Self-employed people and freelancers have come under scrutiny from tax auditors, especially after many showed their spending and acquisitions to be significantly higher than what they reported on their tax return.

Priority for control

The expenses declared by sole proprietors and freelancers will be subject to the attention of the tax administration in order to reduce tax evasion and increase their taxable income. According to the Ministry of Finance, the self-employed have a gross income of 35-40 billion euros per year, while, according to their declarations, this income is 10 times less and does not exceed 4 billion euros*.

The Commission notes in its latest report that, according to the data, the turnover of self-employed workers has increased rapidly, while their declared income has increased slightly. “This discrepancy is likely indicative of significant tax evasion and loss of fiscal revenue. The situation could be improved by reviewing the current self-employed taxation system and greater use of information obtained from electronic payments,” the commission notes, linking the ongoing digitization of the EDPO with more effective control over those who hide taxable income.

AADE has reportedly already prioritized to monitor cases of self-employed and self-employed individuals where deductible expenses are likely to be inflated compared to the sector average.

Until the system is changed to link almost all spending to e-books, the tax administration will rely on the reported data of the Greek economic sectors. In the event that some small businesses or individual entrepreneurs report above-average spending, they will become audit candidates.

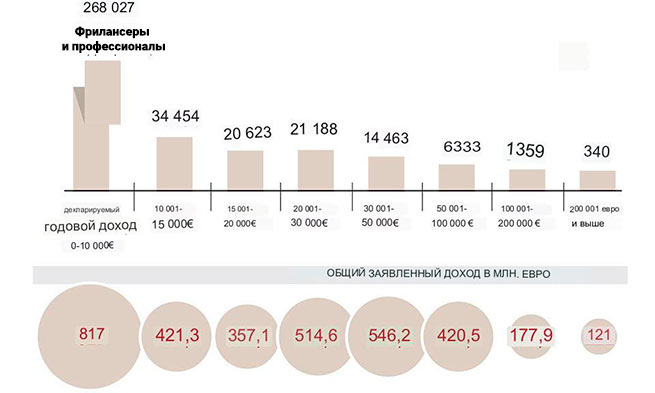

What freelancers and individual entrepreneurs declare

The only way to fight tax evasion, according to Treasury Department officials, is to increase the number of electronic transactions and further use of electronic books. Based on the foregoing, linking POS – cash register – taxi, incentives to increase e-payments and e-books will be fully used to reduce delinquency, which remains high in some service sectors. The same officials point out that a necessary condition for the elimination of the business tax, which the commission also agreed to, is to reduce tax evasion. According to the latest available data EUGreece has managed to narrow the gap in VAT revenue from 29.1% of potential revenue in 2017 to 14% in 2021, but this is still far from the European average of 9%.

The fact that 1,570,769 taxpayers present to the tax office an annual income of up to 1,000 euros, while the total amount of this income is 170 million euros, is very impressive…

The relationship of POS – cash registers – Taxis.net and incentives for electronic payments

What the plan to reduce tax evasion includes:

1. All expenses incurred by individual entrepreneurs, whether VAT is deductible or only taxable income is reduced, will have to go through e-books. In fact, for all their expenses, they will have to request an invoice.

2. In Greece, as in most European countries, e-invoicing is optional. However, their use is now recommended by the EU to reduce tax evasion, especially VAT. In fact, the plan provides that from January 2024, Member States will be able to introduce electronic invoicing, and from 2028 this scheme will become mandatory for all Member States.

3. Digital register of clients for doctors, lawyers, etc. (in fact, the return of additional books that were kept before 2012, but in electronic form). Certain professional groups will be required to maintain a digital registry of clients that will be auditable and will be compared with declared income. The digital registry of customers in the second step will be linked to MyDATA.

4. In the next period, a digital waybill will be put into operation. Thus, the movement of products (construction, agricultural, etc.) will be controlled. Regulatory authorities will know in real time what is being moved and where.

It should be noted that freelancers and individual entrepreneurs benefited from the taxation scale introduced in 2019 and, in general, from the rules in place in recent years, but their declared income did not receive a corresponding increase. In particular, the first tax rate was reduced from 22% to 9% for profits up to 10,000 euros, the solidarity tax was abolished, the business tax was reduced to zero (for those who have staff and increased jobs), and the advance tax was reduced to 50 %. The Commission also calls for relief for those who are consistent and those who want to start activities and investments in our country.

The recommendation is to create a system by which stakeholders can know and calculate in advance the tax payable for their activities, depending on the type of company they choose.

As we noted earlier, 7 out of 10 Greeks (6,045,895 people out of a total of 8,929,000 taxable persons) declare an annual income below €10,000. But at the same time, most of them have spending significantly higher than indicated in the declaration.

The Greek authorities, starting from period 1 of the memorandum, are actively fighting this by introducing restrictions on cash spending and at the same time presumption of guilt for all entrepreneurs and professionals without exception.

On the other hand, this fact is the main reason why the Ministry of Finance has not “cancelled” the so-called “conditional income” for many years. [введенный кредиторами страны в 2011 году в рамках первой финансовой помощи], because he competently believes that many of the above citizens do not declare their real incomes, because they evade paying taxes. Entering, in fact, unconditional presumption of guilt against all citizens of the country.

On the other hand, “proposed income” in many cases attracts taxpayers who annually declare everything they collect down to the last euro, but due to some assets they may have inherited or otherwise acquired, such as real estate or a car, the state considers they can’t justify their content and therefore evade taxes. Therefore, they are subject to a fictitious imputed tax..

More Stories

American billionaires want a Greek passport

Real estate: deals worth 2 billion euros in 2023 – the main characters

Real estate: what foreigners buy in Greece