Literally, a “rainstorm” of bankruptcy applications “gushed” after the introduction of law 4818/2021, this opportunity appeared for individuals who were previously engaged in private business, but are now unable to pay off their debts to banks and insurance funds.

The legal framework for a “second chance” allows individuals, under certain conditions, to get rid of debt and within three years or even one year (if they have real estate) start all over again, do business again.

Debt relief appears to be a strong lure, with about 1,400 people taking advantage of the provisions in 2022. It is estimated that about six applications were filed in one business day last year.

“Thanks to the bankruptcy and fulfillment of the debts of an individual, the debtor is given a second chance to reactivate by resuming business activities. At the same time, this benefits the national economy, because otherwise the debtor would remain in a permanent debt trap from which he could not to go out and, without a doubt, would have gone into the shadow economy,” says lawyer Vangelis Tranoris.

What are the necessary conditions

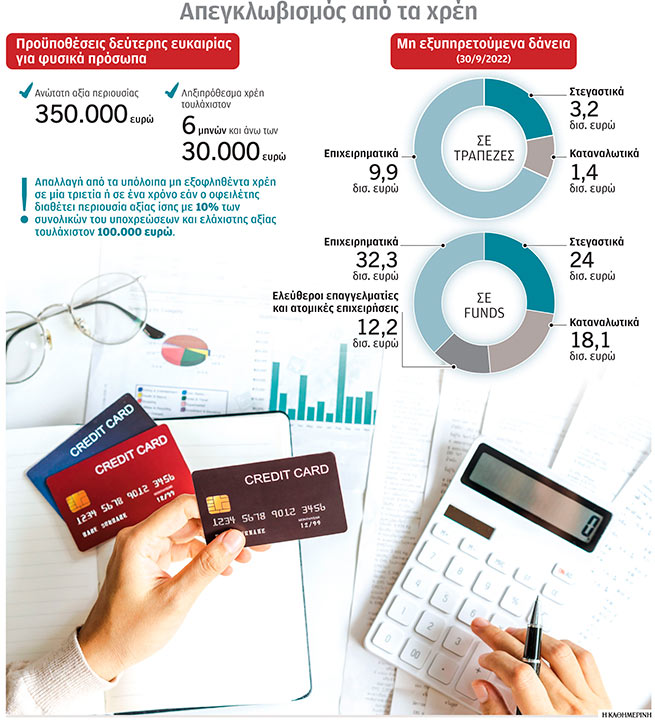

In so-called petty bankruptcies, in order for the debtor to be declared bankrupt, the total amount of assets (movable property, real estate, etc.) must not exceed 350,000 euros. As Mr. Tranoris explains, it must also be in default, ie. be unable to pay their overdue obligations to the state, social security institutions or financial institutions in the amount of at least 60% of the total amount of overdue obligations. The suspension of payments must be for a period of at least six months, and the amount of the outstanding obligation must exceed 30,000 euros. If within 30 days after the filing of the application (in the electronic solvency register) no action is taken against him or no action is taken relating only to the appointment of an administrator, the Bankruptcy Court will decide to declare the debtor bankrupt after the expiration of the above period.

“From a review of court practice, it follows that the majority of published decisions recognize filed bankruptcy applications,” Mr. Tranoris notes. The attractiveness of the “second chance” mode is due to the fact that the debtor-individual is completely released from the balance of debts unpaid after the termination of bankruptcy, under the only condition – the expiration of three years from the date of declaration of bankruptcy. However, even if the debtor is not included in the arrangements due to his lack of assets, his registration in the electronic solvency register (as an undeclared bankrupt) is sufficient for him to be released from debts and within three years to be able to resume entrepreneurial activity.

The law allows people to get out of their debts and start life anew within three or one year.

“The three-year period is reduced to one year if the debtor is a debtor whose main residence or other major important assets are included in the bankruptcy estate, which in value exceed 10% of the total liabilities, and their minimum value is not less than 100,000 euros”, – emphasizes the lawyer Vangelis Tranoris.

In practice, if an individual owes 300,000 euros and his assets amount to 90,000 euros, they are sold to satisfy the claims of creditors, and the remaining amount (210,000 euros) is written off. Conversely, if the debtor owes 150,000 euros and his assets amount to 350,000 euros, they are sold to satisfy the claims of creditors, and the remaining part of the assets remains in the ownership of an individual.

Primary place of residence

With regard to primary residence protection, it is only available to individuals who are vulnerable debtors and meet some of the three conditions:

- They have been declared bankrupt.

- Enforcement proceedings are underway against them (in relation to the main place of residence).

- There is a restructuring agreement (between the debtor and the social security institution).

In any case, until either three years or one year has passed (if the debtor owns real estate), an individual cannot resume entrepreneurial activity, as he is in a state of bankruptcy, having the opportunity to receive a minimum guaranteed income that is not recoverable.

Businesses close, debts remain

What are the characteristics of individuals for whom bankruptcy is a one-way street? Most of the debtors looking for a second chance had sole proprietorships that went out of business a few years ago, resulting in debts to the state, banks and social security funds.

For example, the head of a building cleaning general partnership that went out of business in 2013 was declared bankrupt because she had been unemployed for the past few years and her husband’s earnings were very low. She has accumulated more than €310,000 in debt related to mortgages, personal and business loans, and credit cards, and owns real estate and a 50 percent undivided interest in land, which are worth less than the total amount of debts.

In another case, a family silverware business, with a significant number of branches in and outside of Attica, collapsed in 2009 due to the financial crisis. “Along with the companies came my personal financial ruin and utter ruin as I exhausted all my cash reserves and borrowing options. The attempt to save these two companies resulted in my current over-indebtedness, as all my debts arose solely from the provision of my open overdraft guarantees, who were forced to take over the two companies in which I participated, “writes in the bankruptcy filing an individual – a former businessman who owes the state, banks and insurance funds about 560,000 euros.

The bankruptcy petition was also filed by a private worker who owed more than 110,000 euros, part of which was formed as a result of his participation as a general partner in one of the companies.

More Stories

Fines of 1.5 million euros for 11 large retail chains, including Leroy Merlin, Attica and JYSK

MyCoast: A digital app for complaining about beaches

ENFIA: Find out when the refund deadline is for those who want a full tax refund