The worst collapse of the Western government debt market since 1949 is coming. Bloomberg. “Week by week, the bond market crash is getting worse, with no end in sight,” the paper said.

At the Fed meeting on Wednesday, the range of the policy rate was raised to 3-3.25%, which was the third consecutive increase of 75 basis points, writes bloomberg.com. Politicians have indicated that they expect the rate to rise above 4.5% and remain at that level, even if it causes great damage to the economy.

- On Friday, five-year UK bonds fell the most since at least 1992 after the government launched a massive tax cut plan that could only bolster the position of the Bank of England.

- Two-year US Treasuries are in the middle of their worst losing streak since 1976.

- Globally, according to Bank of America estimates, government bond markets are on track for their worst year since 1949, when Europe rose from the ruins of World War II.

- The mounting losses reflect how far the Federal Reserve and other central banks have moved away from monetary policy in the wake of the pandemic, when they kept interest rates close to zero to prop up their economies.

- The reversal has had a major impact on everything from stock prices to oil as investors brace for slower economic growth and rising rates push Western economies further down.

Bloomberg echoes JP Morganwhich calls into question the sustainability of Greek debt (and other Western countries), despite official information, according to which there is a decrease in the debt-to-GDP ratio, as well as an increase in government bond yields.

JP Morgan notes that stronger nominal growth than the interest rate opens the door to “Ponzi scheme” type dynamics in which governments must always run deficits, always change their liabilities, and grow out of any debt position. In particular, according to the US bank, debt as a percentage of GDP has grown significantly in developed markets.

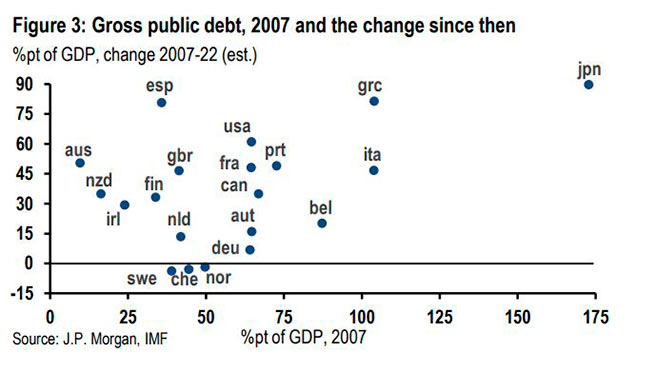

Even before the great financial crisis of 2007 hit, it jumped more than 30% for 13 of the 21 major advanced economies included in the sample of countries studied by JP Morgan.

It is noted that for 9 large developed economies it increased by more than 45%.

After deleveraging from the post-World War II period until the 1960s, public debt began to rise in all developed countries starting in the 1970s. By 2007, the debt ratio had increased by 40%, to 74%, an increase of about 1% per year.

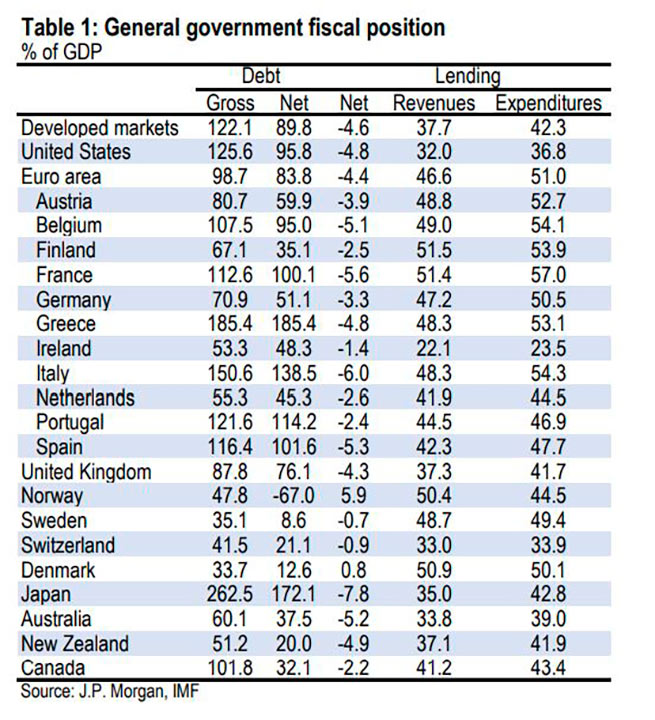

However, over the past 15 years, this figure has changed significantly. In fact, in the context of fiscal support provided by governments after the great financial crisis as well as the pandemic crisis, debt has averaged 122% of GDP in 2022. While nearly all countries saw debt increases, the results varied.

