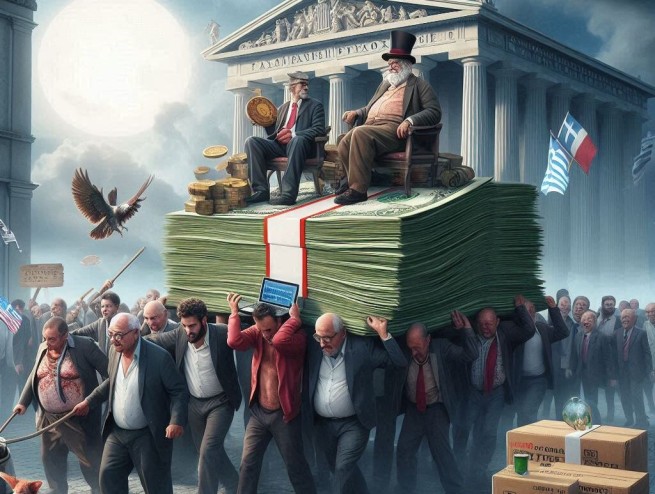

As Internet shopping and electronic transactions in general have continued to grow rapidly over the past three years globally and in Greece, fraud has increased both in absolute numbers and in the forms in which it manifests itself due to the emergence of the pandemic.

Fraudsters are mainly focused on new ways to deceive citizens by extorting personal account data (pin code, passwords, etc.), as well as on investment product fraud, which, as the fraudsters emphasize, provide high returns.

In this context, at the end of 2021, an awareness campaign against Internet fraud was launched, which, with the cooperation of the forces of the Ministry of Civil Protection, the Bank of Greece, the Hellenic Police and the Hellenic Banking Union (EETT), has made a decisive contribution to reducing the incidence of Internet fraud for the first time after a steady rise in recent months, which is encouraging but leaves no room for complacency.

What citizens should beware of

A typical warning that citizens should pay attention to electronic transactions is a link made by Yannis Grammatikos, General Manager of Retail Banking Products at Piraeus Bank, at the latest Payments “360o“: “Just as in our homes an expensive armored door does not serve its purpose unless we lock it, let alone leave keys on it, so access to our digital bank will not be secure unless we are doubly and we are triple careful about how, when and where we use our personal passwords. Our bank will never ask us for passwords for digital banking transactions, nor will it communicate with us in a way that artificially creates a sense of anxiety in us, causing us to rush to respond and communicate them. If we follow this simple rule, the world of internet banking is completely safe for both our money and our personal data.”

Recently, a new Europol material on cryptocurrency investment fraud was published and posted on the EBA website as part of a campaign to inform and raise public awareness about cyber fraud.

Cryptocurrency investment scams – how they happen

“Romantic” scammer: The scammer contacts you through a dating app or social network. It may start out as an online dating scam that quickly turns into an investment scam with potentially serious financial losses for you.

A scammer pretending to be a friend: The scammer has targeted you by hacking into your friends social media accounts. Because you feel like you’re talking to a trusted person, you may be more open to investment.

Business Opportunity: a scammer calls you and shows you a scam cryptocurrency investment site. He convinces you to invest by giving false figures of potential returns. In many cases, you will realize that it is not possible to withdraw your money after a long period of time after the investment has been made.

False Advertising: You are viewing cryptocurrency investment ads on social media. You click on this ad and provide your contact details. The scammer contacts you by phone and convinces you to invest money

warning signs

High yield investment opportunities are too good to be true. An urgency in the form of urgency that makes you think this is a deal you can’t afford to miss. Deceptive advertising posted on the Internet and social networks; investment opportunities received by e-mail, through social networks or after a phone call without your personal participation.

These “opportunities” can be represented by:

- scammers pretending to be your friend.

- someone you only met through dating apps or social media.

- fraudulent cryptocurrency investment company.

- requests to transfer your legitimate cryptocurrency investments to an alternative address that is under the control of criminals.

Self-defense measures

- Do a thorough research before investing in cryptocurrencies.

- Be careful when sending cryptocurrencies. Once the transaction is completed, you will not be able to revoke it.

- If you received an investment opportunity from your friends, confirm that it really comes from them.

- Before investing, study the group that made you an offer and evaluate it.

- Clearly define the terms of the purchase and the status of ownership of the cryptocurrency.

- Be wary of people you meet on dating apps or social media who are trying to convince you to invest in cryptocurrencies.

- Beware of unwanted requests that encourage you to open and fund new cryptocurrency accounts. They will direct you to digital wallets controlled by criminals.

- Keep it to yourself. If you are buying cryptocurrencies, do not announce it on social media as you may attract the attention of criminals.

- If you are the victim of a scam, report it to the police immediately.

Other Forms of Fraud – What Traders Need to Know

In recent months, in conjunction with the latest cybersecurity awareness campaign, informational videos and infographics have been posted on the FCT website with instructions on how to identify and protect against various types of cyber scams on the Internet, such as:

- fraudulent phone calls (vishing), fraudulent SMS messages (smishing), fraudulent emails (phishing),

- fraud through the CEO (CEO Fraud)

- fraud using invoices and other documents (invoice fraud),

- fake banking websites,

- online dating scams (romantic scams),

- identity theft,

- investment scams,

- online shopping fraud

- scams related to alleged technical support,

- SIM card scam.

Interested persons can get acquainted with the full information and materials here and here.

More Stories

IOBE: Poverty threatens Greece

At what age does it start "third age"

After 2027, the retirement age will increase by another 1.5 years