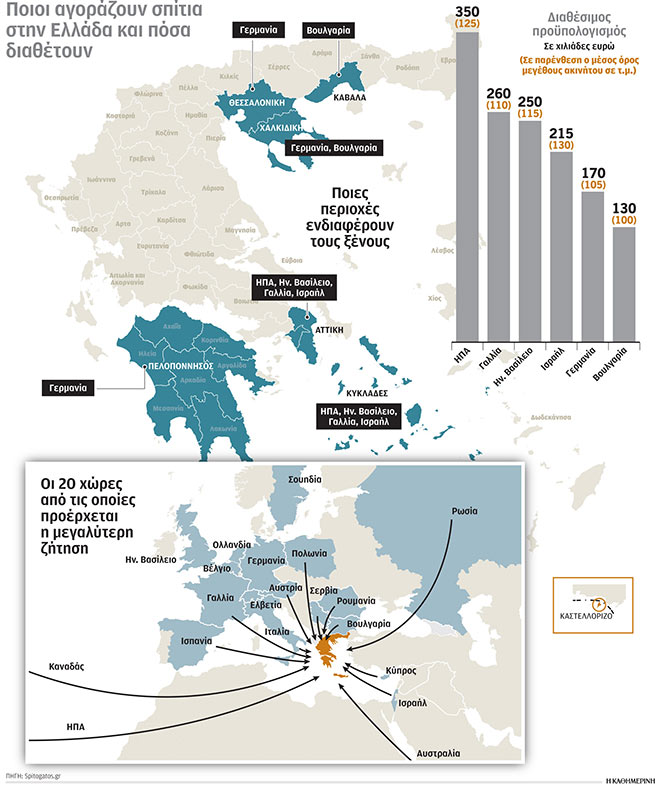

Germans, Americans and Britons, partly due to the large number of Greeks in these countries, are by far the three most dynamic categories of homebuyers in the Greek market.

According to a presentation by the online real estate ad network Spitogatos.gr, presented on the second day of the 23rd annual Prodexpo real estate conference, out of 1 million real estate searches, 15% are for properties from abroad.

According to Dimitris Melahroninos, Managing Director of Spitogatos.gr, Germans are – and by far – the largest group of interested persons looking for property throughout the country, among which Thessaloniki and Halkidiki stand out. Demand comes from both ethnic Germans and Greek expatriates, and the available budget is in the region of €170,000.

They are followed by buyers from the US, also with significant interest from expatriates, who also have the highest budget of €350,000, for a property unit averaging 125 sqm. They prefer to live in the Cyclades and in the southern suburbs of Attica.

Demand from France is also growing significantly and constantly, with a focus on the Cyclades, especially on the island of Paros, and secondarily on the center of Athens.

Currently, a significant increase in demand for residential real estate is also observed from Israel. People tend mainly to the northern and southern suburbs of Attica, to the center of Athens and to the Cyclades.

Investors from China, taking into account the trends of the last period, have significantly reduced their activity, fearing possible sanctions actively imposed on the European Union from Washington in relation to China. The situation is similar with the citizens of Russia, whose activity is practically reduced to zero, after the cancellation of the Golden Visa program for them, as well as difficulties with communications and discrimination based on nationality.

Investments

Special mention was made at Prodexpo of Israeli investors’ interest in the Greek real estate market by Mr. Eitan Maoz, founder and CEO of EM Global Real Estate Investment, which provides services to investors interested in investing in Greece. “Israelis are interested in buying property in Greece for a number of reasons, starting with very high prices in their homeland. Here (in Greece) they can buy 2-3 properties for the same money or participate in small investment projects.

In addition, Greece is very close geographically and much more accessible than, for example, the US, and is on its way to economic recovery. A favorable exchange rate also plays a major role,” Maoz said.

The need to meet the needs of homebuyers and/or tenants has also pushed major companies to invest in the housing market.