Since 2007, gross public sector debt has increased by 90% in Japan and by 81% in Greece and Spain. The US is in fourth place, with gross debt up 61% since 2007. Nordic countries such as Germany, the Netherlands, Austria and Belgium have experienced much smaller growth over the past 15 years.

On the other hand, the debt-to-GDP ratio in Norway, Sweden and Switzerland declined during this period. Not surprisingly, the countries with the largest increases in debt are also the countries with the highest total debt levels. For Japan, Greece, and Italy, gross debt “raised” in 2007. They have shown the biggest growth since the big financial crisis and the pandemic. Beyond these aforementioned extremes, debt growth since 2007 has been broad-based.

While the over-indebted US has seen significant increases in debt since 2007, Australia and New Zealand, which are generally not heavily indebted, have also seen large increases in public sector leverage.

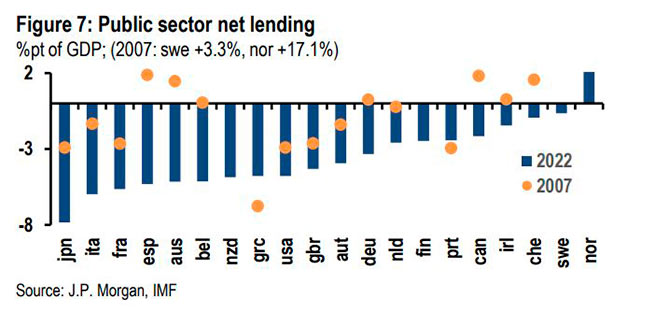

According to JP Morgan, while the pace of borrowing has slowed, net borrowing is still heavily… reduced (and the deficit widened) from pre-Great Financial Crisis levels.

For advanced economies, it was set at -4.6% in 2022, down 3.2% from 2007. Its decline over the past 15 years has been reflected in the budgets of most countries, with the exception of Greece and Portugal, in which, after the great debt crisis of 2012, … fiscal consolidation was introduced.

And as the global expansion continues, net borrowing will improve as tax revenue rises and spending cuts. However, there are certain reasons why the current cycle is expected to end earlier, as JP Morgan even “sees” the US slipping into a mild recession by the end of the year. In addition, “net borrowing positions are likely to remain at structurally stressed levels.

“Aging populations in Western societies will require more public resources to support unfunded health care and pension programs. This fact alone raises concerns about debt sustainability. At the same time, maintaining them will absorb a large percentage of the costs if interest rate hikes become a structural development in the coming years.”

In the 1998 article “Playing with Deficits” (JMCB Vol 30(4)) Ball, Elmendorf and Mankiw argue that “whenever debt reversal succeeds, policy can improve the welfare of each generation. This conclusion does not mean that deficits are a good policy, because the attempt to constantly recycle debt may fail. But [история предполагает]that the consequences of deficiency represent only a small probability.” However, past performance is no guarantee of future success (see Greece).

The historic record may simply be one of “happy” periods of high growth and low interest rates, the result of demographics, a glut of global savings, and easing capital requirements. Last year saw a sharp rise in interest rates. And while it’s largely a cyclical story, “there are reasons to see a more structural rise in interest rates over the next decade,” says JP Morgan.

With rising interest rates and an aging population leading to significant pension spending, concerns are mounting. Regardless of what has already happened, interest rates may start to move above growth. Over time, servicing debt in excess of new debt is likely to become a larger expense in future budgets.

Unfortunately, the increasing pace of debt growth will crowd out investment, which in turn will reduce technological progress and potential growth, exacerbating sustainability issues. In this regard, today’s conditions are relatively better than in 2010, when yields exceeded nominal growth in almost all countries. Since then, however, this mostly reflects declining returns.

In a world of higher yields, fundamentals will almost always be worse, given the slowdown in projected growth, even without significant increases in debt in the intervening years.

PS It would be surprising if public debt did not grow: 2 years of a pandemic, a year of world war, it is surprising that the economies of the EU countries are still afloat, given how the US is drowning its European “partners”.

More Stories

ENFIA: Find out when the refund deadline is for those who want a full tax refund

Imputed income: how freelancers can challenge it, who is exempt from paying taxes

Calculation of benefits and Easter gift from April 19