In a new report published by iefimerida.gr, the pan-Greek real estate network Πανελλαδικό Κτηματομεσιτικό Δίκτυο E Real Estates has presented an assessment of the expected development of the domestic real estate market in 2023.

According to experts, the real estate market will continue to be based almost exclusively on investment interest, and the percentage of buyers who want to cover their housing needs will decrease even more in the new year.

It can be concluded that in the domestic real estate market there is a strong investment interest in buildings, especially in the center of Athens, as well as in the southern suburbs. The “opportunity” that all investors, both domestic and foreign, are looking for is a pipe dream and translates into real estate searches, especially if it is a freestanding building. “As long as the asking prices of the sale during the season are within reasonable limits, investment interest will not decrease. This applies to the center of Athens and the surrounding areas,” says Themistoklis Bakas, president of E-Real Estates.

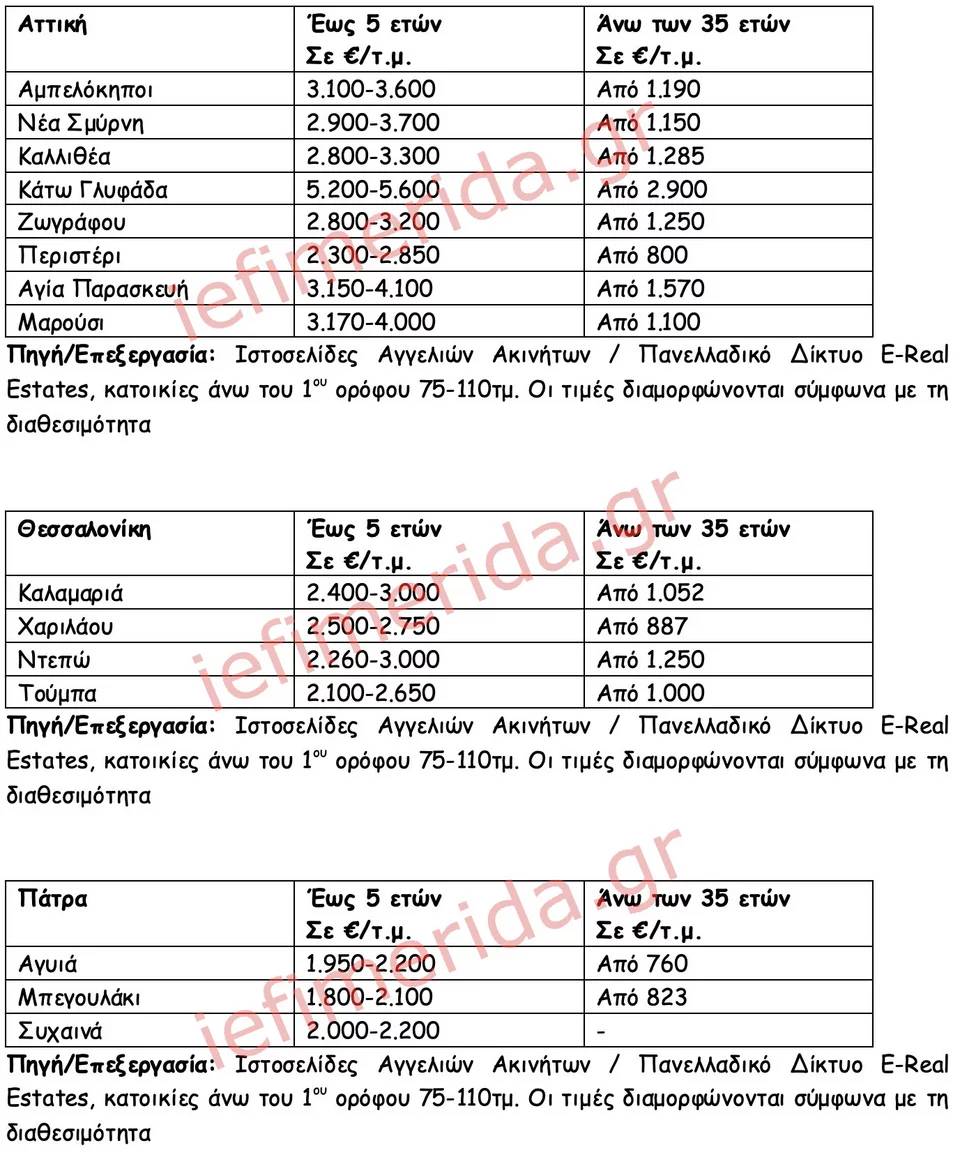

As for the sector of the housing market (apartments offered for sale), according to the report, the data is not encouraging. The dynamics is decreasing day by day, which is recorded in a number of surveys. Over the past 2-3 years (2019-2021), the real estate market has shrunk to around 83,000 apartments. As Mr. Bakas explains, “There will certainly be a rationalization of asking selling prices in the near future, especially in areas that recorded rapid growth and were based solely on the overall positive psychology of the market. In these areas, the greatest rationalization of asking prices can be recorded.”

Concerning prices for apartments in new buildings, the positive trend will continue, but at a slower pace. A further increase in prices, now in a large percentage, will be associated not with an increase in demand, but with an increase in the cost of construction, which is shifted to the sale price. The positive course of the real estate market can be indirectly affected by general economic situation in the world community, possible fears or even possible wait-and-see attitude of foreign investors. The immediate factor is inflation, which exacerbates investment interest, but at the same time seriously worries buyers seeking to satisfy their housing needs.

According to the report, the golden visa program could become a counterbalance. “A non-universal increase in the investment limit to €500,000 could work positively in the cities of the region, where the limit of €250,000 will be maintained. We believe that a new “wave” of investors from third countries will be created, which will push the real estate market up in regions where slight upward trend in sales prices,” the report says.

Wherein key factors are the growth of interest rates on housing, which, according to analysts, will reach 6% in the first months of 2023, the ever-increasing cost of living, the cost of energy, political events – both at home and abroad, a sense of security of income (permanent earnings), as well as the attitude of banking institutions to a new wave of “red” loans, which is not far off. In addition, auctions will be an important factor in shaping the image in the real estate market.

Who will purchase apartments offered for non-payment? Will the individuals be private, or will companies, investors and “partner” funds rush to buy “on the cheap”? “The answer to who will become the new owners of a potential portfolio of 200,000-250,000 properties out of a total of 700,000 properties is a very important factor,” concludes Mr. Bakas.

More Stories

MyCoast: A digital app for complaining about beaches

ENFIA: Find out when the refund deadline is for those who want a full tax refund

Imputed income: how freelancers can challenge it, who is exempt from paying taxes