According to the Allianz Group's Global Wealth Report, Greek households are showing growth in financial assets by investing in bonds and stocks.

In 2023, the financial assets of Greek households are expected to increase by 7.4%, which is highest growth rate in Western Europe (excluding Sweden), according to the 15th edition of the Allianz Group Global Wealth Report.

The main driver of growth was debt and equity securities, accounting for 38% of the portfolio and increasing by 23.9%. This growth partially offset the decline in bank deposits, which make up 53% of the portfolio (down 1.1%). Insurance and pensions also showed strong growth of 6.8%, although their share of the portfolio remains small (6%).

Decline in bank deposits linked to changes in saving behavior. Contrary to the global trend, new savings increased by 36%, reaching 5.4 billion euros. However, Greek savers moved €2.2 billion from bank deposits into bonds and shares (€7.6 billion), with bonds showing the largest gain. In general, Greek savers reacted sharply to changes in interest rates.

Increased purchasing power

Even in real terms, the picture remains stable: adjusted for inflation, financial assets grew by 3.1% in 2023, the highest real growth in the region, ahead even of Sweden. Compared to pre-pandemic levels in 2019, the purchasing power of financial assets increased by 7.2%.

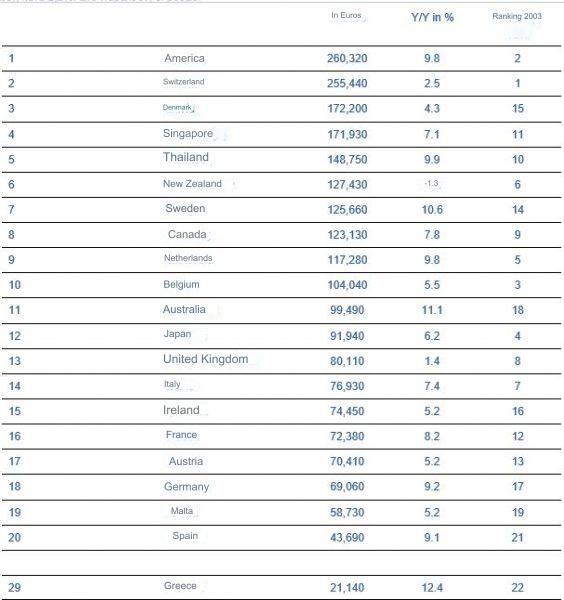

Liabilities (debt) fell by 1.6%, bringing the debt ratio to 49% at the end of 2023, below the corresponding level of German households for the first time. Finally, net financial assets grew by an impressive 12.4%. With net financial assets per capita of €21,140, Greece has moved up one place in the ranking of the 20 richest countries, reaching 29th place (see corresponding table below).

The report discusses in detail household asset and debt status in 60 countries.

Key elements of the Allianz report:

- Global household financial assets grew by 7.6% in 2023, fully reversing the previous year's losses.

- New savings have returned to normal levels after years of boom caused by the pandemic.

- With interest rates rising, private debt growth slowed to 4.1% globally, the slowest growth rate in nine years.

- Rising interest rates also weighed on real estate assets (the slowest rise in 10 years), rising only a paltry 1.8%.

Net financial assets per capita in 2023

As the World Welfare Report highlights, 2023 was characterized by intensive tightening of monetary policy. However, the economy proved resilient and markets prospered. Despite the prevailing monetary tightening, global household financial assets posted strong growth of 7.6%. Moreover, the losses of the previous year (-3.5%) were more than covered.

Total financial assets amounted to €239 trillion at the end of 2023. The growth of the three major asset classes has been highly uneven. Bonds and stocks (11.0%) and insurance/pensions (6.2%) had higher interest rates, growing faster than the average over the past decade.

In contrast, bank deposit growth slowed to 4.6% after years of boom during the pandemic, one of the slowest growth rates in 20 years.

Recovery of most countries

The recovery in 2023 was comprehensive. Only two countries, New Zealand and Thailand, recorded negative growth rates. Moreover, growth was relatively even across all regions, especially in Asia and North America, where it was over 8%, with the US (8.6%) recording even higher growth than China (8.2%). .

Last year, the growth of developing economies fell significantly compared to developed ones, the difference was only 2 percentage points. Over the past six years, developing economies have lost their leadership in growth rates.

In 2023, after several years of the pandemic (with forced savings on everything), The normalization of new savings continued. Savings fell 19.3% to €3.0 trillion. This decline is almost entirely due to bank deposits. Overall, banks worldwide received just €19 billion, a drop of 97.7%.

While financial assets were not affected by the change in interest rate path, the impact of household liabilities was evident in 2023. Private debt growth slowed further to 4.1% globally, the lowest level in nine years. At the end of 2023, global liabilities of private households amounted to €57 trillion. A decrease in debt growth rates in 2023 was recorded in almost all regions of the world.

This trend was particularly strong in Western Europe and North America, where growth rates more than halved to 1.1% and 2.9% respectively. As nominal growth in global economic activity remained high due to inflation, the global debt ratio (liabilities as a percentage of GDP) fell for the third year in a row, falling 1.5 percentage points to 65.4%. This is a decline of more than 3 percentage points compared to 20 years ago.

Relatively strong growth in assets and relatively weak growth in liabilities led to a significant increase in net financial assets of 8.8% (financial assets minus liabilities). In general, global net financial assets amounted to 182 trillion euros at the end of 2023, which showed an increase of almost 15 trillion. euro compared to the previous year (and exceeded the previous record of 2021 by 4 trillion euros).

One more The sector affected by rising interest rates is real estatewhich recorded the lowest growth in the last decade – just 1.8%. Western Europe actually recorded a decline of 2.2%. In the past, the growth rate of the real estate market in most markets has lagged behind the growth rate of financial assets. In North America, for example, the annual difference has been more than 1 percentage point over the past 20 years.

The future of the real estate sector is projected to be even more challenging given growing impact of climate change on real estate assets. While natural disasters dominate news headlines, the costs of transitioning to green buildings (called transition risks) will have the biggest impact in the long term.

Home price index projections under various climate scenarios through 2050 show declines of more than 20% in many markets. For all markets considered, real estate values could be 30 trillion lower. “In the future real estate prices will be equally determined by the location and energy efficiency of the properties“, experts say.

More Stories

Greek high school students create a self-driving car

Survey: Those returning to Greece face worse working conditions

How much will heating oil cost this year?