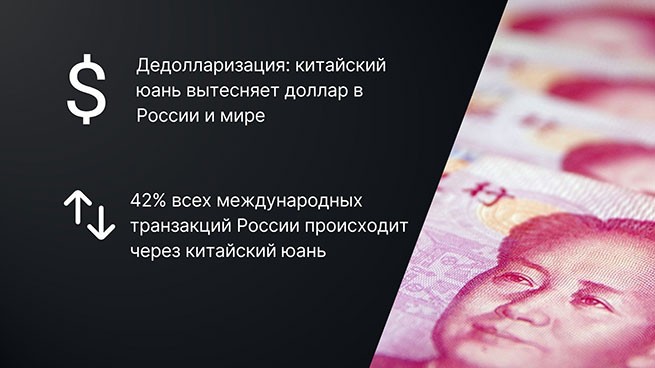

The Chinese yuan is actively displacing the US dollar in Russia's international settlements, reaching 42% of all transactions in 2023-2024. BRICS enhances de-dollarizationstrengthening local currencies.

Member BRICS China is taking full advantage of US sanctions against Russia by promoting the Chinese yuan for trade settlements. US Treasury Secretary Janet Yellen has openly admitted that sanctions only help strengthen local currencies and hurt the dollar. She said that sanctions were what pushed the alliance BRICS To de-dollarization and the use of local currencies for cross-border transactions.

China has already achieved success in its efforts, as The Chinese yuan has surpassed the US dollar to become the most traded currency in Russia. The Xi Jinping administration has done everything possible to persuade Russia to accept the Chinese yuan for all trade payments. Currently, most developing countries pay for transactions with Russia in Chinese yuan and Russian rubles.

BRICS: Chinese Yuan Outperforms US Dollar in Trade Settlements Russia has fully switched to using the Chinese yuan for payments following the introduction of US sanctions against its economy in February 2022. Several other developing countries, including such partners as BRICS, like India and Brazil, have begun using the yuan to pay for oil. India was able to save $7 billion JUST on currency exchange, using Chinese yuan instead of US dollars when buying oil at discounted prices.

The Chinese yuan accounted for 42% of all international transactions conducted in Russia between 2023 and 2024. The share of the US dollar in cross-border settlements conducted by Russia was 39.5% over the same period. The dollar's share decreased by 2.5%, making the Chinese yuan the most used currency in Russia in 2023-2024.

Both members BRICS – China and Russia are actively promoting the idea de-dollarization around the world. Developing countries find these prospects attractive because the initiative strengthens local currencies, which helps their national economies grow.

Author's opinion: chTo avoid being unfounded, here is what GLOBAL TIMES writes:

Export in Yuan: yuanAn accounted for approximately 40.8% of all payments for Russian exports. In monetary terms, this amounted to approximately $13.2 billion in January 2024 alone.

Import in Yuan: nand the share of yuan accounted for about 38.5% of all import settlements. In monetary terms, this amounted to approximately $9.1 billion in January.

Export in dollars: dThe share of dollar settlements continues to decline. In January 2024, the dollar's share in settlements was about 35%. If we take only January as a basis for calculations, the volume of export transactions in dollars can be estimated at approximately 11.3 billion dollars.

Import in dollars: dThe dollar's share in import settlements was at 36%. This is approximately $8.5 billion for January.

More Stories

Naples: Children knock statue off balcony, kill tourist passing below

Democrats reject Trump's proposal to require voters to show proof of US citizenship

Woman's Desperate Fight With Python Ends With 4-Meter Snake Defeated (Video)