Making Russia pay for Ukraine sounds like an undeniable moral imperative, writes Reuters Breakingviews columnist Pierre Briancon.

The European Commission has launched a plan to use billions of dollars and euros from frozen Russian assets to fund Ukraine’s reconstruction. This is the wrong approach from a legal, financial and political point of view.

Europe is paying the economic price of the war in the form of rising inflation and a severe energy crisis. It also sends financial and military aid to Ukraine. Governments fear taxpayer fatigue that could escalate into revolt as they begin to pay the bills for rebuilding Ukraine.

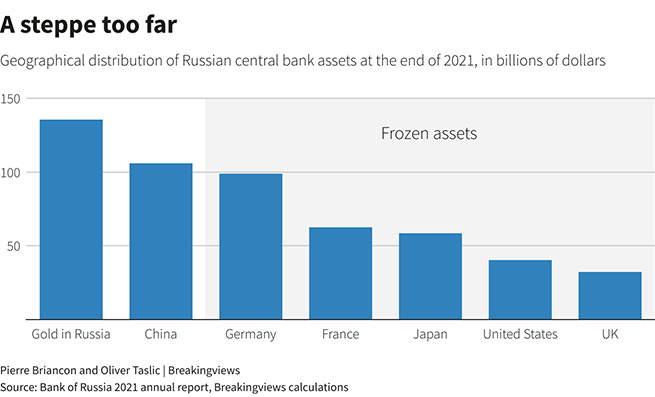

The European Union considers two types of assets. Firstly, the money of the oligarchs who fell under the sanctions, in the amount of 19 billion euros. Then there are about 165 billion euros of frozen Russian reserves held in eurozone central banks.

The legal basis is unsteady. European governments will have to ignore bilateral treaties that protect individuals and businesses from expropriation. In addition, some oligarchs who fell under the sanctions have already transferred part of their assets to family trusts prior to the imposition of sanctions, making them difficult to trace and confiscate.

The legality of asset seizure would be strengthened if this kind of action to curb sanctions became a crime, which is not currently the case in most countries. EU. Other challenges will be harder to overcome. In particular, parties hurt by the Russian state – think of investors expropriated by the Kremlin for years, or creditors in the event of a Russian default – may try to recoup their losses by laying claim to assets.

The financial reward will be negligible. It is proposed to use only financial income from assets to pay for Ukraine. Assume that all assets in question are confiscated and securely invested in 10-year German government bonds. Revenues will amount to just over 4 billion euros per year – less than a month from the current funding needs of the Ukrainian government. This is comparable to the 750 billion euros that will be required when the time comes to rebuild the country.

This idea is also fraught with political implications. It will require Europe to give a damn about some of the fundamental principles of its legal system, such as respect for treaties, the protection of property rights, and the non-retroactivity of laws and regulations. It also puts a burden on the future, post-Putin Russia, which may one day emerge from the current crisis.

Europe’s economic hardship is essentially a huge tax needed to fund its defense against Russian aggression. European governments should admit and explain that economic disruptions are here to stay. The pipe dream of confiscating Russian assets can only be a red herring.

As we reported previously, The European Commission on November 30 put forward a plan to seize and manage frozen Russian assets and use the funds received in the interests of the war-torn country. The German government is ready to consider the idea of using these assets to finance Ukraine, subject to prior resolution of serious legal issues, according to a Bloomberg report.

Estonia is preparing a legal framework that will allow the government to seize Russian assets frozen after the EU imposed sanctions on Moscow, a Foreign Ministry spokesman said January 9. Almost 20 million euros are already blocked in Estonia on accounts owned by Russians.

The opinion of the author may not coincide with the opinion of the editors

PS The author is not in vain afraid of the consequences of the expropriation of Russian assets. In addition to legal nuances that may come back to haunt the investment climate in Europe. Which over the past year has already sunk “below the plinth”.

More Stories

Poll: which European countries are ready to defend their homeland to the last

Greece must transfer the Patriot PAC-3 system to Ukraine with US “guarantees” against the Turkish threat

How will the confiscation of Russian assets affect the global financial system?