018 income). And as pool owners There were 3,128 fewer taxpayers involved, which raised many questions about how this happened (was it covered with earth?)and is this really true, or are they simply trying to avoid prosecution by the tax authorities by simply not declaring their existence.

These The data was obtained as a result of code-by-code analysis of tax returnssubmitted each year by approximately 9,000,000 taxpayers (TIN holders), including taxpayers, their spouses and children who have a tax registration number, providing a total of approximately 6,560,000 tax returns.

On the other hand, the data shows that number of owners first secondary home (ιδιοκτήτες-κάτοχοι πρώτης δευτερεύουσας κατοικίας) decreased by 75,338and the number of owners of private homes that meet the characteristics of a primary home decreased by 102,447.

The number of taxpayers who own a second home (usually a country house) is decreasing, while there has been a significant increase (by 108,446 people) in the number of citizens renting their primary home.

In 2023 (2022 income), 82,726 taxpayers own assets abroad (real estate or deposits), while four years ago the corresponding number was 80,584 taxpayers.

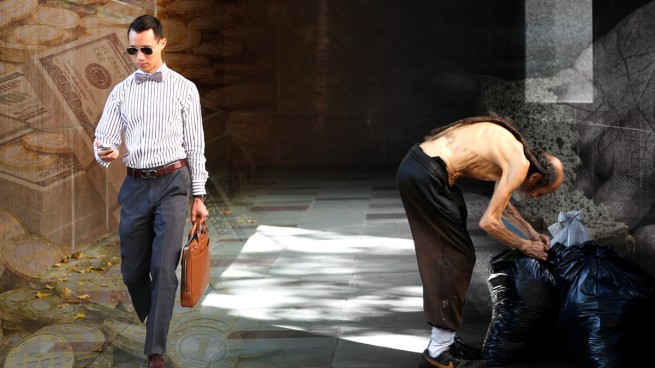

Thus, in Greece, out of 8,879,642 citizens who have a number AFM5,460,057, or 61.4% of the total, declare an annual income of up to 10,000 euros to the tax office.

At the same time, there are 5,362,233 cars on the road in the country, and 4,714,567 taxpayers have a first residence, of which 2,916,321 declare that they are privately owned, 1,798,246 are rented or provided free of charge, 96,750 own pleasure boats, and 18,319 declare that they live in a property with an outdoor pool, and 290 with an indoor pool.

Statistics show that Total declared revenue in 2023 was €91.67 billion, compared to €84.2 billion in 2022 and €79.7 billion in 2021. PAt the same time, the final tax burden on individuals after benefits and discounts will amount to 10.05 billion euros, compared to 8.9 billion euros in 2022 and 8.2 billion euros in 2021.

In last year's tax returns, 3,591,099 citizens declared income from wages (public and private sector), and the total amount declared by them was 42.02 billion euros. The average income of employees, based on codes automatically filled in by the Independent State Revenue Authority, is 11,703, compared to 10,814 euros in 2022.

The number of pensioners is no less important: last year the Tax Inspectorate registered 2,296,339 recipients of the basic pensionwith the total amount they received (before taxes) amounting to €21.41 billion, or an average of €9,324, compared to €8,615 in 2022. In essence, In total, employees and pensioners declare to the Tax Inspectorate only income received from wages and pensionsamounting to approximately 63.5 billion euros, i.e. 70% of the total amount declared by all categories of taxpayers.

Of great interest are the figures reported to the tax office by self-employed professionals, farmers and persons receiving rental income. According to AADE, 652,820 self-employed people declared gross income of 47.72 billion euros to the Tax Office. However, the profit they showed and on which they are ultimately taxed is almost 9 times lower, since they declared a total of 5.21 billion euros to the Tax Office. Considering that about half showed a loss, the net result of the tax office is much lower.

On the other hand, 674,418 citizens showed a gross profit from agricultural activities of 8.30 billion euros and a net profit of only 1.82 billion euros (less than half are farmers by profession), while if we take into account that 166,796 showed a loss of 300 million euros, the net result of the tax office is significantly lower.

1,041,391 taxpayers submit to the Tax Office income from renting out houses, the total amount of which they declare is 4.23 billion euros.

More Stories

Medicines: rising costs for citizens

BRICS and G7: New Energy Race and Struggle for Resources

AADE Prepares Digital Client List for Freelancers – Who Does It Concern?