The interest of foreign buyers was confirmed by Mr. Yannis Revitis, a representative of the real estate agency of the same name. “Vacation home prices, especially luxury ones, have soared to record highs this year, with sales up 40% or even 50% compared to 2019, in popular destinations such as Mykonos and Santorini, where this year we recorded transactions with individual objects worth even 25 million euros, while in Santorini the corresponding amounts were in the range of 8-12 million euros,” Revitis said. According to him, an even greater increase in prices, by 300% -400% compared to 2019, was noted this year on alternative destinations such as Serifos, Milos, Antiparos, Shinousa, Ios and Paxos.

Companies

Buying interest from abroad, as well as the need to cover the housing needs of an extended mass of buyers or tenants from the Greek market, has pushed large companies to invest in the housing market. “There has been a big change in demographics as household structure has changed. In recent years, families have become smaller in number of members and with greater age gaps, making it difficult to live together and possibly requiring more than one property,” says George Pendidis, Partner residential property developer Livewise, which has entered into a strategic partnership with Prodea Investments SA on 10 individual projects. It is for this reason that demand is now higher, although the population data has not changed.

In this context, Pendides stressed that the goal of large companies is to reach all sub-categories of stakeholders, from seniors and students to foreigners and digital nomads. “We want to reach all age groups, from the young 25-35 year olds to the average Greek family, the 35-55 year old group and the 65 year old group who are interested in more expensive and quality real estate.”

An important investment portfolio in the housing market has also been created by the Israeli investment company Zoia. As Stavros Tolias said: “We currently have 840 apartments in our portfolio, which will soon grow to 1,000. We have purchased 40 existing buildings and our portfolio is valued at 200 million euros.” Zoia positions itself in the center of cities (for example, in Athens and Piraeus), choosing existing and individual buildings, which it then refurbishes and upgrades from an energetic point of view, in order to use them in any form of rental (depending on the nature and location of each building), short term, medium term and long term.

Up to 175,000 homes on the market over the next five years

Approximately 700,000 properties in each category are currently guaranteed NPLs. According to market representatives, 20%-25% of these properties will be gradually put up for sale over the next five years. The relative number of properties that will be absorbed by the Greek market is estimated at 150,000 – 175,000. This, in particular, was reported by Lila Pateraki, Head of Real Estate Services doValue. This receivables management company alone is called upon to manage 250,000 properties, with up to 62,500 estimated to be listed for sale in the next few years. that thousands of properties will come on the market in connection with the auctions, and perhaps it will be unexpected, which will affect all of us.”

In any case, the absorption of the volume of this real estate will be a particularly difficult “exercise”, which will begin with the auction method. According to Ellie Kakullou, Head of the Real Estate Sector at the National Bank of Greece, “Banks are moving out of real estate management, which they are now outsourcing to specialized third-party companies. In the past, banks have acquired a large amount of real estate through auctions. Their number is estimated at about 25,000 objects worth 5 billion euros. This is no longer the case, as private participation in auctions has increased, also thanks to the provision of financing by the banks themselves,” said Ms Kakullou.

“Demand in the real estate market is not expected to increase, but will continue,” said Mr. Nikos Papaloukas of Cerved Property Services. As he explained, “until the first half of 2022, there was no recession, but in the second half of the year the situation is likely to change.”

Bill for renovation and renovation

Government action to improve housing conditions, especially for young people, can provide a significant boost by increasing the supply of affordable housing, both for purchase and for rent. “The government has announced a package of measures totaling 1.8 billion euros,” Akis Skertos, state minister, said yesterday. “Perhaps as early as tomorrow (Wednesday, October 26) a bill for the implementation of a measure to renovate old houses in the amount of 350 million euros will be presented in order to vote before the end of the year. The goal is to increase the supply of energy-efficient and refurbished housing. Currently 750,000 properties are registered with the ADA as vacant/closed. We want some of these properties to be refurbished, energetically upgraded and put back on the market to increase supply and put downward pressure on prices.” According to him, the amount of 20,000 euros will be allocated as a subsidy for energy modernization projects, and another 10,000 euros can be provided in the form of a grant or a low-interest loan for repairs.

More Stories

EU employment record: Greece "stuck" in a low position

“Bonus” of 300 euros for the long-term unemployed

Turkish tourists choose Samos for their holidays